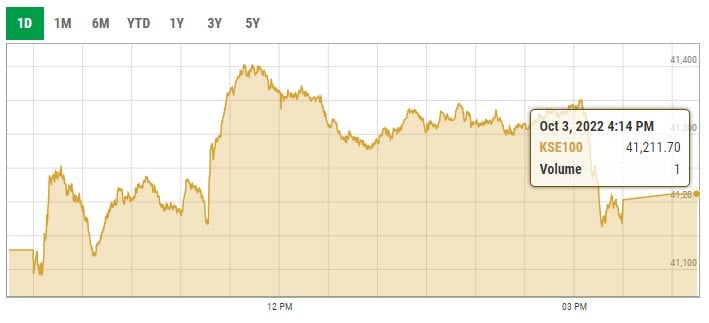

Bulls dominate, KSE-100 gains over 80 points

Uptrend was fuelled by continuous appreciation of Pakistani rupee against US dollar

October 03, 2022

- KSE-100 index closes at 41,211.70 points with a rise of 0.20%.

- Uptrend fuelled by continuous appreciation of rupee against dollar.

- Shares of 344 companies were traded during the session.

KARACHI: The bulls maintained their grip on the Pakistan Stock Exchange (PSX) for the second consecutive day as the benchmark KSE-100 index registered nominal gains on Monday.

The uptrend was fuelled by the continuous appreciation of the Pakistani rupee against the US dollar, coupled with a recovery in global and Asian markets.

Moreover, the anticipation of encouraging financial results for the first quarter of the fiscal year 2022-23 strengthened investors’ sentiment.

However, the market experienced pressure during intra-day trading and towards the end. The government’s decision to slash petrol prices by Rs12.63 has raised concerns regarding the ongoing International Monetary Fund (IMF) programme.

The benchmark KSE-100 index closed at 41,211.70 points with an increase of 83.03 points or 0.20%.

Shares of 344 companies were traded during the session. At the close of trading, 140 scrips closed in the green, 181 in the red, and 23 remained unchanged.

Overall trading volumes rose to 185.36 million shares compared with Friday's tally of 205.69 million. The value of shares traded during the day was Rs9.38 billion.

Hubco was the volume leader with 30.84 million shares traded, gaining Rs5.24 to close at Rs75.15. It was followed by TRG Pakistan with 15.99 million shares traded, gaining Rs0.72 to close at Rs129.58 and HBL with 13.16 million shares losing Rs1.52 to close at Rs68.19.

A look back at September’s performance

AHL in its monthly commentary said that the return of the KSE-100 index turned negative during September, with the bourse closing losing 1,222 points or 2.9%.

Investors continued to take account of the destruction from floods, while the sentiment at the index also remained frail initially due to continued weakness in the Pakistani rupee which almost touched its all-time low level of 239 against the US dollar by mid-month.

Moreover, the announcement of consumer price index-based inflation data for the month of August (a 47-year high), added to the pressure. In addition, foreign reserves held by the State Bank of Pakistan (SBP) showed further erosion despite the disbursement of $1.17 billion tranche by the IMF.

Albeit, the rupee displayed a recovery to 228.45 against the greenback with the new Finance Minister Ishaq Dar taking oath in the last week of the outgoing month and expectations of flows of $1.5 billion, $0.5 billion and $0.2 billion from the Asian Development Bank, Asian Infrastructure Investment Bank, and the Japanese government, respectively.

Moreover, the World Bank is also expected to offer flood-related support of $1.7 billion. However, improvement in the market trajectory remained short-lived as one of the largest private banks in Pakistan once again came under international scrutiny.

With that said, the incumbent government completed its second quarter in Parliament. The KSE-100 index posted a return of -1.0% during the third quarter of the calendar year 2022 against -7.5% in the prior quarter whereby political uncertainty and delay in the IMF programme hammered the market returns.

Key events this quarter included: devastating floods impacting lives, livestock and infrastructure hit Pakistan, the government reached a staff-level agreement with the IMF which paved the way for the disbursement of its tranche, and credit rating agencies (Fitch and S&P Global) downgraded Pakistan’s outlook from neutral to negative, and Financial Action Task Force completed its onsite visit to Pakistan.