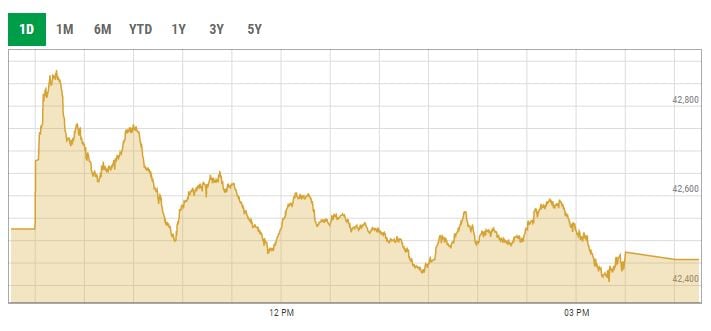

Dead cat bounce: KSE-100 sees recovery but still ends in red

Early hours recovery was short-lived as KSE-100 index reversed positive trend losing nearly 70 points

June 22, 2022

- Early hours recovery was short-lived as KSE-100 index reversed positive trend losing nearly 70 points.

- Investors opt to cherry-pick stocks at attractive valuations across the board.

- Optimism comes after Pakistan, IMF evolved a broader agreement on budget for FY23.

KARACHI: The Pakistan Stock Exchange's (PSX) benchmark KSE-100 index opened in the green on Wednesday, continuing its momentum from the previous day, just hours after Islamabad and the International Monetary Fund (IMF) reached an understanding on the federal budget.

However, the recovery was short-lived as the market reversed the positive trend and lost nearly 70 points after clarification and details regarding IMF's broad agreement poured in.

At close, the benchmark KSE-100 index closed at 42,458.14 points after shedding 67.81 points or 0.16%.

The optimism in the early hours came after Pakistan and the IMF evolved a "broad agreement" on the budget for the fiscal year 2022-23 to revise upward the Federal Board of Revenue (FBR) target and slash the expenditures to achieve a revenue surplus in the next fiscal year.

Speculation about the end to the prolonged economic turmoil instilled optimism among investors, who eventually opted to cherry-pick stocks at attractive valuations across the board.

However, this short-lived recovery was because investors thought IMF has revived the programme and they rebounded, then they realised that the programme is still on hold so all gains were reversed by the end of the session.

A report from Arif Habib Limited noted that the KSE-100 index opened in the green zone as the rupee, during the day, snapped its losing streak against the dollar a day after the government secured the much-anticipated deal with the IMF.

"Investors opted for profit-taking in the last trading hour which led the index to close in the red zone. Volumes remained healthy in the main board stocks," it stated.

Sectors contributing to the performance included cement (-39.7 points), technology (-28.2 points), exploration and production (-21.4 points), oil marketing companies (-18.7 points) and pharma (-11.6 points).

Shares of 336 companies were traded during the session. At the close of trading, 133 scrips closed in the green, 176 in the red, and 27 remained unchanged.

Overall trading volumes rose to 266.09 million shares compared with Tuesday’s tally of 300.59 million. The value of shares traded during the day was Rs8.46 billion.

Pakistan Refinery Limited was the volume leader with 23.87 million shares traded, gaining Rs0.13 to close at Rs18.98. It was followed by TPL Properties Limited with 23.15 million shares traded, gaining Rs0.74 to close at Rs21.97 and Cnergyico PK Limited with 16.79 million shares traded, losing Rs0.10 to close at Rs5.56.

Market expected to maintain growth momentum

Speaking to Geo.tv, BMA Capital Director Saad Hashemy said following the agreement with the IMF, investors' primary concern regarding external account funding will end which will give a major boost to their confidence.

He added that the market will maintain the growth momentum as the Pakistani currency will now strengthen against the US dollar which will also add to the list of positive economic developments.

However, the analyst was of the view that the recovery percentage of the benchmark KSE-100 depends on some factors which include:

- Exact details of the Pakistan and IMF ‘broad agreement’

- The direction of commodity prices in the international market

“Valuations are very attractive at the moment and PSX may recover massively; however, aforementioned factors will play a key role in setting the direction of the market,” he said.

Pakistan-Kuwait Investment Company Head of Research Samiullah Tariq also said that the stock market has more space for recovery and can recover around 7-8%.

Although the "broad agreement" is short of a staff-level pact, it may help soothe markets and end a four-month-long period of uncertainty that took a heavy toll on financial markets, unleashing a wave of inflation and eroding the confidence of markets and investors.