Budget 2021-22: In final debate session, govt announces adjusted revenue measures, spending plans

Tarin announces tax on mobile phone calls lasting more than 5 minutes; withdrawal of tax on dairy products

June 25, 2021

- Finance Minister Shaukat Tarin addresses final session of debate on budget 2021-22 in National Assembly.

- House considers recommendations made by Senate for incorporation to finance bill 2021-22.

- Tarin announces tax target set at an ambitious Rs5,800 billion.

The government will now be taxing mobile phone calls lasting more than five minutes.

This was announced by Finance Minister Shaukat Tarin while addressing a session of the National Assembly, chaired by Deputy Speaker Qasim Suri, to conclude the budget 2021-22 debate on Friday. Tarin responded to the recommendations made by the senators and Opposition.

The government has set its revenue target at an ambitious Rs5,800 billion and Tarin said they are getting rid of 12 withholding taxes.

Tarin shared that speaking over your mobile for more than five minutes will be taxed at 75 paisas, but there will be no tax on an SMS and mobile internet.

Earlier, the finance minister had said that Prime Minister Imran Khan and the cabinet had opposed the imposition of tax on mobile phone calls, internet data and SMS, after which they would not be taxed.

Budget 2021-22: No increase in tax rate of mobile phone calls, SMS, internet, says Shaukat Tarin

Key developments

- Tax on gold and silver reduced from 17% to 1-3% percent.

- 17% tax on value addition of gold will remain.

- No tax levied on wheat or its byproducts.

- Revenue target set at Rs5,800 billion.

- Tax on 1,000cc cars reduced.

- Tax on milk, yogurt and other dairy products is being withdrawn.

- Mobile phone calls over 5 minutes to be taxed; no tax on SMS and mobile internet

- Third party not FBR to conduct audit of tax evaders

- Tax on medical devices has also been withdrawn.

Tarin said that "harassment" by the Federal Board of Revenue is a problem for everyone, because of which tax payers do not file their returns.

For this, he said the government plans to set up a third party with a legal structure. "We will only do an audit and talk to the tax payer," he said, emphasising that a tax payer will not be arrested.

Budget 2021-22: Government targets 4.8% growth in 'people-friendly' budget

He shared that the government has the profiles of at least 15 million people who are not paying their taxes. But the FBR will not approach these people. Instead, under the government's new plan, the third party will approach these non-taxpayers.

Why did Pakistan go to the IMF?

The finance minister spoke about some of the major challenges faced by the PTI government and explained how the government tried to deal with these challenges.

The biggest problem, he said, when the PTI government came to power, was the country's current account deficit of $20 million.

In the past, growth had been seen after taking loans, he said, explaining that the current account deficit left the government no choice but to go to the International Monetary Fund (IMF).

Tarin reasoned that Pakistan's economy declined because IMF had placed some strict conditions, including an increase in the discount rate to 13%, devaluing the rupee and an increase in tariffs, when Pakistan approached it for its programme.

In addition to all this, Tarin said the icing on the cake was when the coronavirus pandemic took over the country.

He explained that Prime Minister Imran Khan then decided to develop the country's industry.

What are the government's revised plans?

Tarin emphasised on "comprehensive and sustainable development this time around" during his budget speech.

"We will give interest free loans up to Rs300,000 for agriculture. An interest free loan of up to Rs 500,000 will be given to an individual for doing business in urban areas," he announced.

The finance minister said the tax on gold and silver has been reduced from 17% to 1-3%. But the 17% tax on the value addition of gold will remain.

Budget 2021-22: Realistic or over-optimistic?

No tax has been levied on wheat or its byproducts, while the tax on 1,000 cc cars will be reduced and the tax on dairy products and medical devices is being withdrawn.

"We are bringing the idea of agri malls to get rid of the middle man’s role," Tarin shared, explaining that the network of agri malls will be spread across Pakistan and get rid of the middle man’s current 400-500% profit margin.

He said e-commerce tax is being ended and registered e-commerce companies have to pay zero tax.

"We will continue to provide incentives for textiles. We will introduce a ‘my car’ scheme. All the demands of the IT sector have been met as well," he said.

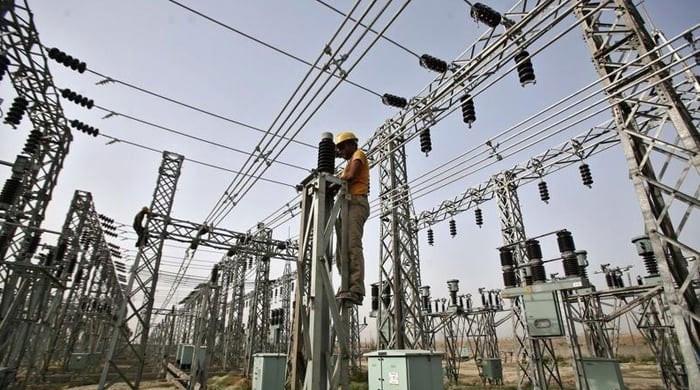

Under the government final budget plans, every citizen can get a housing loan from banks. Low income households, meanwhile, will be given a targeted subsidy for electricity and wheat.

He also shared that PM Khan has refused to increase the electricity tariff, while Rs260 billion has been set aside for the Ehsaas program this year.

The government has allotted $1.1 billion for coronavirus vaccines and set aside Rs5 billion to introduce an electronic voting system.

Tarin said previous governments did not set money aside in the budget for a dam project as they thought it would not be completed in their tenure.

"Imran Khan has set aside money in the budget for a dam project," he said.

Read more: Gwadar’s first university missing from budget 2021-22

The finance minister said that the government has increased the annual PSDP by 40% from Rs630 billion to Rs900 billion. He said projects pertaining to transport and energy as well as projects in underdeveloped areas, including Balochistan, tribal areas and Gilgit-Baltistan, have been given priority in the development plan to bring prosperity and reduce poverty.

The minister pointed out that Pakistan has become a net food importer and the present government will now spend on the agriculture sector to achieve self-reliance. He said that a plan has been formulated in cooperation with the provinces to uplift this sector.

He said that cold storages and warehouses will be established.

For the industrial sector, he said incentives of Rs40 billion will be given with an aim to increase competitiveness in this important sector of the economy. He said that tax relief has been given to the SMEs sector and loans of Rs100 billion rupees will be given to them on a markup of 9%.