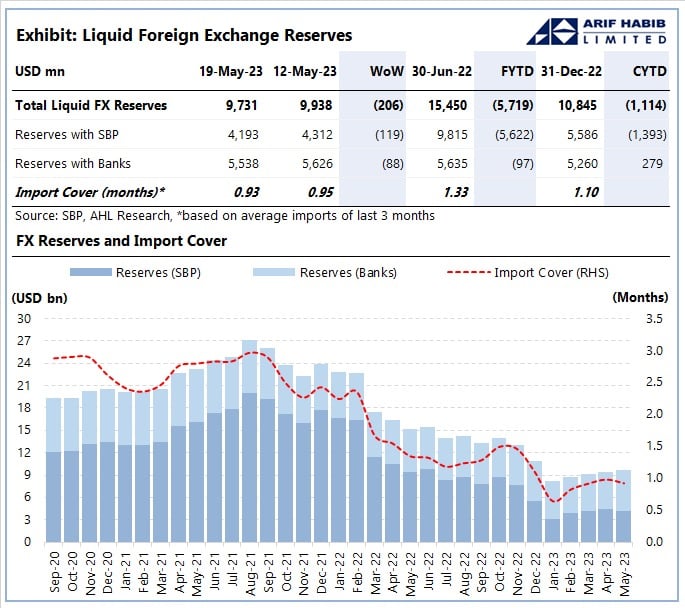

SBP’s reserves drop to $4.2 billion

State Bank of Pakistan's foreign exchange reserves provide import cover of less than a month

May 25, 2023

- Forex reserves to cover less than a month's imports.

- SBP's reserves have fallen $119 million as of May 19.

- Total liquid forex reserves stand at $9.7 billion.

The State Bank of Pakistan (SBP)-held foreign exchange reserves dropped to $4.2 billion as the cash-strapped nation fails to secure external financing despite attempts to resume a stalled bailout programme.

In its bulletin, the SBP said its reserves have fallen $119 million as of the week ended May 19 due to external debt repayments, and currently stand at $4.19 billion, with Arif Habib Limited saying the reserves would provide an import cover of less than a month.

The net foreign reserves held by commercial banks stand at $5.54 billion, $1.34 billion more than the central bank, taking the total liquid foreign exchange reserves to $9.7 billion.

This is the fourth weekly drop in the foreign exchange reserves, with Pakistan seeing no signs of securing external financing any time soon amid political instability — which has had a huge impact on the deteriorating economy.

The $350 billion economy is in turmoil amid financial woes and the delay in an agreement with the International Monetary Fund (IMF) that would release much-needed funding crucial to avoid the risk of default.

The government has been in talks with the Washington-based lender since end-January to resume the $1.1 billion loan tranche that has been on hold since November, part of a $6.5 billion Extended Fund Facility (EFF) agreed upon in 2019.

A deal with the IMF will also unlock other bilateral and multilateral financing avenues for Pakistan to shore up its foreign exchange reserves.

The ninth review was due in November 2022 but the two sides have not yet reached consensus.

The IMF has been insisting that the government needs to secure "significantly more financing" for a successful bailout review, but the local authorities remain adamant they have already met the requirements.

Federal Minister for Finance and Revenue Senator Ishaq Dar said Wednesday all technical formalities and prior actions had been completed but, unfortunately, the IMF programme was facing a structural delay.

Dar expressed his belief that Pakistan would not default and the coalition government was committed to completing the 9th Review of the IMF programme.