Why the rupee keeps faltering

Pakistan's struggles with rupee expose failure to address fundamentals such as institutional credibility

July 16, 2025

This isn't just a question for economists; it affects every Pakistani, from the price of imported wheat to fuel costs and national standing. While short-term fixes like exchange rate adjustments or central bank tweaks grab headlines, they’re mere Band-Aids.

A currency's long-term strength rests on deeper pillars: productivity, institutional credibility, macroeconomic discipline, and global trust. Pakistan's struggles with the rupee expose a failure to address these fundamentals.

Short-term exchange rate models, like interest rate parity or purchasing power parity, explain daily or monthly moves. But they don’t explain why the Japanese yen remains a reserve currency while the Argentine peso or Turkish lira collapse repeatedly.

Productivity is crucial. The Balassa-Samuelson effect shows that growth in exportable sectors raises wages and prices, strengthening the real exchange rate. Japan's post-war boom, fuelled by innovation and manufacturing, made the yen globally respected. China's rise followed a similar path, though the yuan lags due to capital controls and limited international use.

Institutional credibility also matters. Legal transparency, stable governance, and political continuity attract capital and bolster confidence. Switzerland's franc thrives due to its neutrality and rule of law. The UK’s pound held firm post-Brexit thanks to its institutions and deep markets. In contrast, Venezuela and Zimbabwe's institutional collapse triggered hyperinflation and currency collapse.

Macroeconomic discipline is non-negotiable. Inflation, as Milton Friedman argued, is a monetary phenomenon but also a signal of how seriously leaders take economic stewardship. Germany’s Bundesbank built early trust in the euro with its anti-inflation stance, a legacy carried forward by the European Central Bank. Countries like Singapore and Germany maintain tight fiscal control, keeping currencies stable even in crises. Argentina, by contrast, has suffered chronic deficits and repeated defaults.

Global demand reinforces strength. The US dollar accounts for 48.5% of global payments (as of May 2025), far ahead of the euro, pound, yen, and yuan. Despite talk of "de-dollarisation", its share has grown.

Liquidity, legal protections and trust make it indispensable. Even China’s yuan, despite the size of its economy, remains hamstrung by capital controls and opaque governance.

The Pakistani rupee has depreciated by nearly 70% against the US dollar over the past decade, a far steeper decline than most regional peers: the Sri Lankan rupee fell by about 65%, while the Bangladeshi taka lost around 32%, the Indonesian rupiah 25%, the Indian rupee 22%, the Malaysian ringgit 21%, the Philippine peso 20%, the Vietnamese dong 18%, and the Thai baht only 8%.

Repeated balance-of-payments crises and IMF bailouts reveal the depth of its structural flaws. From 2015 to 2024, the trade deficit averaged 8.7% of GDP. Remittances averaged 7.4%, higher than in India or the Philippines, yet still couldn't plug the gap. The problem is not the exchange rate; it’s the economy itself.

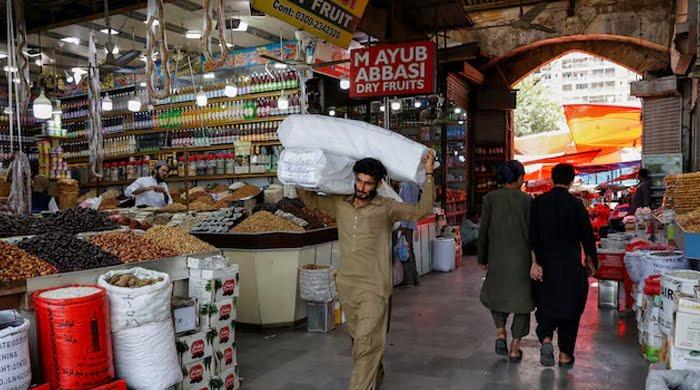

In 2024, Pakistan's imports hit $55 billion. Staggeringly, 39% went to food, textiles, and agricultural goods – items like wheat, palm oil, raw cotton, synthetic yarn and fertilisers. Another 30% went to fuel. For a country where 40% of the workforce is in agriculture, importing basic agro-products is a national embarrassment. Devaluation might offer temporary relief, but it’s no solution. The real problem is Pakistan’s low productivity, particularly in agriculture, which employs millions but underdelivers.

Countries that innovate and produce efficiently see their currencies appreciate over time. Pakistan is stuck in a low-productivity trap. Its agriculture relies on outdated methods, poor infrastructure and minimal investment. A country that should be feeding itself is importing essentials. Meanwhile, exports — mainly low-value textiles — have stagnated, unable to compete with more modernised economies like Bangladesh and Vietnam.

The industrial and service sectors lag as well, hobbled by energy shortages, bureaucratic red tape, and a shortage of skilled labour. The real effective exchange rate, often cited by officials, is misleading. It blends traded and non-traded sectors, masking core inefficiencies. Policymakers must stop chasing cosmetic solutions and focus on building real, productive capacity.

Institutions are another weak link. Corruption, political instability and weak governance undermine investor confidence. Unlike Switzerland or the UK, where institutions underpin currency strength, Pakistan۔s inspire little trust. The State Bank of Pakistan (SBP) has made progress, but it operates in a political climate where short-term populism routinely overrides sound policy. Fiscal discipline is weak. Chronic deficits and reliance on external borrowing have left the country exposed.

Compare this to Singapore or Germany, where consistent, prudent policies foster trust and investment. No currency can thrive without credible institutions and disciplined management.

Internationally, the rupee is a non-player. It's not freely convertible, and its use in global trade is negligible. Even the yuan, backed by the world's second-largest economy, struggles to gain traction due to capital controls.

For Pakistan, with a smaller economy and weaker institutions, the challenge is even greater. Building a respected currency requires open markets, legal transparency and policy reliability — traits Pakistan lacks.

This crisis isn't just about the rupee; it’s about the deeper failures in productivity, governance and economic vision. To move forward, Pakistan must invest in productivity by modernising agriculture, supporting industry with reliable energy and smart regulation and investing in education and skills. It must strengthen institutions by fighting corruption, securing judicial independence and depoliticising economic policy.

Fiscal discipline must be restored through reduced deficits and a broader tax base. Reliance on the IMF is a symptom, not a strategy. The country must diversify and upgrade exports, learning from Bangladesh’s garments or Vietnam’s electronics. It must also earn global trust by gradually opening its capital accounts and building a reputation for consistency.

Currencies, like reputations, are built over decades. The US dollar’s dominance, despite geopolitical shifts, reflects trust, scale and usability. The yen, franc and pound endure because their economies deliver on fundamentals. Pakistan’s rupee, by contrast, reflects decades of neglect of agriculture, industry, institutions and long-term strategy.

The message is clear: stop blaming the dollar or the IMF. The rupee’s weakness is a mirror of our own failures. It’s time to demand better: better governance, smarter policy and a relentless focus on productivity. Only then will Pakistan’s currency rise on its own strength, not stumble with every gust of global uncertainty.

Disclaimer: The viewpoints expressed in this piece are the writer's own and don't necessarily reflect Geo.tv's editorial policy.

The writer is former head of Citigroup’s emerging markets investments and author of ‘The Gathering Storm’.

Originally published in The News