PSX upgraded to MSCI Emerging Market index

Managing Director PSX says per capita investment in the country is at its highest in history

May 31, 2017

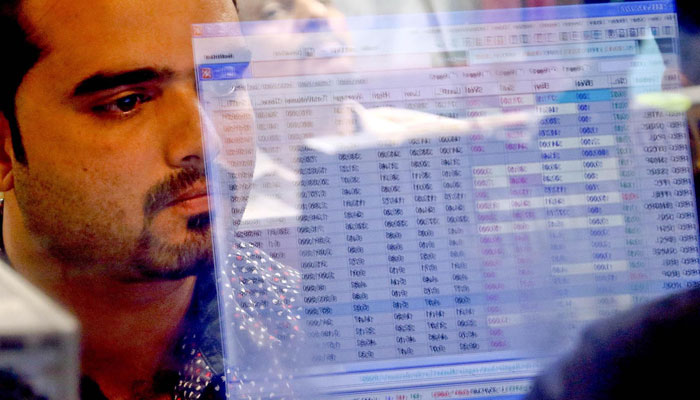

KARACHI: Amid high volume and record transactions, the Pakistan Stock Exchange remained bearish this week against expectations of bulls ruling the market, losing almost 3.5 percent in three days and seeming to remain so in coming days, analysts said.

On June 1, PSX would be included in the Morgan Stanley Capital International (MSCI) Emerging Markets index, seen as a major booster to the market by analysts.

The PSX-100 index dropped 861 points to 50,519 points, but volume surged to 410 million with record turnover of USD 783 million, almost 4.5 times higher than normal transacted value at PSX, dealers said.

Pakistan stocks were expecting some big inflows ahead of June 1 when the bourse was to be upgraded and included in the MSCI Emerging Market regime after almost ten years. Experts were hoping for huge trading activity and a bullish trend in the market as huge foreign inflows were expected ahead of June 1 from investors who follow MSCI EM index.

The PSX and brokerage houses have made special arrangements to take additional trading load (volume and value) since Monday (May 29) when it started a special 15-minute session after the closing of the market with share prices recorded two hours before the closing. This special arrangement would continue till June 1 to accommodate and settle transactions from the EM investors. Top brokerages have also started working early (as early as 6:00am) to take orders from the foreign investors likely to enter Pakistan market, especially from the far East Asian markets that open three hours ahead of Pakistan.

On Wednesday, market activity was the culmination of selling/profit-taking/exit from local institutions, foreign active funds, or foreign frontier funds who had bought earlier, analysts said. Their focus was on main six companies included in the MSCI EM index, including HBL, UBL, LUCK, OGDC, ENGRO and MCB.

The country's stocks were the best performers among the MSCI's Frontier Market and Pakistan worked hard to re-enter emerging market valued high by international funds and follow MSCI's index in making investment decisions across the globe.

Pakistan remained in the MSCI EM Index from 1994 to 2007, but was demoted to MSCI Frontier Market index after the 2008 market crash that led to its closure, leaving foreign investors trapped and unable to leave the market. Once it reopened, they exited the market. This shock delinked the Pakistan market from huge foreign investment that Emerging Market fund managers invest internationally.

But the D-Day would be on June 1, 2017 when Pakistan would formally join the Emerging Market regime that provides Pakistan stock market access to estimated USD1.5 trillion investable funds with investors. But the country gets the share on its position in MSCI's ranking and weight and Pakistan weighted 0.15 percent, which translates to around one billion to one-and-a-half billion dollars flowing to the Pakistan market, though not in one day.

Is Pakistan ready?

While officials and brokerage houses in Pakistan were upbeat about this development, Mark Mobius, of Franklin Templeton Investments, a leading global investor, reportedly believed that Pakistan was not yet ready to become an emerging market. Mobius was and is one of the major foreign fund investors in Pakistan.

Nadeem Naqvi, Managing Director PSX, did not agree with Mobius, saying we have worked hard to convince MSCI about viability, capability, and capacity of the Pakistan stock market since 2013 to be included in the emerging market index.

