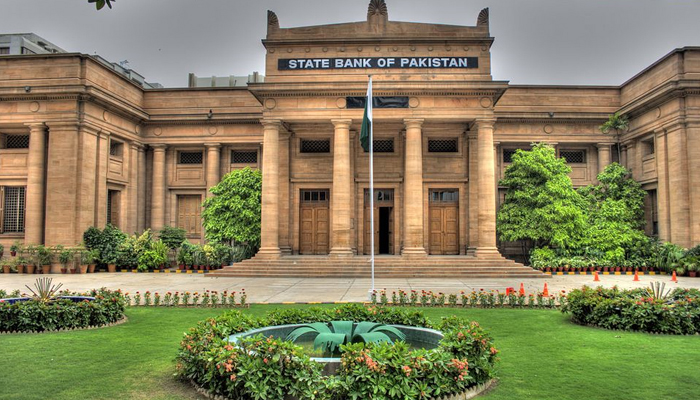

SBP brings 'structural reforms' for 'transparency' in exchange companies' sector

Leading banks engaged in forex business to establish wholly owned exchange companies to meet needs of public

September 06, 2023

- Various exchange companies to be consolidated as a single category.

- Reforms' aim is to cater to the legitimate forex needs of public.

- Rupee strengthens against dollar in open market.

Amid the presence of a grey market of the dollar, the State Bank of Pakistan (SBP) on Wednesday decided to introduce structural reforms in order to bring "transparency" in the exchange companies sector.

"As part of these reforms, leading banks actively engaged in foreign exchange business will establish wholly owned Exchange Companies to cater to the legitimate foreign exchange needs of general public", a press release issued by the central bank stated.

Under the reforms, various types of existing exchange companies and their franchises will be consolidated and transformed into a single category of "Exchange Companies" with a well-defined mandate.

Moreover, the minimum capital requirement for exchange companies has been increased from Rs200 million to Rs500 million.

Here are the Exchange Companies reforms

• ECs-B may graduate to Exchange Companies after meeting all regulatory requirements, within three months; otherwise, their license would be cancelled.

• Franchisees of Exchange Companies may either merge or sell operations to the concerned franchiser company, within three months after meeting all regulatory requirements.

For the above purpose, the ECs-B and Franchises of Exchange Companies will submit their conversion plan and seek a no-objection certificate (NOC) from SBP within one month.

The above reforms have been introduced to provide better services to the general public and bring transparency and competitiveness in the exchange companies’ sector.

This is expected to strengthen governance, internal controls, and compliance culture in the sector, the SBP stated.

Rupee strengthens against dollar in open market

Meanwhile, the Pakistani rupee gained ground against the US dollar in the open market in the last couple of days, and closed at Rs312.

The greenback depreciated Rs 17 during the last two days, since the close of Rs329 two days ago.

Chief of Army Staff (COAS) General Asim Munir's meeting with prominent businessmen, where he discussed ways to boost investment and economic growth brought a positive mood in the market.

“It has created a positive sentiment in the market, which reflected from the dollar-rupee parity which remained almost stable in the interbank and open market,” said general secretary of the Exchange Companies Association of Pakistan Zafar Paracha said on Tuesday.

In the meeting, COAS Gen Munir assured the business community of the army’s support in tackling corruption, smuggling, tax evasion and exchange rate issues.

Govt cracks down against dollar smugling, hoarding

In a move against the cartels of organised crimes, the government launched a crackdown to curb dollar smuggling and hoarding.

As per the Ministry of Interior, lists of the groups involved in the crimes has been prepared after the identification of facilitators of the government officials and their patrons.

It said that the illegal movement of goods and currency will not be allowed, trading of commodities and currency will be transformed, while surveillance systems at land, sea and airports will also be upgraded.