Should the State Bank be autonomous?

The proposed SBP Act introduces several key amendments, including on price stability, monetary policy objectives, and appointment procedures

January 05, 2022

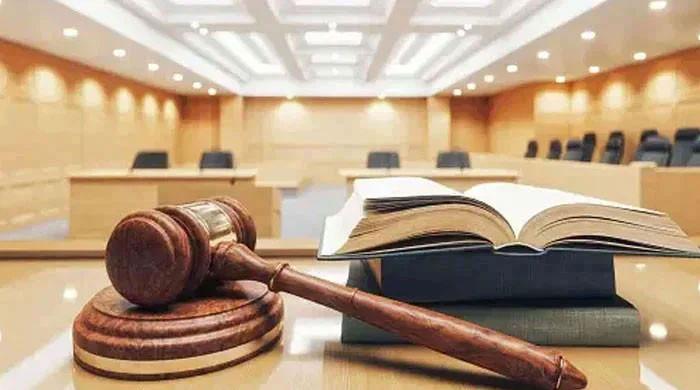

In the wake of the government’s agreement with the International Monetary Fund (IMF) for reviving its $6 billion loan, it had committed to granting an autonomous status to the State Bank of Pakistan (SBP).

For this purpose, the SBP Act, 1956, is being amended through the SBP (Amendment) Act, 2021 for enhanced central bank autonomy, price stability, and accountability. Although there are benefits to SBP’s proposed independence, it raises further questions: should the SBP be fully autonomous? Is the current institutional framework able to support the proposed autonomy, and what future implications would this have on Pakistan?

The proposed SBP Act introduces several key amendments, including on price stability, monetary policy objectives, and appointment procedures.

Significant changes include a complete ban on government borrowing from SBP, and any future amendments in the SBP Act are undertaken with SBP’s prior consent. The Act also proposes to abolish the Monetary and Fiscal Coordination Board, limiting such coordination to the extent of liaising between the governor and finance minister.

It further establishes an executive committee for making policy decisions regarding SBP’s core functions, administration, and management. According to the Act, the president, upon the federal government's recommendation, can appoint the SBP Governor for a tenure of five years, which could be extended for another term.

Once appointed, governors or deputy governors can only be removed for serious misconduct, or if they are incapable of properly performing their duties due to physical or mental incapacity. Initially, the Bill provided blanket immunity to SBP officials from courts and accountability agencies; however, such provision has been removed from the revised draft.

Internationally, many countries have been introducing reforms to safeguard their central banks against any political influences; thus, there is a case to be made in favour of SBP’s autonomy. Such autonomy allows freedom to monetary policymakers in determining monetary policy, free from any political interference.

Previously, many fiscal authorities have exerted pressure over the SBP to force manipulation of the interest and exchange rates to support their political agendas. Moreover, under the current law, there is little performance evaluation. Arguably, greater autonomy will lead to higher accountability and hence, the proposed law will lead to better SBP performance.

Nevertheless, the suitability of SBP autonomy and proposed amendments have to be evaluated in a Pakistan-specific context.

Institutional autonomy may not prove to be suitable for developing countries, which are still vulnerable to foreign agendas in the context of aid and development assistance. Therefore, in Pakistan’s case, SBP’s autonomy remains a slippery slope.

Even if political interference in SBP policies is curtailed, third-party influence from other countries and international financial institutions, like the IMF, may remain a concern nevertheless. Moreover, price stability objectives are not likely to be addressed by the SBP alone, regardless of the autonomy granted to it.

In a sense, the SBP has been autonomous in many operational matters. For instance, the SBP is fully autonomous in interest rate determination and has maintained a high interest rate despite opposition from the finance ministry. However, the status quo has failed to improve the domestic economy or yield price stability, especially when inflation is linked to supply-side factors.

Further reservations stem from the proposed terms and conditions of service of SBP officials. Independent decision-making will be affected as these terms are determined by the Board itself, which will be chaired by the SBP Governor.

For effective SBP autonomy, the Board of Directors itself may require structural changes. Additionally, all nominations and appointments must be strictly vetted and undergo a clear scrutiny process. Central bank autonomy cannot occur in isolation and that too at the cost of transparency. For the proposed SBP autonomy to work, internal accountability mechanisms and transparency must be appropriately strengthened, along with rigorous external auditing.

Recently, a revised draft was tabled before and approved by the cabinet. It is currently being debated in the national assembly and is likely to be passed by the parliament with minor adjustments, despite the opposition’s objections.

The government has made efforts to keep SBP’s proposed autonomy in line with international principles whilst keeping it accountable to the parliament. This may prove particularly crucial in ensuring cohesion between the federal government’s and SBP’s policies so that both follow the same direction for national interests.

Overall, independence of the SBP is a welcome and important development but requires stronger transparency, with improved accountability and oversight mechanisms in place. This would also be in line with international practices, where central banks around the world are autonomous but by no means unaccountable.

A crucial consideration would be the grant of de facto autonomy as opposed to the mere de jure autonomy seen in the past. The government and legislature must try their best to make the SBP and its Governor accountable to the democratic system for any proposed autonomy to function effectively.

Noshab is a research associate at the Centre for Law and Security.