Economic Survey 2024-25: Govt misses growth target amid remittance surge, tame inflation

FinMin says tax filers doubled in outgoing fiscal year, economy acknowledged globally for achieving stabilisation

June 09, 2025

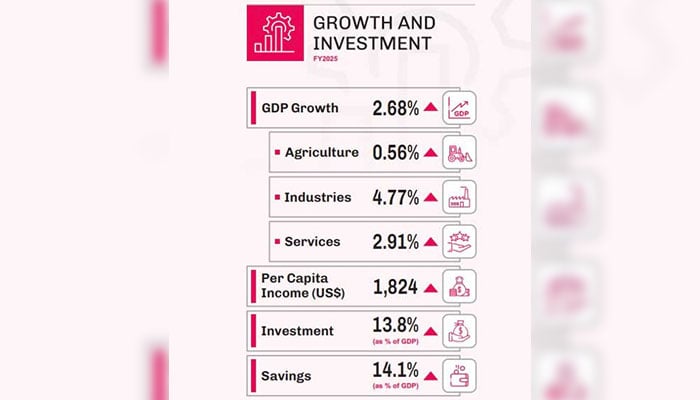

- Pakistan's GDP grew by 2.7% against target of 3.6%: FinMin.

- Aurangzeb says number of tax filers doubled in outgoing FY.

- "Reforms were necessary to change DNA of Pakistan's economy."

ISLAMABAD: Federal Finance Minister Muhammad Aurangzeb, while presenting the Pakistan Economic Survey 2024-25 on Monday (today), revealed that the country's Gross Domestic Product (GDP) grew by 2.7% with inflation clocking in at 4.6% in the outgoing fiscal year.

The government initially targeted 3.6% growth in gross domestic product for this financial year, but lowered that to 2.7% last month. The International Monetary Fund expects growth of 2.6% this financial year and 3.6% next.

The survey holds significance ahead of the annual federal budget — set to be tabled in the National Assembly tomorrow (Tuesday) — offering detailed insights into the country’s socio-economic performance in the outgoing fiscal year. It includes statistics related to GDP growth, tax revenue, the position of various industries, and other key fiscal and economic indicators.

These include inflation, trade and balance of payments, public debt, population growth, employment levels, and the impacts of climate change. By presenting a consolidated view of these indicators, the survey aims to inform public debate and guide policy planning in the lead-up to the new fiscal year.

Divulging into the key statistics, the finance czar highlighted the major reduction in the policy rate from 22% to the current 11% and remarked that there were record recoveries in the power sector courtesy of reforms.

Noting that there was a 7% surge in Pakistan's exports, Aurangzeb shed light on the country's growing Information Technology (IT) potential and said that freelancers earned as much as $400 million during the outgoing fiscal year, whereas the IT exports amounted to $2.8 billion.

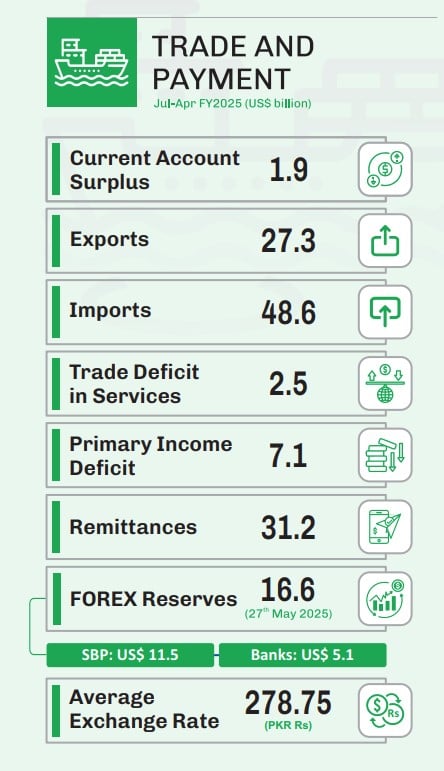

With an 11.7% increase in imports, the current account deficit, he added, reflected a surplus of $1.9 billion (July to April) along with a 26% rise in revenue collection.

On the all-important issue of remittances — which are a key source of much-valued foreign exchange — the federal minister said that they witnessed an increase of around $10 billion in two years.

In relation to the government's ongoing efforts to expand the tax net, the finance minister said that the number of individual tax filers doubled in the outgoing fiscal year.

Commenting on the country's economic recovery, the finance czar said that Islamabad has recovered in terms of GDP growth compared to global growth.

