Rs40,000 premium prize bonds investment records 21% growth

The unregistered bonds remained attractive for investors, as the stock increased 3% to Rs739 billion by the end of October 2020

December 10, 2020

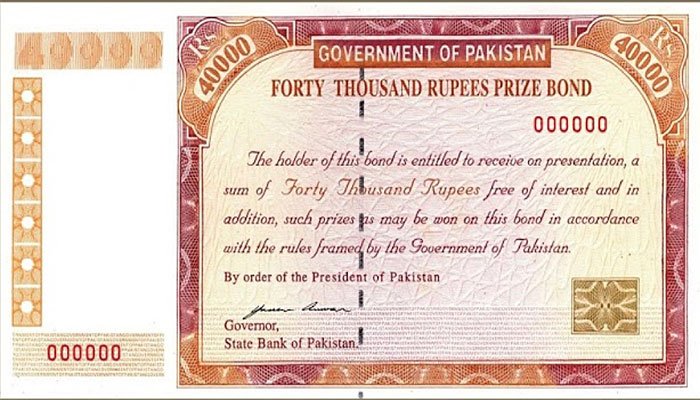

KARACHI: Investment in premium Rs40,000 prize bonds has seen a growth of 21% to Rs20.54 billion by the end of October 2020, compared with Rs16.93 billion in the same period of the last fiscal year, reported The News citing the Central Directorate of National Savings (CDNS) data.

The premium prize bonds were launched by the government close to three-and-a-half years ago in April 2017 to document the economy. The premium prize bonds are issued only against CNIC with valid bank accounts.

Toe make it an attractive investment bond, the government also announced biannual profit, which would be directly transferred to the bondholders.

The investment in premium prize bonds remained attractive, as the government announced to withdraw same denomination unregistered prize bonds to eliminate all unregistered debt securities and to ensure a verified source of income and to comply with the requirements of the Financial Action Task Force (FATF).

Read more: Prize Bond Schedule 2021 – Prize Bond Draw List, Date & Venue

The move was made legal through the Ministry of Finance in early January 2020 when it issued the “National Saving Schemes (AML and CFT) Rules, 2019” to stop terror financing and money laundering.

Under these rules, the authority would collect all the information of persons investing in saving schemes. The information would include name, address, CNIC, passport, etc.

Further, the investors either existing or new would require to provide a source of money related to the invested amount.

The pace of investment in these premium prize bonds witnessed a significant increase in July 2019 after the government’s announcement of the discontinuation of the bearer or unregistered bonds of Rs40,000 on June 24, 2019.

The bearer bonds of Rs40,000 was to be completely discontinued for legal tender by March 2020. However, it is extended up to December 30, 2021.

The extended date resulted in a rising stock of unregistered prize bonds of Rs40,000 denomination.

The total stock of bearer bonds of Rs40,000 denomination was reduced to Rs756 million by June 2020, but it again increased to Rs2.1 billion by the end of October 2020.

The unregistered bonds of all denominations remained attractive for investors, as the stock increased 3% to Rs739 billion by the end of October 2020, compared with Rs719 billion in the same month of the last year.