Pakistan stocks move both ways to end higher

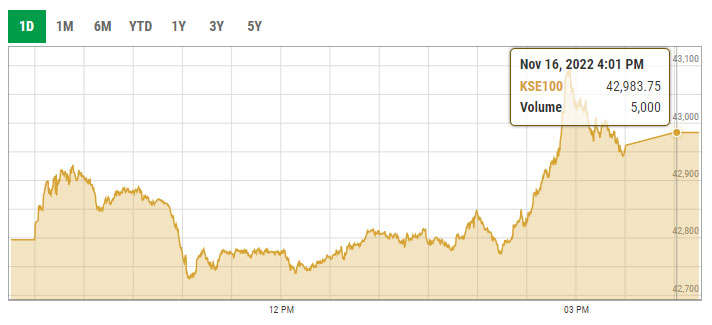

PSX's benchmark KSE-100 index strengthened by 186.90 points or 0.44% to close at 42,983.75 points

November 16, 2022

- Trade remains on a tight leash as investors stay on sidelines.

- Credit Default Swap worsens to 75.5 as sentiment cools off.

- Activity likely to remain lacklustre in risk-averse environment.

KARACHI: Stocks Wednesday clawed back early losses to print moderate gains, buoyed by fertilisers, tech, and power in a well-guarded trade as the Toshakhana scandal has set the political scene on fire, adding to the instability worries.

Pakistan Stock Exchange’s benchmark KSE-100 Shares Index strengthened by 186.90 points or 0.44% to close at 42,983.75 points.

Arif Habib Limited (AHL) in a post-market note said the PSX saw another range-bound session amid lacklustre activity.

“Trade remained on a tight leash throughout the day and the market swung in both directions due to a lack of investor engagement,” the brokerage said.

The AHL reported that mainboard volumes reduced considerably, while third-tier companies continued to lead in terms of volumes.

Sectors that mostly supported the index were fertiliser (+134.3 points), technology and communication (+97.7 points), investment banks/companies/securities firms (+24.0 points), power generation and distribution (+21.3 points), and chemical (+7.4 points).

Volumes slightly decreased by 1.0% to 186.7 million shares from 188.7 million shares recorded on Tuesday, while the average traded value slumped by 10.3% to $29.96 million as against $33.40 million.

Unity Foods led the volumes chart. Stocks that contributed significantly to the volumes were Hascol Petrol, TRG Pakistan, Sui Southern Gas Company, and JS Bank Limited.

Topline Securities in its market wrap said the index initially opened with a positive gap but succumbed to selling pressure as Pakistan Credit Swap further increased to 75.5%.

“This development weighed on market sentiments, which directed the index towards an intraday low of 42,729 with a loss of 68 points or 0.15%.”

Topline analysts added that at the aforesaid level, buying interest kicked in which supported the market to make an intraday high of 43,098, up 300 points or 0.70%.

Engro Corporation, TRG Pakistan, Dawood Hercules Corporation Limited, System Limited, and Hub Power Company, added 261 points, cumulatively.

Being the major laggards, Pakistan Petroleum Limited, Oil and Gas Development Company, and Habib Bank Limited together erased 45 points from the benchmark index.

Pakistan's perceived risk of default, gauged by the 5-year credit default swap (CDS), hit 75.5%, owing to uncertainty over the International Monetary Fund's (IMF) ninth review.

AHL data showed Pakistan's 5-Year CDS jumped from 5,620 basis points (bps) on November 14 to 7,550bps on November 15, an increase of 1,929.6bps.