Bears hold sway as PSX falls below 46,000-point mark

November 12, 2021

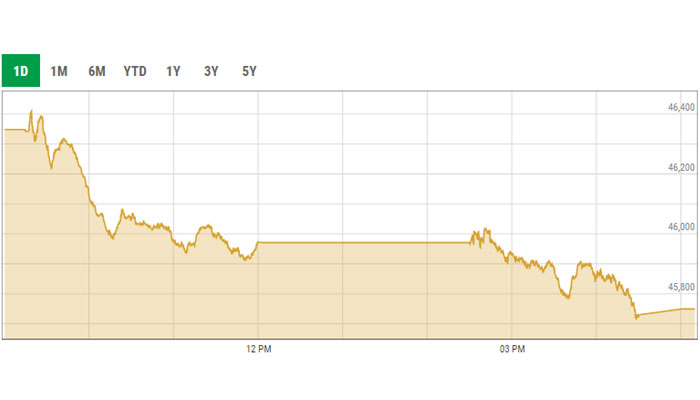

- At close, the benchmark KSE-100 index shed 599 points to settle at 45,749.15 points.

- Investors kept a close watch on news about the revival of the IMF loan programme and rupee-dollar parity.

- Overall trading volumes plunged to 192.5 million shares compared with Thursday’s tally of 269.5 million.

KARACHI: The bears continued to hold sway at the stock market for the second consecutive session on Friday as the benchmark KSE-100 index fell nearly 600 points and closed below the 46,000-point mark.

The stock market traded between hope and despair, which eventually let loose the bears, dragging the bourse into the red.

Investors kept a close watch on news about the revival of the International Monetary Fund (IMF) loan programme and rupee-dollar parity.

Moreover, the MSCI, a global index provider, today disclosed constituents alongside the November 2021 Semi-Annual Index Review (SAIR), according to which Pakistan’s weight is estimated at 1.36% (as per yesterday's closing) in the MSCI FM large-cap index with Lucky Cement (0.56% weight), Habib Bank (0.42% weight) and MCB (0.37% weight) cutting.

The MSCI development, coupled with weakening oil prices in the international market, further impacted investment negatively.

The KSE-100 index opened in the green, but it encountered frequent falls at regular intervals. The downward trend turned steeper in the second session of the day and the bourse failed to sustain the 46,000-point mark.

At close, the benchmark KSE-100 index fell 599.03 points, or 1.29%, to settle at 45,749.15 points.

During the session, shares of 345 listed companies were traded. At the end of the session, 92 stocks closed in the green, 236 in the red, and 17 remained unchanged.

Overall trading volumes plunged to 192.5 million shares compared with Thursday’s tally of 269.5 million. The value of shares traded during the day was Rs7.7 billion.

Unity Foods was the volume leader with 14.9 million shares, gaining Rs0.83 to close at Rs29. It was followed by Ghani Global Holdings with 14.5 million shares, gaining Rs0.90 to close at Rs33.09, and Byco Petroleum with 9.3 million shares, losing Rs0.10 to close at Rs7.