PSX closes at all-time high on easing regional tensions

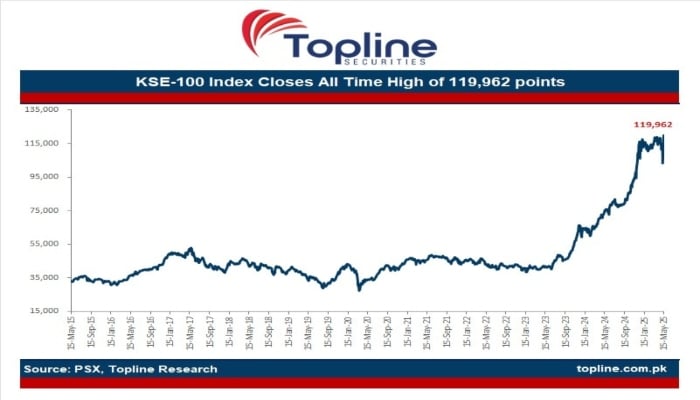

Benchmark KSE-100 Index closes at 119,961.91, up 1,425.39 points, or 1.20%

May 15, 2025

- Several positive developments driving market upwards.

- Intraday high of 119,990.30 marked gain of 1,453.78 points.

- Intraday low of 118,871.13, still up 334.61 points, or 0.28%.

Bulls took charge at the stock market on Thursday, driven by sustained market momentum, improving economic indicators, and easing regional tensions, all contributing to investor confidence across multiple sectors.

The Pakistan Stock Exchange’s (PSX) benchmark KSE-100 Index settled at an all-time high of 119,961.91 points, up 1,425.39 points, or 1.20%, from the previous close of 118,536.52.

The index touched an intraday high of 119,990.30 points, reflecting a gain of 1,453.78 points, or 1.22%, as strong institutional interest supported the day’s performance.

“Refinery stocks are up today after news of a Rs34 billion compensation package for the sector. We’ve already been observing some momentum, particularly with talk of the IMF disbursement and the geopolitical ceasefire,” said Sana Tawfik, Head of Research at Arif Habib Limited.

“There’s also discussion of an increase in OMC margins, which has caused movement in that sector too. Yesterday, Barron’s called Pakistan a ‘macroeconomic miracle’ in a positive report, all these factors are adding up to the positive sentiment.”

On Wednesday evening, the State Bank of Pakistan (SBP) confirmed receipt of the second IMF tranche of $1.023 billion, under the Extended Fund Facility (EFF). The inflow will be reflected in the country’s reserves for the week ending May 16.

International financial media has also taken note of Pakistan’s turnaround. US publication Barron cited a “macroeconomic miracle,” pointing out that inflation had dropped from nearly 40% to near zero, Eurobond prices had doubled, and the KSE-100 Index had tripled over two years, even amid tensions with India.

Meanwhile, US President Donald Trump said on Monday the United States “stopped a nuclear war” between India and Pakistan, noting that Washington had brokered the ceasefire between the two rivals. He announced intentions to boost trade with both nations and offered to work towards a long-term resolution on Kashmir.

Earlier this month, the SBP cut the benchmark interest rate by 100 basis points to 11%, surprising markets. The Monetary Policy Committee cited sharp declines in electricity tariffs and food prices as key drivers behind the disinflation trend.

The KSE-100 had closed nearly flat on Wednesday, edging down 39.36 points, or 0.03%, to 118,536.52, following three straight sessions of strong gains. The index had reached a high of 119,460.54 and a low of 118,148.65 during that session.