SBP reserves fall to $4.09bn as Pakistan mulls fresh IMF deal

SBP says forex reserves have fallen $102 million as of the week ended May 26 due to external debt repayments

June 01, 2023

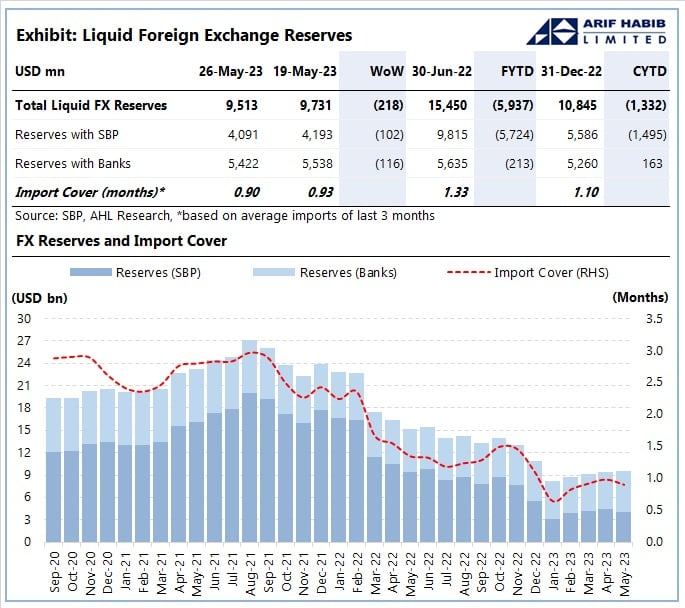

- Forex reserves to cover less than a month's imports.

- SBP's reserves have fallen $102million as of May 19.

- Total liquid forex reserves stand at $9.5 billion.

Foreign exchange reserves held by the State Bank of Pakistan (SBP) fell to $4.09 billion as the liquidity-challenged country considers quitting the stalled International Monetary Fund (IMF) programme without completing it and entering a fresh bailout deal.

In a statement, the SBP said its reserves have fallen $102 million as of the week ended May 26 due to external debt repayments, and currently stand at $4.09 billion with an import cover of less than a month.

The net foreign reserves held by commercial banks stand at $5.42 billion, declining $116 million. But were $1.33 billion more than the reserves held by the central bank.

The total liquid foreign exchange reserves of the country stood at $9.51 billion.

This is the fifth weekly drop in the foreign exchange reserves, with Pakistan seeing no signs of securing external financing any time soon amid political instability — which has had a huge impact on the deteriorating economy.

The $350 billion economy is in turmoil amid financial woes and the delay in an agreement with the IMF that would release much-needed funding crucial to avoid the risk of default.

The government has been in talks with the Washington-based lender since end-January to resume the $1.1 billion loan tranche that has been on hold since November, part of a $6.5 billion Extended Fund Facility (EFF) agreed upon in 2019.

However, sources told Geo News today that Pakistan had decided to negotiate a new programme with the IMF immediately after the budget as the coalition government is planning to conclude the $6.5 billion EFF without completing all the pending reviews.

The coalition government has been negotiating with the Washington-based lender to revive its bailout programme since November, with the financing gap among the biggest roadblocks. There’s about $2.5 billion left to disburse from the $6.5 billion programme that’s scheduled to expire on June 30.

The sources said that while negotiations on the ninth review were almost complete, a staff-level agreement is yet to be reached. Even after this review completes, the 10th and 11th reviews will remain pending.

“Completion of both reviews before June 30 seems impossible and the government has decided against seeking an extension,” the sources said, adding that Ishaq Dar-led Ministry of Finance will approach the Fund for a new programme after the budget — which is expected to be tabled on June 9.

The sources further revealed that if the coalition government fails to complete the negotiations before its term ends in August, the caretaker government will hold talks with the Washington-based lender.

Disclosing some of the details of the new programme, the sources said that the economic team has begun working on the agreement “which is expected to be tougher” than the existing programme agreed in 2019 by the Pakistan Tehreek-e-Insaf (PTI) government.

Moreover, they said that the new bailout programme will likely be for more than three years. “Pakistan will desperately need an IMF programme in September as the country needs to pay around $9-11 billion dollars in repayments of external debt by December 2023,” they added.