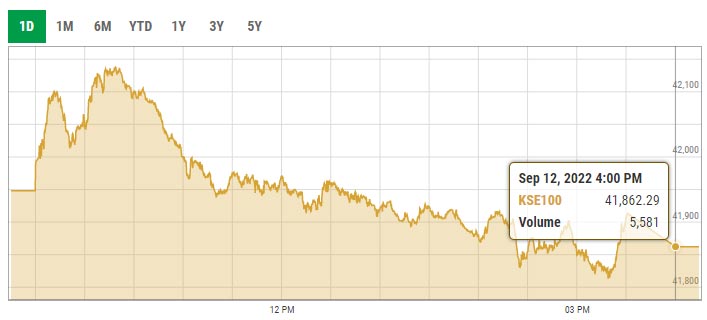

Weak economic cues drag KSE-100 down

Owing to the negative triggers, market players resorted to across-the-board selling; KSE-100 index closed at 41,862.29 points

September 12, 2022

- Benchmark KSE-100 index settles at 41,862.29 points.

- Owing to negative triggers, players resorted to across-the-board selling.

- Shares of 323 companies were traded during the session.

KARACHI: The Pakistan Stock Exchange (PSX) continued its descent on Monday and fell nearly 90 points owing to weak economic cues.

Continuous depreciation of the Pakistani rupee, which closed at Rs229.82 after losing Rs1.64 against the US dollar in the interbank market, dented investors' sentiment.

Owing to the negative triggers, market participants resorted to across-the-board selling due to which index-heavy cement, and fertiliser sectors ended the day with substantial losses.

Following a brief opening in the positive, the KSE-100 index entered the negative zone in initial trading. Throughout the day, the index fell at a steady pace on negative news flow. Late session buying helped erase some of the losses.

At close, the benchmark KSE-100 index settled at 41,862.29 points with a decrease of 85.87 points, or 0.20%.

A report from Arif Habib Limited noted a range-bound session was witnessed at the PSX today due to mounting inflation, and economic and political concerns.

“No materialisation of funds from friendly nations kept sentiments in check,” the post-market commentary noted, adding that the benchmark KSE-100 index observed a volatile session as investors opted to remain sideways due to the continuous fleet of the US dollar against the Pakistan rupee.

Shares of 323 companies were traded during the session. At the close of trading, 102 scrips closed in the green, 203 in the red, and 18 remained unchanged.

Overall trading volumes soared to 161.42 million shares compared with Friday's tally of 146.63 million. The value of shares traded during the day was Rs5.83 billion.

HBL Total Treasury ETF was the volume leader with 45.07 million shares traded, gaining Rs0.01 to close at Rs10.01. It was followed by TRG Pakistan with 15.74 million shares traded, gaining Rs2.34 to close at Rs96.16 and WorldCall Telecom with 9.94 million shares traded, losing Rs1.20 to close at Rs9.94.