Dar directs FBR to take steps for achieving tax collection target

Tax collection machinery collected only Rs740bn against desired target of Rs965bn for December 2022

January 02, 2023

- Dar directs FBR to increase its efforts to achieve true tax potential.

- FBR faces a revenue shortfall of Rs225 billion for December 2022.

- Revenue shortfall will now make it hard for government to convince IMF to revive its stalled programme.

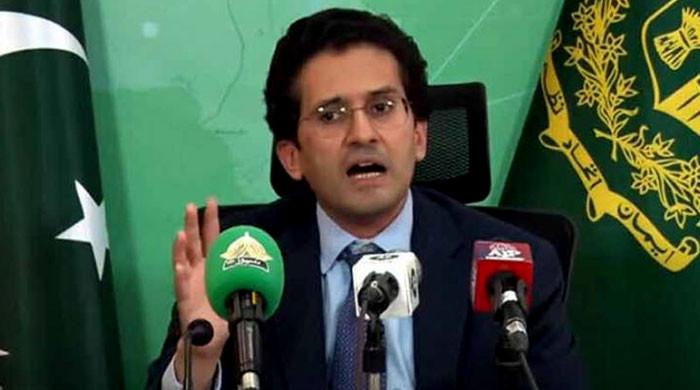

Finance Minister Ishaq Dar has directed the Federal Board of Revenue (FBR) to make all possible efforts to achieve the true tax potential in the country as the body has missed the target for the outgoing month of December 2022.

The finance minister made the remarks while chairing a meeting on the revenue performance of FBR in Islamabad.

During the meeting, FBR Chairman Asim Ahmad gave a detailed presentation on revenue targets and performance of FBR for the months of November and December 2022.

It is pertinent to mention here that FBR faces a revenue shortfall of Rs225 billion for the outgoing month of December 2022; the tax collection machinery collected only Rs740 billion against the desired target of Rs965 billion.

This increased revenue shortfall will now make it hard for the government to convince the IMF to revive the stalled IMF programme without taking additional and substantial taxation measures such as a mini-budget for the current fiscal year.

The government is contemplating options for the imposition of Flood Levy in the range of 1% to 3% to fetch Rs60 billion. Other taxation measures towards direct taxation are also on the cards. But the government is in a catch-22 situation and has identified only those areas that earned lofty profits because across-the-board taxation during the time of prevalent stagflation might further erode already sluggish economic activities.

However, the FBR sources argued that the imports compression and lingering litigation in higher judiciary resulted in lowering the revenue collection target. They have conveyed to the IMF that the collection of pending revenue would be materialised till March 2023. So, the FBR’s annual target of Rs7.47 trillion would remain intact, they believe.

But independent analysts are of the view that it would be hard for the FBR to achieve the desired tax collection target of Rs7 trillion by the end of June 30, 2023. The FBR has so far collected Rs3.428 trillion in the first half (July-Dec) period of the current fiscal year against the desired target of Rs3.673 trillion. The FBR collected Rs2.9 trillion in the same period (July-Dec) of the last financial year 2021-22.

According to the official statement, the FBR has demonstrated a remarkable revenue collection performance in the first six months of the current financial year 2022-23 and has collected Rs3,428 billion for the first six months against Rs2,929 billion collected in the corresponding period of last year depicting an increase of 17%.

The FBR collected Rs740 billion for the month of December 2022 against Rs599 billion in the same month last year, showing an impressive growth of almost 24% compared to the same month last year. This performance is despite huge import compression and zero rating on petroleum.

Direct taxes collection continues to grow at a robust pace, which has shown a growth of 66% during December 2022 compared to December 2021, a clear indicator of the policy of shifting the tax burden on the wealthy and affluent. Direct taxes collection for the first six months has also registered an unprecedented growth of 49%. This was achieved despite the fact that certain policy interventions having a revenue impact of Rs250 billion introduced through Finance Act 2022 could not be implemented as these are sub-judice in the courts. The target for the month of December was Rs965 billion, which could not be achieved due to the aforementioned reason.

The revenue collection performance is also exceptional when viewed in the context that the FBR has also issued refunds of Rs176 billion during the first half of the current financial year as against Rs149 billion during the corresponding period of last year.

Additional input from Radio Pakistan, The News