Monetary policy rate unchanged at 5.75 percent: SBP

The revival of domestic demand, in particular, has been instrumental in the current upturn

May 20, 2017

The Monetary Policy Committee of the State Bank of Pakistan (SBP) decided to keep the policy rate unchanged at 5.75 percent on Saturday.

Real GDP growth in the fiscal year 2017 is provisionally estimated at 5.3 percent, representing a 10-year high.

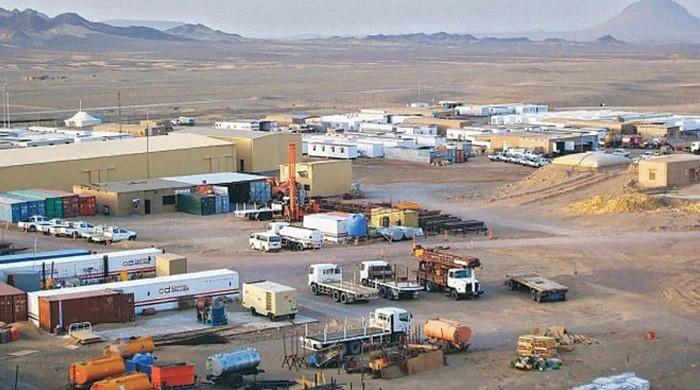

The revival of domestic demand, in particular, has been instrumental in the current upturn. The major thrust has come from the ongoing public and private investment chiefly in infrastructure and power sector, the SBP said.

Public and private investment particularly in infrastructure and power sector played a major role in the uptick, while consumer spending also saw an expansion due to a stable inflationary environment and banks’ renewed interest in consumer financing, the SBP said.

On the supply side, recovery in major crops from last year, better energy supplies, and a broad-based increase in large-scale manufacturing have facilitated this expansion.

Improvement in economic activity and recovering global oil prices led to increase in headline CPI inflation in recent months. It is expected to increase in FY18 as well attributable to rising income, surge in imports, and accelerating credit to private; however, it is likely to remain within the target.

The upbeat economic sentiments and low interest rates have encouraged the private sector to undertake capacity expansions. Private sector credit posted a net expansion of Rs503 billion during

Jul-Apr FY17, which is significantly higher than the uptick of Rs 334 billion in the same period of last year. In line with the current trends in expansion in the economic activity, private sector credit uptake is expected to continue in FY18, the new monetary policy said.

Surge in import payments during Jul-Apr FY17 was also seen. Exports, however, saw only a marginal recovery; whereas, workers’ remittances also slowed down this year mainly due to the changing labour market dynamics in the GCC region.

According to the state bank, all these factors led to a sharp widening of the current account deficit during Jul-Apr FY17, compared to the same period last year. As the financial inflows did not entirely cover the current account imbalance, the overall balance of payments turned into deficit from a surplus in the same period last year.

Going forward, the bank expects official inflows to provide support to foreign exchange reserves. Increase in private inflows – foreign direct investments and export earnings in particular – is also needed to facilitate surge in imports. The uptick in economic activity is expected by an improvement in global demand and the current composition of imports, mainly machinery. The SBP also expects the growth led by CPEC-related investments to boost foreign direct investment inflows.