PSX sees worst-performing week of FY22 as all sessions end in red

Hike in policy rate, economic uncertainty, and local selling emerge as main factors behind the 3.4% decline

September 25, 2021

- The benchmark KSE-100 index closed the week at 45,073.52, down 1,563 points.

- The decline comes on the back of a hike in policy rate coupled with uncertainty on the economic front.

- A report from Arif Habib Limited predicts that the resumption of the IMF programme next month can provide a breather to the market.

KARACHI: A turbulent week at the Pakistan Stock Exchange (PSX) saw off the futures rollover deadline, with the benchmark index recording a 1,563 point slump to settle at 45,073.52 points. This made the outgoing week FY22’s worst performing to date (second-worst of CY21).

The benchmark KSE-100 index sustained its losing streak for a second successive week as it ended all five sessions in the red, with a cumulative loss of 3.4%, as the index faltered below the 46,000-point mark.

On Monday, as rising demand and a surge in international commodity prices exacerbated the deficit on the external front, raising red flags over future inflation readings and building pressure on the Pakistani rupee, the Monetary Policy Committee announced a 25bps raise in the policy rate which affected the investment climate negatively throughout the week.

Selling pressure also came on the back of fears that the economic recovery may halt as a widening current account deficit and a year-on-year drop in foreign direct investment dented investors’ sentiment.

Wednesday brought no respite as stocks bled with the index diving over 1,000 points in intra-day trading, but a bloodbath was averted by buying towards the end of the session.

Speaking to Geo.tv, Pakistan-Kuwait Investment Company Head of Research Samiullah Tariq had said the market “over-reacted because of the monetary policy tightening”.

The analyst was of the view that investors panicked as they assumed that the central bank will continue to tighten its monetary policy going forward.

Triggered by continued panic selling, the index fell below the 46,000-point mark that day.

In the last two sessions, negative market activity was fuelled by a bearish spell in global equity markets coupled with falling international oil prices.

On the other hand, rupee depreciation against the US dollar during the week also maintained pressure at the PSX as the currency fell around Re1 during the week under review.

Investors remained on the edge during the week as the government and central bank shifted the focus from prioritising growth to now ensuring sustainability as they aim to stop the economy from overheating.

Other major developments during the week were: EU extended GSP Plus status of Pakistan with six new conventions; the Asian Development Bank predicted Pakistan's economy will grow at 4% in FY22; Pakistan said it was ready to issue new international Sukuk in October; Punjab issued 22 NOCs for setting up cement factories; the government proposed up to 37% hike in gas tariff; and reports that talks with the International Monetary Fund (IMF) will begin from October 4.

Foreign buying was witnessed this week, clocking at $6.7 million against a net sell of $10.9 million recorded last week. Buying was witnessed in other sectors ($6.1 million), technology and communication ($3 million), and oil and gas marketing companies ($1.8 million).

On the domestic front, major selling was reported by individuals ($7.5 million) and companies ($3.5 million).

During the week under review, average volumes clocked in at 384 million shares (down by 4% week-on-week), meanwhile average value traded settled at $73 million (down by 18% week-on-week).

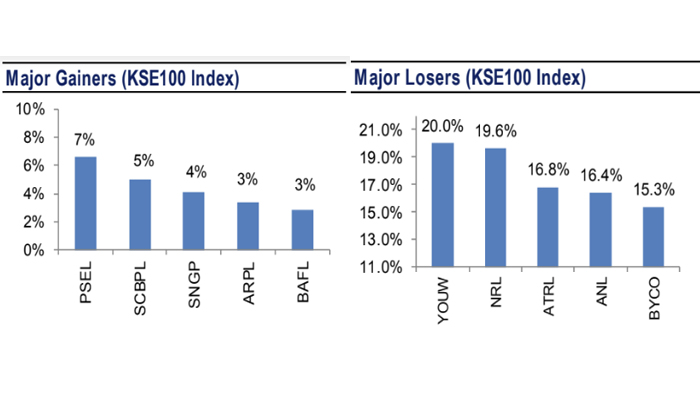

Major gainers and losers of the week

Sector-wise negative contributions came from technology (-275 points), cement (-196 points), commercial banks (-148 points), fertiliser (-137 points) and exploration and production (-134 points). Sectors which contributed positively were miscellaneous (+41 points) and chemical (+3 points).

Scrip-wise major losers were TRG Pakistan (-142 points), Systems Limited (-124 points), HBL (-71 points), Oil and Gas Development Company (-70 points) and Pakistan Petroleum Limited (-55 points). On the flip side, major gainers were Pakistan Services (+46 points), MCB (+18 points) and Bank AlFalah (+15 points).

Outlook for next week

A report from Arif Habib Limited stated: “Going forward, with the government making all efforts to restrict imports, tax collection (silver lining in the domestic economic climate at the moment), may also be hurt.”

“Whereas sentiment of the market may once again be tested with the government proposing a hike in gas and electricity tariffs.”

However, the resumption of the IMF programme next month could provide a breather, the brokerage house predicted.

“The KSE-100 is currently trading at a PER of 5.3x (2021) compared to Asia-Pacific regional average of 14.4x while offering a dividend yield of 8.1% versus 2.3% offered by the region,” it further stated.