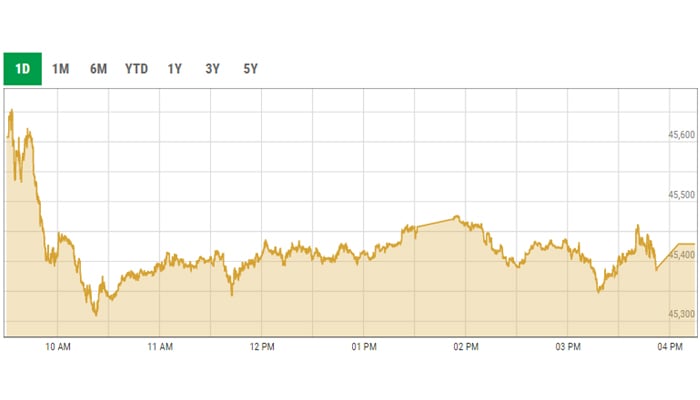

PSX begins rollover week with 149-point loss

Benchmark KSE-100 index settles at 45,429.21, recording a decrease of 0.33%

October 25, 2021

- Benchmark KSE-100 index settles at 45,429.21, recording a decrease of 0.33%.

- Analysts predict volatility during the ongoing week, citing it was a rollover week.

- A report from Topline Securities notes that a lacklustre session was observed at the bourse today.

KARACHI: Stocks struggled to find a floor on the first day of the future rollover week on Monday due to weak cues coupled with internal and external headwinds.

Uncertainty about the delay in a decision by the International Monetary Fund (IMF) programme coupled with concerns regarding rupee-dollar parity kept the investment climate negative

The bears dominated the proceedings and the benchmark KSE-100 index endured another round of stock selling, dipping nearly 150 points by the end of the session.

Analysts predicted volatility during the ongoing week, citing it was a rollover week and marked the beginning of corporate earnings season.

Trading kicked off on a negative note and the market continued its downtrend till the end of the session.

The benchmark KSE-100 index shed 149.15 points or 0.33% on Monday, to close at 45,429.21 points.

A report from Topline Securities noted that a lacklustre session was observed at the bourse today with the KSE-100 index closing the day down 0.33%.

“Higher international oil prices coupled with concerns over the inflationary pressure kept the market in check,” it said.

The report noted that Meezan Bank, Lucky Cement, HBL, Maple Leaf Cement Factory and AKBL were the major laggards in the KSE-100 index and cumulatively dragged the index down by 126.06 points. While on the other hand THALL, Pakistan Petroleum, Dawood Hercules Corporation, Fauji Fertiliser and Shifa International Hospitals cumulatively added 62.2 points.

On the corporate results front, DG Khan Cement Company announced earnings per share (EPS) of Rs2.33 for the quarter ended September 30, 2021, compared to a loss per share of Rs0.74 in the same period of the last year. The company posted a profit-after-tax of Rs1.13 billion during the first quarter of FY22.

Meanwhile, in the oil sector, Pakistan Petroleum posted a profit-after-tax of Rs14.32 billion for the quarter ended September 30. Meanwhile, Fauji Fertiliser Bin Qasim and Unilever Pakistan also released their quarterly results posting handsome profits for the quarter under review.

However, Pakistan Refinery posted a loss after tax of Rs378 million for three months ended September 30, 2021, with a loss per share of Rs0.60 compared to earnings per share of Rs0.49 during the same quarter of FY21.

Hum Network Limited was the volume leader with 50.8 million shares, losing Rs0.04 to close at Rs6.61. It was followed by WorldCall Telecom with 17.4 million shares, losing Rs0.02 to close at Rs2.35, and Bank of Punjab Limited with 10.04 million shares, losing Rs0.39 to close at Rs8.30.