GST increased by 1%, duty on cigarettes hiked on IMF demand

Govt aims to fetch Rs115 billion by increasing GST and Federal Excise Duty on cigarettes

February 15, 2023

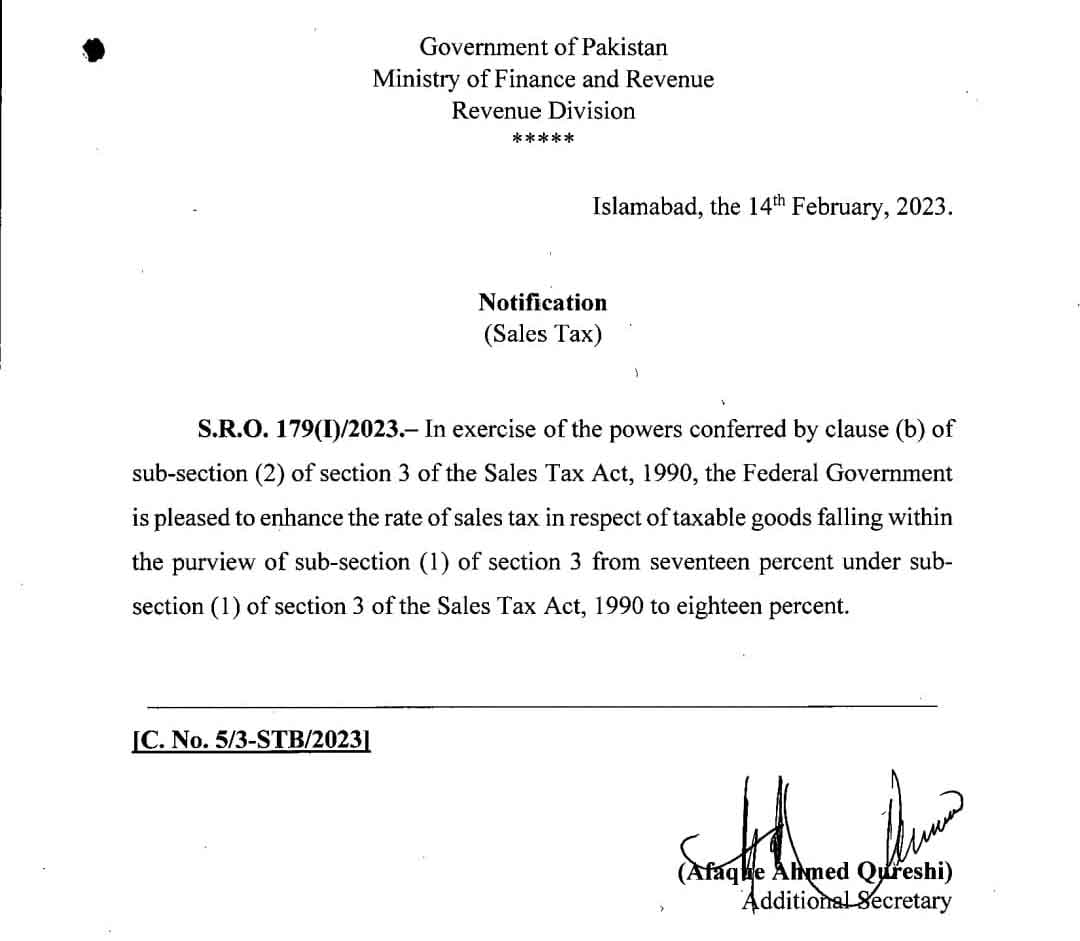

- Standard rate of GST has been jacked up from 17 to 18%.

- It would go into effect from February 15, 2023.

- Tax Amendment Bill 2023 to be tabled in Parliament today.

ISLAMABAD: Running against time to pacify the International Monetary Fund (IMF) for the revival of the bailout programme, the Shehbaz Sharif government on Tuesday introduced fresh taxation measures worth Rs115 billion through a notification issued by the Federal Board of Revenue (FBR).

The government moved swiftly and got the money bill approved by the federal cabinet after President Dr Arif Alvi refused to promulgate an ordinance for unveiling a mini-budget.

After this announcement, the cabinet met under the chairmanship of PM Shehbaz Sharif in which it was decided to slap Rs115-116 billion in taxes through an SRO by the FBR while the remaining taxation measures of Rs55 billion would be introduced through a money bill before the Parliament.