He further said Pakistan held roadshows abroad, apprising investors of Pakistan's potential as a place to invest in. He said MSCI took this decision after assessing the country's readiness and on input from big international investors. He said Pakistan had also assured MSCI against a repeat of the 2008 episode and pledged no restrictions on funds movement would be imposed in the future.

While Mobius said he would continue to treat Pakistan as a Frontier Market, Naqvi said the foreign fund investor may be looking at Pakistan from a governance perspective on which the country has improved a lot and our top companies are compatible to any company elsewhere.

To support Pakistan's position and qualification for the EM index, Naqvi gave fundamentals of the market as well as Pakistan's economy. He said Pakistan was better equipped to handle bulk trading volumes and capable of absorbing huge inflows. He said PSX market capitalization, which was USD50 billion three years ago, has now reached USD97 billion. The market has enough liquidity, and trade volumes have increased manifold as well as the value. He said 23 percent stock was free-float (tradable) thus making sufficient cushion to accommodate fresh inflows.

He mentioned improvement in Pakistan's economy and market fundamentals, saying Pakistan stocks average earnings was 17 to 18 percent, whereas return on equity was around 20 percent—the highest in Asia. He also mentioned foreign direct investment decisions by foreign investors and mentioned a few projects including Asia's largest bottling plant, a bike manufacturing facility coming up, and entry of the world's fifth largest and Holland's top dairy producing company in Pakistan.

A Turkish company has also entered Pakistan and has acquired majority shares in a company involved in manufacturing home appliances, including air conditioners and refrigerators. Naqvi also sees a booster for foreign investment in the country in the shape of the China Pakistan Economic Corridor (CPEC), which envisages some USD55 billion to USD60 billion over the years. He said now per capita investment in the country was at its highest in history.

Naqvi said that, despite outflow of USD350 million so far this year, the market was stable and local fund managers, institutional and individual investors have lifted those stocks. "Pakistan was all set to absorb USD2 billion after inclusion in MSCI EM index," he added.

Some players fear a repeat of the Qatar and Dubai episode where the market bogged down to pressure and volumes on inflows upon entry into the MSCI EM index.

Atif Zafar, Head of Research at JS Global Capital, said selling was noticed by the Frontier market funds and some buying by passive funds from MSCI EM was seen. Since Monday, PSX was under selling pressure thus lowering the index. On Wednesday, most of the traded scrips were closed at lower lock. "The market would remain passive during the month (due to Ramazan) and occasionally we expect some gains," Zafar said.

However, Muzzamil Aslam, CEO EFG Hermes Pakistan, said the investor were rebalancing and adjusting their positions in the Pakistan market.

Market settling down

Despite apprehensions that some brokerage houses lack financial capacity, the initial wave passed without any problem and the market was in the process of settling down.

Nadeem Naqvi said the brokers have sought credit lines and piled stocks to meet the demand besides adding capacity to handle the volume. He said other systems were also stress-tested by the respective organisations like PSX and Central Depository Company (CDC). He was of the view that, with all arrangements taken in hand, brokers would be able to handle 20 percent more business at any given point of time.

"We have negotiated with three main foreign banks – Citi, Standard Chartered and Deutsche Bank – who handle bulk of portfolio transactions to remain open late in order to handle the foreign investment," he added.

Muhammad Sohail of Top Line Securities said passive buyers have made investments and the transition from Frontier Market to Emerging Market was smooth on May 31, but break-up would be available later in the night. Thursday would be a new day for Pakistan Market, he said.

A quick analysis of gross FIPI flows (Buy+Sell) by Top Line indicates that during calendar year through April, daily average gross foreign activity was USD36.6mn, whereas activity picked up sharply in May, averaging USD60.9mn (excluding Wednesday), indicating foreigners were already rebalancing having learnt a lesson from Dubai and Qatar.

Pakistan is now on the radar of foreign investors.