Rupee takes breather as IMF talks revive market confidence

Local currency closes at 267.89 in the intraday market after gaining nearly Rs2 per dollar

January 31, 2023

- Rupee gains nearly Rs2 against US dollar.

- It closes at 267.89 in interbank market.

- Local currency lost Rs37 in last four days.

The Pakistani rupee started showing signs of recovery on Tuesday as it gained nearly Rs2 against the US dollar to close at Rs267.89 after the developments surrounding talks with the International Monetary Fund (IMF) unfolded.

The local currency, which had closed at an all-time low of 269.63 on Monday, gained Rs1.74, or 0.65%, and closed at 267.89 against the greenback in the interbank market.

Since a cap on the currency was lifted on January 25, the rupee has been falling in order to shift to a market-driven exchange rate.

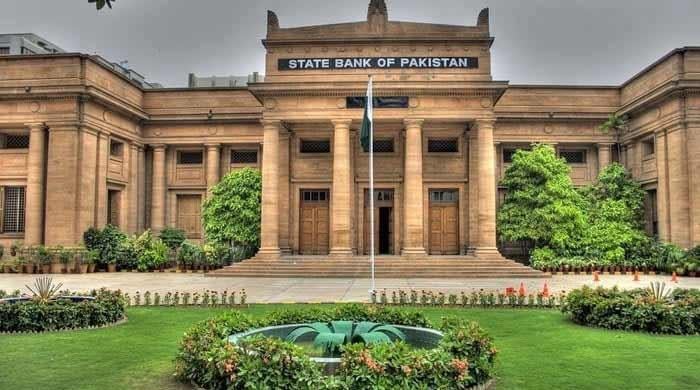

The local currency lost Rs37, or 13.81%, overall since January 25 compared to Wednesday’s close of Rs230.89 to a dollar, according to the State Bank of Pakistan (SBP) data.

Following the massive plunge the rupee became the region’s worst-performing currency so far this year, slumping 16%.

Arif Habib Limited Head of Research Tahir Abbas, while speaking to Geo.tv said, that the currency gained lost ground as inflows from export proceeds and remittances began to improve.

The analyst said that the availability of the US dollar in the open market also played a significant role in the local currency’s recovery.

“The aforementioned reasons combined with the unfolding developments regarding the ongoing technical-level talks with the International Monetary Fund (IMF) faded speculations while boosting market player’s confidence,” he said.

Abbas predicted that the currency will consolidate within a range of 260-270 against the greenback in the upcoming days.

The crisis-hit country is dealing with a serious balance of payments crisis and has just about three weeks’ worth of import coverage in foreign exchange reserves. Pakistan is scrambling to secure foreign financing to avoid default.

As of January 20, the foreign exchange reserves of the central bank stood at $3.7 billion.

It should be noted that after the government's move to remove the self-imposed cap, the exporters have drawn more loans even though export activity was low. This suggests that exporters borrowed in the local currency (at high rates) but did not bring in their export proceeds.

Analysts estimate this figure to be around $2.5 billion. Now having a windfall they may not wait for the rupee to depreciate further in a race to pay back their high-interest money and to quickly procure raw materials before the prices jump up, according to Tresmark.

Pakistani rupee to weaken further: Fitch

Earlier today, Fitch Solutions predicted that the Pakistan rupee is expected to weaken further, particularly with Pakistan’s balance of payments positions likely to remain weak for several more months.

It warned that the rupee depreciation will have broader economic implications for the country which is already gripped by a major economic crisis, with the local unit plummeting, inflation soaring and energy in short supply.

In its quick view, the New York-based research agency noted that the rupee’s devaluation was triggered by the decision among local foreign exchange companies to remove the self-imposed cap on the exchange rate on January 25.

The SBP initially intervened, but the significant depreciation in the rupee “is a clear sign the authorities have effectively loosened their grip on the currency.”

Fitch Solutions mentioned that their current forecast for the rupee to reach Rs248 per dollar by year-end “is therefore now looking out of date”.

“We believe that the rupee’s weakness still has further to run particularly with Pakistan’s balance of payments positions likely to remain weak for several more months,” it noted.

The agency said that there remains a “considerate amount of uncertainty at this juncture” therefore it is difficult to gauge the extent to which the latest devaluation has caused investor sentiment to soar further.

“We will therefore firm up our rupee forecasts over the coming weeks, once the dust settles,” the quick view mentioned.

In its analysis, Fitch warned that a continued weakening in the rupee will have broader economic implications too in the near term, “it could exacerbate imported inflationary pressure and may eventually result in steeper policy rate hikes from the SBP.”

The report added that Fitch expects Pakistan’s economy to contract by 0.3% in the fiscal year 2022-23.

Fitch, however, mentioned that the rupee’s devaluation will help Islamabad secure further disbursements from the International Monetary Fund (IMF), which would be a positive for the longer-term outlook as it would help ease Pakistan’s balance of payments strains.

The world's fifth-biggest population has less than $3.7 billion as reserves in the State Bank — enough to cover just three weeks of imports.