Bears hold sway at PSX as political tensions weigh

March 08, 2022

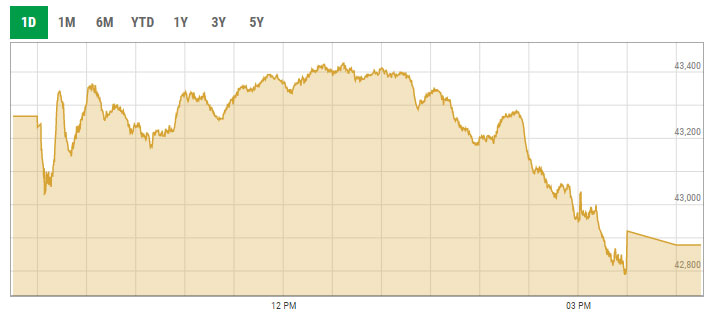

- KSE-100 index plunges 388.62 points to settle at 42,873.35.

- Benchmark index falls below 43,000-point mark.

- Uncertainty in international crude oil market also fuelled bearish momentum.

KARACHI: The bears maintained their control over the Pakistan Stock Exchange (PSX) on Tuesday, in line with the preceding session, as the market reacted to repercussions of political uncertainty.

In the backdrop of a worsening political scenario coupled with poor economic data as a result of the rising geopolitical tensions and commodity prices in the international market, the index fell below the 43,000-point mark.

At the close, the benchmark KSE-100 index plunged 388.62 points, or 0.90%, to settle at 42,873.35 points.

Political instability following the Opposition’s decision to submit the no-confidence motion against Prime Minister Imran Khan in the National Assembly Secretariat impacted the investment climate.

Uncertainty in the international crude oil market coupled with projections benchmark interest rate also fuelled the bearish momentum.

The State Bank of Pakistan (SBP) later after the session announced that the Monetary Policy Committee (MPC) has decided to hold the policy rate at 9.75% for the next six weeks.

Arif Habib Limited in its post-market commentary noted that a volatile session was observed today due to political unrest and an overheated commodities cycle.

“The market opened in the red zone and stayed under pressure throughout the day,” it said, adding that the cement sector stayed in the red zone due to mounting international coal prices.

Meanwhile, in the last trading hour, across the board selling was witnessed.

Sectors contributing to the performance included banks (-85.8 points), cement (-67.7 points), exploration and production (-62.1 points), power (-37.3 points) and oil marketing companies (-34 points).

Shares of 343 companies were traded during the session. At the close of trading, 102 scrips closed in the green, 223 in the red, and 18 remained unchanged.

Overall trading volumes dropped to 226.10 million shares compared with Monday’s tally of 236.88 million. The value of shares traded during the day was Rs7.12 billion.

TPL Corporation was the volume leader with 17.35 million shares traded, losing Re1 to close at Rs10.46. It was followed by Unity Foods with 17.18 million shares traded, losing Rs1.49 to close at Rs23.64, and Ghani Global Holdings with 16.90 million shares traded, losing Rs0.87 to close at Rs15.83.