Stocks at PSX fall on rising COVID-19 cases

Mixed expectations about central bank’s policy rate announcement sparks volatility with low investor participation

January 13, 2022

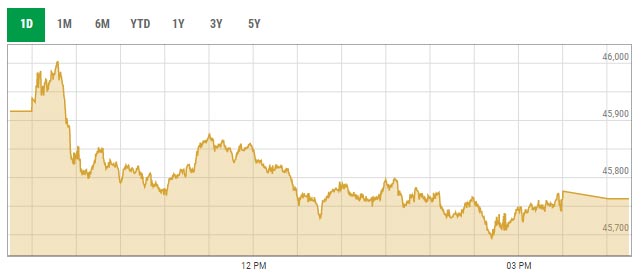

- KSE-100 index sheds 0.33% to close at 45,763.20 points.

- Expectations about SBP’s policy rate announcement sparks volatility.

- Rising COVID-19 cases affects the investment climate negatively.

KARACHI: The bears staged a comeback at the Pakistan Stock Exchange (PSX) on Thursday as sceptical investors took a cautious stance ahead of the State Bank of Pakistan’s (SBP) monetary policy announcement next week. Resultantly, the benchmark KSE-100 index shed over 150 points.

Mixed expectations about the central bank’s policy rate announcement sparked volatility with low investor participation resulting in thin volumes.

Moreover, the rising COVID-19 cases — as the country reported more than 3,000 coronavirus cases for the first time since September 15, 2021 — affected the investment climate negatively as investors resorted to profit booking during the session.

At the close, the benchmark KSE-100 index sheds 153.05 points, or 0.33%, to close at 45,763.20 points.

A report from Arif Habib noted that the market remained volatile today as the country reported the highest ever COVID-19 infections in the last four months.

“The market opened on a bleak note as investors remained risk-averse,” it said.

In the refinery sector, Cynergyico PK Limited remained in the limelight as its board approved the acquisition of a 57.37% stake in Puma Energy under which it will become the second-largest retail fuel network in Pakistan.

The report added that in the last trading hour, profit-taking was witnessed across the board.

Sectors contributing to the performance included technology and communication (-50.4 points), cement (-33.8 points), tobacco (-14.3 points), pharmaceutical (-12 points) and vanaspati (-11 points).

Shares of 353 companies were traded during the session. At the close of trading, 135 scrips closed in the green, 196 in the red, and 22 remained unchanged.

Overall trading volumes plunged to 327.6 million shares compared with Wednesday’s tally of 514.38 million. The value of shares traded during the day was Rs6.48 billion.

Cynergyico PK Limited was the volume leader with 74.07 million shares traded, gaining Rs0.43 to close at Rs7.31. It was followed by WorldCall Telecom Limited with 47.8 million shares traded, remaining unchanged at Rs2.53, and Hascol Petroleum with 23.39 million shares traded, gaining Rs0.20 to close at Rs7.11.