Noting that global inflation was at 6.8% in the last two years and currently stood at 0.3%, he said that the country's forex reserves witnessed a remarkable increase in the current fiscal year.

"We now have to move towards GDP stabilisation," he said adding: "We are currently moving in a better direction".

Pakistan is consistently advancing on upward trajectory with GDP growth projected at 5.7% over medium term, he noted.

Commending the caretaker government for keeping the country on track with regards to the International Monetary Fund (IMF) programme, the finance minister, accentuated that reforms were necessary to change the “DNA” of Pakistan's economy.

"The government has made reforms to improve the performance of the Federal Board of Revenue (FBR)," he remarked, while stressing that every economic transformation required two to three years to manifest.

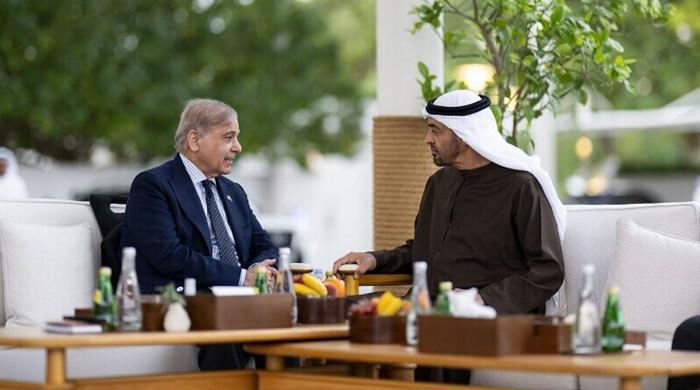

Prime Minister Shehbaz Sharif's government is aiming for 4.2% growth next fiscal year amid competing priorities, including boosting investment, maintaining a primary surplus, and managing defence spending amid tensions with India.

Finance Minister Aurangzeb said he did not want the economy to expand too quickly, which has led in the past to a surge in imports.

“Don't get into a sugar rush,” Aurangzeb said. “Because the moment we go into a consumption-led growth, and our imports go haywire and our balance of payments problem intensifies, that sort of derails the entire discussion,” he told a press conference.

For fiscal year 2025, growth was held back by a reduction in output from large-scale manufacturing and a decline in major crops. Agricultural sector growth of 0.6% was the lowest in nine years, hit by adverse weather.

Topline Securities, a local brokerage, said the 2.7% growth in fiscal 2025 was well below Pakistan's long-term average of 4.7%, and was likely to be revised down due to optimistic assumptions on industrial output.

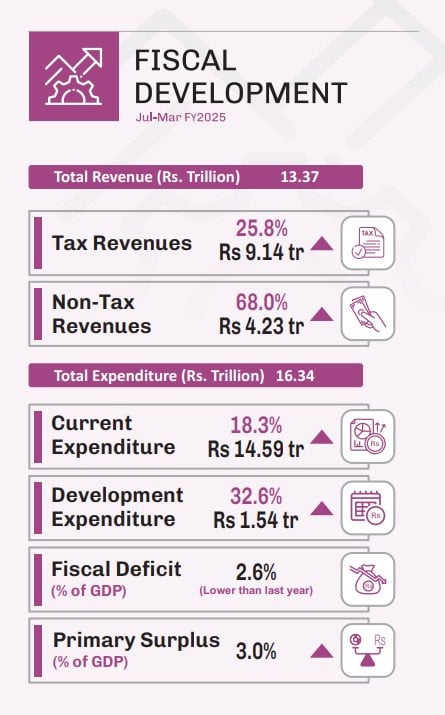

The government's total revenue for the first three quarters of fiscal 2025 was Rs13.37 trillion, the survey showed, up 36.7% over the previous year.

Pakistan had a current account surplus of $1.9 billion in the nine months compared with a deficit of $200 million in the same period a year earlier, it showed.

The central bank, in a bid to encourage growth, has cut its policy rate by more than 1,000 basis points this fiscal year. Its latest cut last month brought the key rate to 11%, resuming an easing cycle that had brought rates down from 22% after a pause in March.

Aurangzeb said easier credit terms should bolster the economic recovery.

The fiscal deficit was 2.6% of GDP in the first three quarters of the fiscal year. Inflation was seen at 4.6% for the year.

The update comes as Pakistan’s economy is stabilising but remains fragile as the country navigates reforms under a $7 billion IMF programme.

Revenue

In fiscal terms, total revenues grew by 36.7% to Rs13,367.0 billion during July–March FY2025. This included a 26.3% rise in tax revenues to Rs9,300.2 billion, and a sharp 68% increase in non-tax revenues to Rs4,229.7 billion. The FBR’s tax collection matched the overall tax figure, also at Rs9,300.2 billion. The fiscal deficit narrowed to 2.6% of GDP, while the primary balance posted a surplus of Rs3,468.7 billion, equivalent to 3.0% of GDP.

