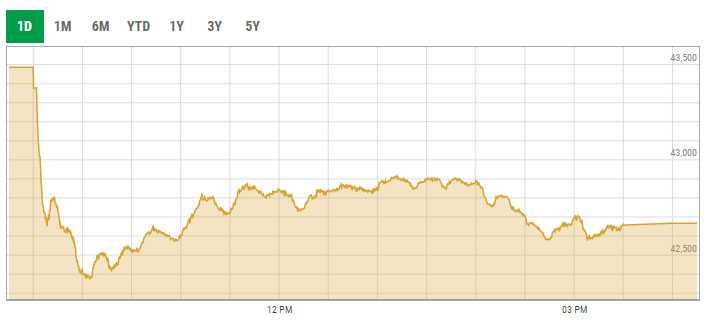

Monday blues: PSX bleeds as benchmark index sheds over 800 points

At close, KSE-100 index settles at 42,667.32 as revailing political uncertainty, rupee depreciation strips investors’ confidence

May 16, 2022

- KSE-100 index settles at 42,667.32 with a loss of 1.88%.

- Prevailing political uncertainty, rupee depreciation strips investors’ confidence.

- Shares of 340 companies were traded during the session.

KARACHI: The Pakistan Stock Exchange (PSX) witnessed major selling pressure on Monday as the benchmark KSE-100 index plunged over 800 points as prevailing political uncertainty and Pakistani rupee depreciation against the US dollar stripped investors’ confidence.

The market began its slide soon after opening at 42,424.48 points, with the benchmark KSE-100 index plummeting 1,111 points or 2.55% by 10:10am.

At close, the benchmark KSE-100 index closed at 42,667.32 with a loss of 819.14 points, or 1.88%.

Sectors contributing to the performance included banks (-171.9 points), cement (-125.1 points), exploration and production (-110.1 points) and technology (-108.1 points).

Alpha Beta Core CEO Khurram Schehzad said that investors were expecting an increase in oil prices after midnight causing the subsidy to drop.

Explaining what he meant by subsidy, Schehzad said that the oil is currently being sold for an even lower price in the local markets than in the international market and the government is paying the taxes in the form of a subsidy.

In Schehzad's view, the subsidy is not the problem but dealing with it is.

“The subsidy must be given smartly or should be targeted to only small vehicles,” he said.

Speaking about the government’s claims of the subsidies on oil prices being non-funded, Schehzad said that it was a political decision and there was no supporter for the subsidy.

“The subsidy being funded means if you have a greater revenue and lesser expenses, you can invest the revenue somewhere else and fund any expense but nothing can be funded when there are already greater expenses even if there is a slight rise in the revenue.”

Schehzad said that the incumbent govt was expected to pass on things as soon as it took office but they adopted the opposite policy which increased the energy requirements.

"Closing market for a single day or closing early would make an impact of $1 billion to $1.5 billion,” he said.

Shares of 340 companies were traded during the session. At the close of trading, 63 scrips closed in the green, 263 in the red, and 14 remained unchanged.

Overall trading volumes rose to 250.44 million shares compared with Friday's tally of 208.11 million. The value of shares traded during the day was Rs8.9 billion.

Lotte Chemical was the volume leader with 18.14 million shares traded, gaining Rs1.16 to close at Rs27. It was followed by Pakistan Refinery with 18.06 million shares traded, losing Rs0.57 to close at Rs14.84 and Cnergyico PK Limited with 14.16 million shares traded, losing Rs0.31 to close at Rs5.18.