Debt, dust, and the end of illusions

Seville hosts the Fourth International Conference on Financing for Development

June 29, 2025

As global leaders gather in Seville for the Fourth International Conference on Financing for Development, this reflection traces how debt became a quiet instrument of imbalance — especially across the Global South. Inspired by the moral clarity of the Jubilee Report and the principles of Islamic finance, it calls for not just relief, but reform: a financial architecture rooted in justice, symmetry, and shared risk.

In the beginning, there was restraint. Debt was a shadow, not a sign of strength. Among Muslim societies, borrowing came with shame, not swagger. Loans were tools of survival, not ceremony. But with time, that memory was uprooted — replaced by suits, certificates, and imported frameworks. The new keepers of economic truth — polished in Western halls, fluent in metrics — taught us something strange: a clean balance sheet was weakness; leverage, a mark of vision.

They were not villains. They believed they were lighting the way. But the glow they followed was not the sun — it was a screen.

Now, the machine is faltering.

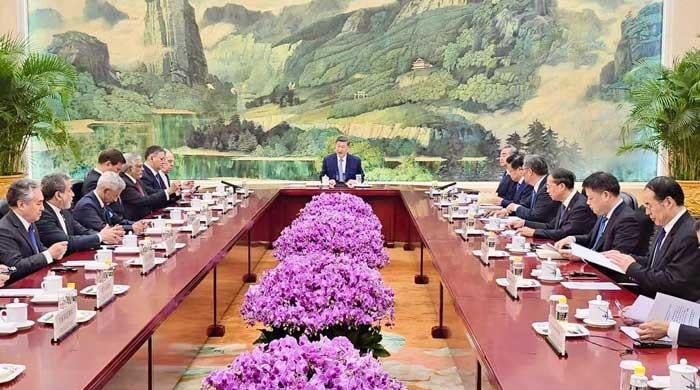

Seville hosts the Fourth International Conference on Financing for Development. There, a soft-spoken earthquake will be presented: The Jubilee Report, commissioned by Pope Francis, composed by the minds of Stiglitz, Guzmán, Mazzucato, and others who have seen too much to keep quiet. It speaks clearly: 3.3 billion people live in countries that pay more interest than they invest in health. 2.1 billion spend more on debt than on their children’s education.

This is not economics. This is betrayal in ledger form.

The report does not merely seek relief. It seeks release. It calls for a court for sovereign bankruptcies. For creditor nations to end the masquerade of magnanimity. For loans without surcharges, for contracts that balance gain with grief. It dares to say what Islamic finance has whispered all along: If you seek profit, bear the risk.

But the real demand is deeper. The Global South does not want pity — it wants tools. It needs not just money, but the right to produce. To build, to fail, to try again on its own terms. It asks the world not for mercy, but for symmetry.

Even Pakistan — quiet and chaotic, faithful and fractured — has pledged to go interest-free by 2028. Its banking sector, though reluctant, holds the ability. But it is late. The people of the book have picked up the work. To those resisting: don’t just bandage the wound. Cure it. A loan without return is noble. A loan with a return must carry its share of loss.

Nature speaks in patterns. The tree sheds leaves. The tide pulls back. The moon fades. Even the sun dims behind passing clouds.

Only illusions grow forever.

If Seville simply resets the system, it will fail again — and faster. But if it plants something new, something just, perhaps next time we’ll harvest more than debt. Perhaps we’ll find that real wealth lies not in what grows forever — but in what endures.

Disclaimer: The viewpoints expressed in this piece are the writer's own and don't necessarily reflect Geo.tv's editorial policy.