Remittances

Meanwhile, between July 2024 and April 2025, Pakistan received a total of $31.2 billion in remittances, marking a 31% year-on-year increase from the $23.8 billion recorded during the same period in FY2024. The uptick in remittance inflows was instrumental in supporting the country’s $1.9 billion current account surplus.

Inflation

On the monetary front, CPI inflation averaged 4.7% during July–April FY2025, with April 2025 inflation dipping to 0.3%, marking a multi-decade low. While core inflation figures were not explicitly stated, the State Bank of Pakistan reduced the policy rate by 1,100 basis points since June 2024 in response to easing price pressures. The KIBOR also declined to 11.3%.

Agriculture

In FY2025, Pakistan’s agriculture sector recorded a modest growth of 0.56%. Within this sector, important crops declined by 13.49%, while cotton ginning fell by 19.03%. Conversely, livestock demonstrated strong performance with a 4.72% increase, and other crops grew by 4.78%.

Crops which took a hit include maize (-15.4%), and rice (-1.4%). Contrastingly, potato and onion crop yield increased by 11.5% and 15.9%, respectively.

Industrial sector

The industrial sector posted a 4.77% growth in FY2025. However, performance varied across subsectors: mining and quarrying declined by 3.38%, and large-scale manufacturing (LSM) contracted by 1.53%. On the positive side, electricity, gas and water supply surged by 28.88%, while construction registered a growth of 6.61%.

Service sector

The services sector expanded by 2.91% during FY2025, with mixed trends across its components. Wholesale and retail trade saw minimal growth of 0.14%, while transport and storage improved by 2.20%. The finance and insurance subsector rose by 3.22%, general government services increased substantially by 9.92%, and other private services grew by 3.64%.

External sector

The external sector showed encouraging signs. Exports grew by 6.4% to $26.9 billion, and imports increased by 7.5% to $48.3 billion, leading to a trade deficit of $21.3 billion. However, the current account posted a surplus of $1.9 billion, a notable turnaround. The exchange rate stabilised at Rs278.72 per US dollar, and foreign exchange reserves rose to $16.64 billion.

BISP, social protection

In terms of social protection, the government allocated Rs471 billion to the Benazir Income Support Programme (BISP) in FY2025. The Benazir Kafaalat initiative disbursed Rs366.9 billion to 8.5 million families, while Benazir Taleemi Wazaif provided Rs55.4 billion to support the education of 7.96 million children. Additionally, Benazir Nashonuma extended Rs5.48 billion to benefit 0.7 million mothers and children.

Education

The Prime Minister Shehbaz Sharif-led government spent 0.8% of the GDP on the education sector in FY25 between July 2024 and March 2025, with the nation's literacy rate standing at 60.6% where the male and female literacy rate was 68% and 52.8%, respectively.

The number of universities in the country is 269 of which 160 are public whereas 109 private.

A total of Rs61.1 billion was allocated for higher education with PhD faculty members figure standing at 37.97%.

Manufacturing and Mining

Overall manufacturing growth slowed to 1.3% in FY 2025, compared to 3.0% last year. This deceleration was primarily driven by a contraction of 1.5% in Large-Scale Manufacturing (LSM), compared to a modest growth of 0.9% in the previous year, the economic survey stated.

In contrast, Small-Scale Manufacturing (SSM) and Slaughtering grew by 8.8% and 6.3%, respectively, providing some support to the sector.

Meanwhile, the Mining and Quarrying sector continued to face difficulties, contracting by 3.4% in FY 2025; an improvement compared to the 4.0% decline recorded in the previous year.

Fiscal Development

The fiscal consolidation efforts initiated in FY 2024 remained on track in FY 2025 for a second consecutive year, thus reinforcing fiscal discipline, according to the economic survey.

Effective consolidation measures helped in reducing the fiscal deficit to 2.6% of GDP during July-March FY 2025 from 3.7% last year. Similarly, the primary surplus improved to Rs3,468.7 billion (3.0% of GDP) from Rs1,615.4 billion (1.5% of GDP) due to contained non-markup expenditures.

Provinces also played a major role in supporting the fiscal consolidation efforts of the federal government by posting a significantly higher cumulative surplus of Rs1,053.3 billion during July-March FY 2025 against the surplus ofRs 435.4 billion last year.

— With additional input from Reuters