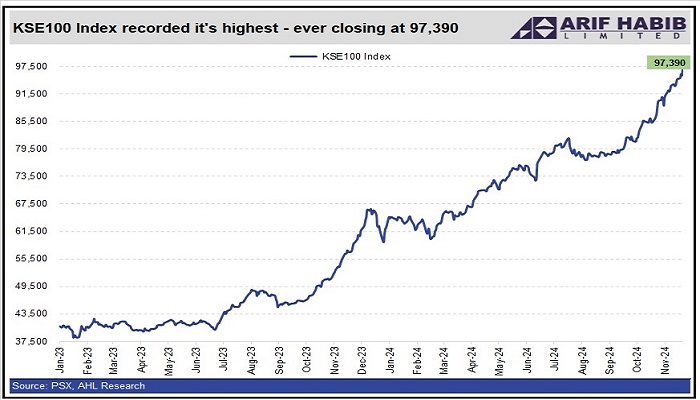

PSX tops 97,000, shrugging off political jitters amid strong fundamentals

Market resumed rally, led by small and mid-cap stocks, analyst says

November 21, 2024

- $349m current account surplus lifts morale.

- Multi-year-low bond yields drive market rally.

- Banking, fertiliser, and automobiles in limelight.

The capital market on Thursday pulled off a massive rebound, crossing the 97,000 mark for the first time, shrugging off political uncertainty arising from the main opposition party's "do-or-die" protest call for November 24.

The Pakistan Stock Exchange’s (PSX) benchmark KSE-100 Shares Index surged by 1781.94 points, or 1.86%, to close at an all-time high of 97,328.39 after touching an intraday high of 97,437.15 points.

Ahsan Mehanti, Managing Director and CEO of Arif Habib Commodities, also highlighted the factors driving today’s record surge, saying, “Stocks bullish led by scrips across the board as investors weigh drop in government bond yields and robust economic data for current account surplus, remittances, exports, and foreign direct investment.”

“Surging foreign exchange reserves and speculations over government decisions on economic reforms and privatisation played a catalyst role in the record surge at PSX,” he added.

The government raised Rs350 billion through the auction of Pakistan Investment Bonds (PIBs), exceeding the target of Rs300 billion, with yields on five-year and 10-year papers falling to their lowest levels since March 2022.

“The central bank received bids amounting to Rs893 billion, against a target of Rs300 billion, resulting in a bid-cover ratio of 3.0x,” said Arif Habib Limited in a note.

The cut-off yield for the two-year zero-coupon bond decreased by 19 basis points (bps) to 13.0%. Meanwhile, the cut-off yield for the three-year bond remained unchanged at 12.5%.

The yields for the five-year and ten-year bonds also fell, decreasing by 9bps and 14bps, respectively, settling at 12.7% and 12.838%.

The current account surplus added another layer of confidence, with the State Bank of Pakistan (SBP) reporting a surplus of $349 million for October 2024 — the third consecutive monthly surplus.

This improvement is attributed to a 7% month-on-month and 24% year-on-year increase in remittances. Foreign exchange reserves also reached a two-year high, bolstering confidence in the country’s economic recovery.

Cumulatively, the current account surplus for the first four months of FY25 stood at $218 million, compared to a deficit of $1.53 billion during the same period last year.

Foreign Direct Investment (FDI) also demonstrated robust growth, increasing by 32% year-on-year to $904.3 million during the July-October period.

October saw a slight dip in FDI compared to the same month last year. Total foreign investment inflows for the period reached $1.242 billion.

With reserves projected to cross $11 billion in the coming weeks, local mutual funds have actively shifted investments from fixed-income securities to equities, driving the benchmark index’s 20% surge since September.

Commenting on the market’s recovery, Muhammad Saad Ali, Director Research at Intermarket Securities Ltd, stated, “Yesterday was a healthy correction. The market has resumed its momentum, and the range of stocks which are rallying is broadening to include more small and mid-caps.”

Buying was witnessed in multiple sectors including automobile assemblers, commercial banks, fertilisers, pharmaceuticals and refineries.

The rebound follows a volatile midweek session that ended with a 310-point decline amid profit-taking and political uncertainty.

The political backdrop has been tense, with the main opposition party planning a major protest in Islamabad on November 24, demanding electoral reforms and the release of its detained leaders and workers.

The protest, labelled as a “do-or-die” demonstration, has heightened political uncertainty, further fueled by the government’s strong warnings of strict action against any unrest.

Meanwhile, security concerns and increased militant activity in the northwestern regions have added to the unease, creating a challenging environment for investors.

On Wednesday, the PSX witnessed wild swings, with the KSE-100 Index surging to a new intraday high of 96,711.33 points during morning trade before closing 310.21 points lower at 96,381.21.