Renowned banker Muhammad Aurangzeb to be 'appointed finance minister'

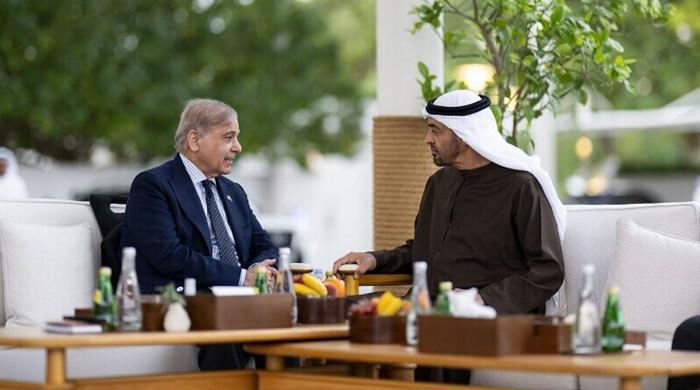

Senator Ishaq Dar is out of the race, say sources, as PM Shehbaz begins picking federal cabinet members

March 05, 2024

- PML-N's Senator Ishaq Dar is out of the race: sources.

- Dar has health issues, might be given another role.

- Aurangzeb has over 30 years of experience in banking.

ISLAMABAD: Renowned banker Muhammad Aurangzeb is all set to become the country’s next finance minister, sources said Tuesday, as newly-elected Prime Minister Shehbaz Sharif is all set to appoint his federal cabinet.

The sources added that Ishaq Dar, a former finance minister and a close aide of Pakistan Muslim League-Nawaz (PML-N) supremo Nawaz Sharif, is out of the race as he has health issues.

Dar might be given another important post, the sources said, as during the previous Pakistan Democratic Movement, he had faced an uphill task in reviving the stalled International Monetary Fund (IMF) programme.

Aurangzeb is currently HBL’s president. He has served as the CEO of JP Morgan’s Global Corporate Bank in Asia and has rich international banking experience of over 30 years in other senior management roles.

Meanwhile, sources close to Islamabad/Pindi say an even more senior choice for finance minister was Sultan Ali Allana, the chairman of HBL, due to his vast experience in finance and economy.

However, due to international work commitments in relation to the Aga Khan, he couldn't commit. Allana has been credited in the past for conceptualising Roshan Digital and the behind-the-scenes project management required to get Pakistan out of the FATF Grey list.

After taking charge as the prime minister a day earlier, Shehbaz held a meeting on the economy and ordered to begin talks with the IMF on a new Extended Fund Facility (EFF).

Economists, investors, and foreign capitals are watching closely for an announcement by Shehbaz on the cabinet, especially the important finance portfolio. The next finance minister will have to lead tough talks with the IMF to get a new multi-billion dollar funding agreement.

The struggling $350 billion economy has a narrow path to recovery and an ongoing IMF agreement expires on April 11, with critical external financing avenues linked to securing another extended programme.