Chinese loan shores up SBP-held reserves to $3.8bn

SBP reserves rise by $556m during week ended February 24

March 02, 2023

- SBP reserves rise by $556m during week ended Feb 24.

- Amount calculated after accounting for debt repayments.

- Total liquid foreign reserves rise to $9,267.9 million.

Following the refinancing by the China Development Bank, the foreign exchange reserves held by the State Bank of Pakistan (SBP) rose by more the $500 million.

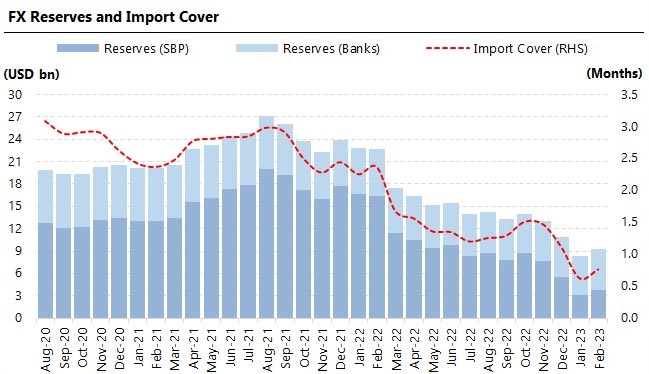

The central bank, in its weekly bulletin, said that its foreign exchange reserves have increased by $556 million to $3,814.1 million as of the week ended February 24, which will provide an import cover of around eight weeks.

During the week ending on February 24, the SBP received $700 million as the government of Pakistan commercial loan disbursement from China. However, after accounting for external debt repayments, the SBP reserves increased by $500 million.

Pakistan received $700 million loan facility from China Development Bank in February; moreover, the Chinese Foreign Ministry also said it is calling on all creditors to play a constructive role on Pakistan, when asked if China would rollover its loans to the nation.

The net foreign reserves held by commercial banks stand at $5,453.8 million, $1,639.7 million more than SBP, taking the total liquid foreign reserves to $9,267.9 million.

Cash-strapped Pakistan has been trying to secure the International Monetary Fund (IMF) bailout to avert a debt default, unlock more funding and stave off severe supply shortages. There are $7 billion of repayments in the coming months, including a Chinese loan of $2 billion due in March, according to Fitch Ratings.

The nation needs to repay about $3 billion dues in the upcoming payments while $4 billion is expected to be rolled over, SBP Governor Jameel Ahmad said in an analyst briefing after the announcement of the monetary policy rate — which has been jacked by to a 27-year high of 20%.

Prime Minister Shehbaz Sharif this week said an agreement with the IMF could be reached within the next few days. Federal Minister for Finance and Revenue Ishaq Dar said the negotiations “are about to conclude and we expect to sign a staff-level agreement with the IMF by next week.” in a tweet on Thursday.

In a bid to resume the delayed IMF programme and avoid a default, the incumbent coalition government has taken steps in the past three months ranging from imposing new taxes, increasing energy prices, withdrawing subsidies, and loosening its control on the rupee.

Pakistan's foreign exchange reserves can only be improved if the country successfully secures critical funding from the Washington-based lender.