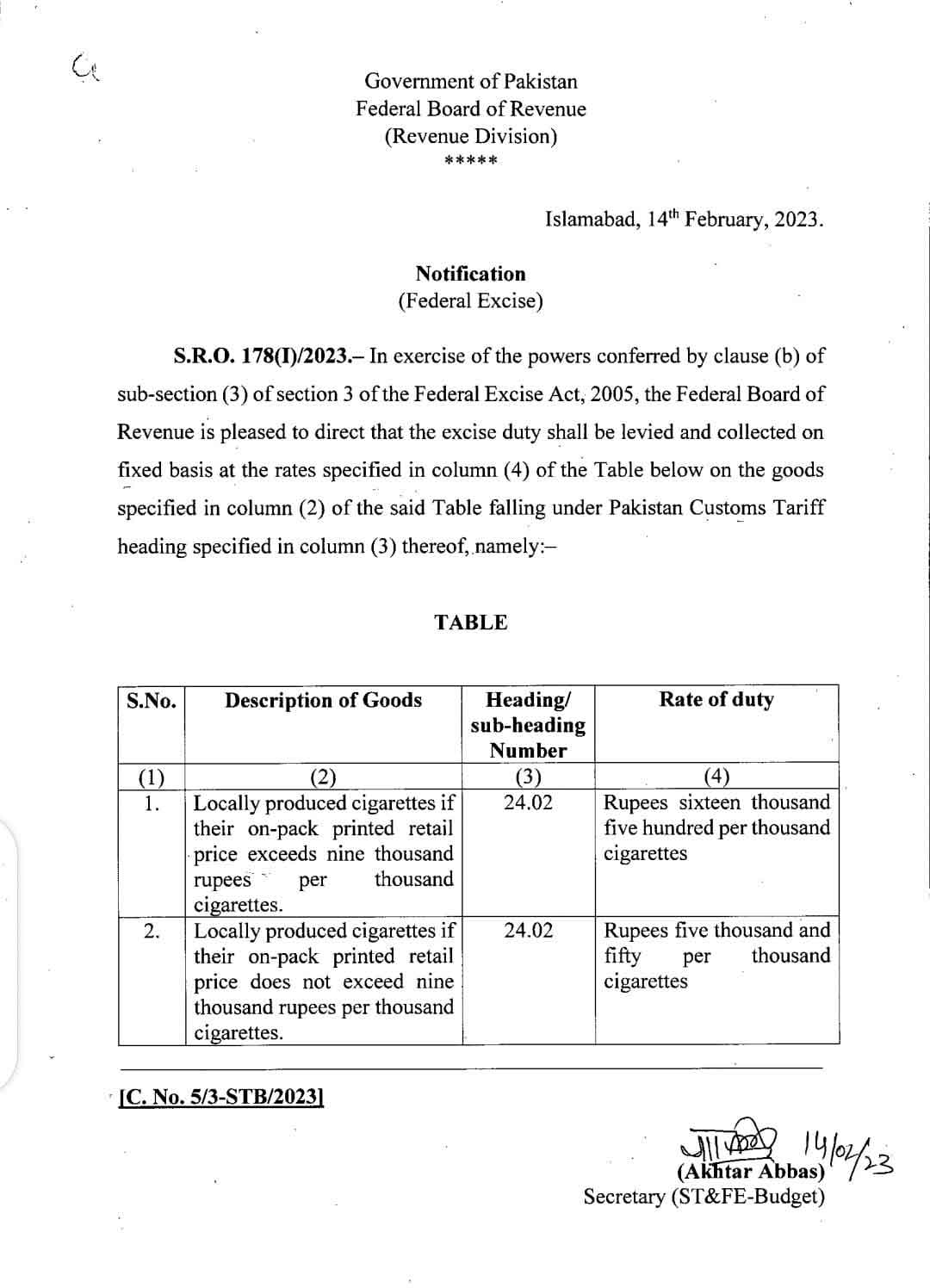

Following the cabinet’s nod in the shape of Tax Laws Amendment Bill 2023, the FBR issued the Statutory Regulatory Order (SRO) for hiking the General Sales Tax GST rate from standard 17 to 18% and increasing the Federal Excise Duty (FED) on cigarettes in order to fetch an additional Rs115 billion out of Rs170 billion agreed to by the government in line with the IMF conditions.

However, sources disclosed that the government also approved the GST on hundreds of high-end luxury items at the rate of 25% but it will be introduced through the Tax Amendment Bill 2023, which would be laid down in the Parliament on Wednesday (today).

The FBR slapped enhanced the GST rate on all those imported luxury items which were banned by the Ministry of Commerce sometime back in order to make imports more expensive. The enhanced rate of GST on some locally made luxury goods has also been proposed.

The government has abandoned the imposition of the Flood Levy due to stiff resistance by the Washington-based lender.

Alvi declines to promulgate ordinance

Despite adopting this route for slapping Rs115 billion in taxes on an immediate basis with effect from February 15, 2023, with the consent of the federal cabinet, the IMF’s staff-level agreement might get delayed, as the government has summoned the National Assembly session today at 3.30 pm and the Senate at 4.30 pm to lay down the Tax Amendment Bill 2023.

Finance Minister Ishaq Dar was scheduled to announce the salient features of the mini-budget through a televised speech at 9:25pm but after changing the course of action, his scheduled presser was cancelled at the last hour.

Dar told reporters outside the Finance Ministry after attending the federal cabinet meeting that he had requested the president to promulgate an ordinance but he declined.

He suggested to the government that the bill should be introduced for imposing taxes.

Dar informed the president that there were taxation issues involved and that the government could not wait for 8 to 10 days more because certain measures would have a financial impact but the president refused to entertain the request.

He said that the government adopted the other route and directed the FBR to issue an SRO for jacking up the GST rate to 18%, while the FED on cigarettes would be jacked up.

The finance minister refused to share the exact rate and advised patience till the issuance of a formal notification to this effect.

The FED on beverages, sugary drinks and juices would be increased from 13 to 20% and it would be made a part of the Tax Amendment Bill 2023, which will be laid down in the Parliament (today).

The minister hoped that the staff-level agreement would be signed within this week.