KSE-100 reverses trend, sheds over 250 points

Investor mood remained sombre ahead of Morgan Stanley Capital International’s (MSCI) reclassification on December 1

November 30, 2021

- Investor mood remains sombre ahead of Morgan Stanley Capital International’s (MSCI) reclassification tomorrow.

- Institutional investors accumulate stocks across the board during the session.

- Cumulatively, KSE-100 index closes at 45,072 points, down by 1,112 points during November.

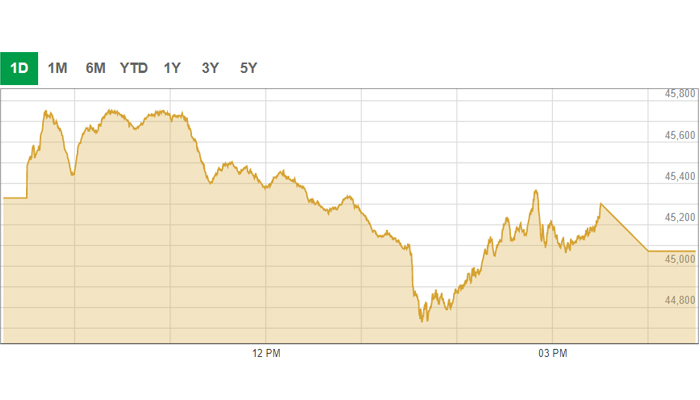

KARACHI: The Pakistan Stock Exchange (PSX) closed the last trading day of November on a negative note. The benchmark KSE-100 index shed over 350 points on the MSCI rebalancing day.

Investor mood remained sombre ahead of Morgan Stanley Capital International’s (MSCI) reclassification tomorrow (December 1).

Earlier this month, the MSCI had relocated three leading Pakistani stocks; Lucky Cement, Habib Bank (HBL), and Muslim Commercial Bank (MCB), to its MSCI Pak FM standard cap with effect from December 1, 2021.

At close, the benchmark KSE-100 index shed 257.67 points, or 0.57%, to close at 45,072.38 points.

Arif Habib Limited in its post-market commentary noted that on the MSCI rebalancing day, the benchmark KSE-100 index witnessed a volatile session as it made a dicey move of more than 1,000 points, finally closing above 45,000 points benchmark.

“Exploration and production sector stayed in the limelight as the government is considering a scheme to reduce the stock of the circular debt by declaring dividends for the shareholders of energy sector companies,” he said.

The brokerage house added that in the last two trading hours, institutional investors accumulated stocks across the board as it was the last opportunity to catch a foreign selling spree due to the transition from 'emerging' to 'frontier' market.

Sectors contributing to the performance included commercial banks (-160 points), fertiliser (-78 points), investment banks (-18.3 points), fast-moving consumer goods (-16.2 points), and textile composite (-12.8 points).

Shares of 345 companies were traded during the session. At the close of trading, 125 scrips closed in the green, 198 in the red, and 22 remained unchanged.

Overall trading volumes surged to 411.5 million shares compared with Monday’s tally of 268.2 million. The value of shares traded during the day was Rs34.8 billion.

HBL was the volume leader with 31.5 million shares traded, losing Rs1.81 to close at Rs123.35. It was followed by First National Equities with 22.3 million shares traded, losing Rs0.23 to close at Rs10.76, and UBL with 20.8 million shares traded, losing Rs2.45 to close at Rs141.25.

KSE-100 lost 1,112 points during November

Cumulatively, the trading activity remained chaotic and gloomy during November. The benchmark equity bourse witnessed a blood bath during the last week of the month amid macro-economic concerns and foreign selling.

The AHL report cited that the negative sentiments during the month were fuelled by:

- State Bank of Pakistan’s decision to increase the policy rate by 150bps to 8.75%;

- Alarming current account deficit which increased to $5.1 billion during 4MFY22;

- Net selling from foreigners amid reclassification from Emerging Market to the Frontier Market;

- Higher than anticipated inflationary readings; and

- Pressure on forex reserves resulting in rupee depreciation.

“Consequently, the KSE-100 closed at 45,072 points, down by 1,112 points or 2.41% during November,” the brokerage house stated.

Average daily volumes during the outgoing month settled at 316.1 million shares (+44.7% month-on-month), whereas average daily traded value also increased by 23.7% to $72.2 million.

Foreign investors sold shares worth $83 million, predominantly in banks ($45.3 million), cement ($ 13.5 million), fertiliser ($13.1 million), exploration and production ($11.4 million), power ($2.8 million) and oil and gas marketing companies ($1.8 million), while net buying worth $5.4 million and $1.2 million was witnessed in the technology and food sector respectively.