Damning revelations in Sugar Inquiry Commission's report implicate powerful players

Sugar inquiry commission report exposes 'fake' exports of sugar, overpricing of commodity and rampany corruption within the industry

May 21, 2020

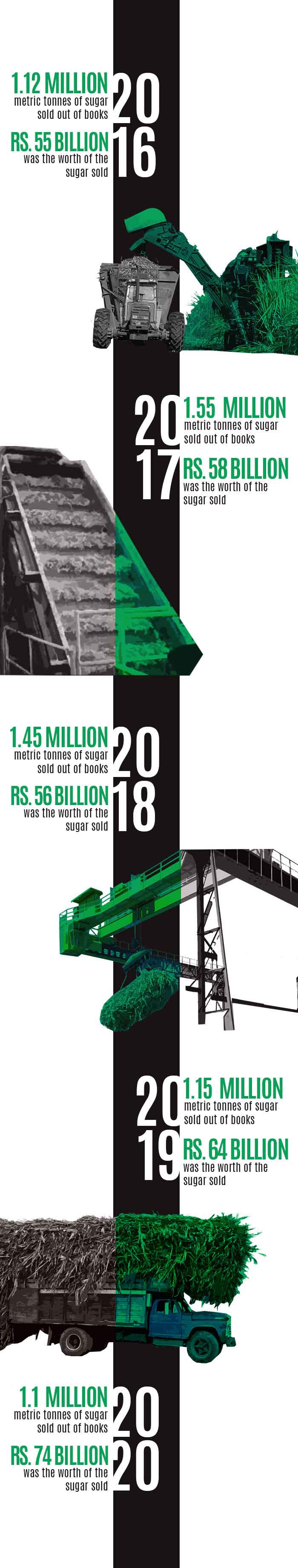

ISLAMABAD: The Sugar Inquiry Commission report, which finally made its way to the prime minister in its final form, has laid bare some startling revelations about how the price of sugar is fixed, how exports of the commodity are faked to avail rebates on sales taxes, and how billions of rupees are overcharged by sugar mills owners.

According to sources, the report mentions in depth how the amount of sugar exported to Afghanistan is routinely inflated to show as if 75 tonnes of the commodity are being exported per truck.

However, this is barely possible, given that the maximum capacity of a truck, even when overloaded, does not exceed 30 tonnes.

There are many ways the sugar mafia can benefit from overstating exports of the commodity to Afghanistan. For one, billions of rupees in subsidy are received from the government for the exports. Secondly, the higher the exports showed on paper, the higher the sales tax rebate a sugar mill owner can claim.

The scam also seemingly has another purpose: laundering money. If sugar is being exported to Afghanistan, the payment should also be coming in from the same country.

However, it was found by the commission that many sugar mill owners were receiving telegraphic transfers for payments for sugar sold to Afghanistan from the US and Dubai, therefore seemingly whitening money and earning dollars at the same time.

Another important finding highlighted in the report is that sugar mills paid an estimated Rs22bn in taxes to the Government of Pakistan, but out of that total amount, Rs12bn was reclaimed in rebates. Hence, the net contribution was close to around Rs10bn.

And that was not all.

As the government paid Rs29bn in subsidies to sugar mill owners. Rounded off, the government was actually paying Rs20bn to mill owners to run their already profitable sugar mills.

The commission also found that the ex mill sugar price, set for sugar by people in charge of regulation, was not subject to proper checks and balances and the regulators were most probably in on the scam as well.

The sugar mills association would dictate the price unchallenged most of the time, which amounted to blatant conflict of interest. The probe revealed that the price of sugar was overstated by Rs15-30 per kilogramme over the years.

The price of sugar was overvalued this year by Rs20 per kilogramme, which means that the public paid Rs20 more for sugar than they should have.

The probe further revealed that for every Re1 overcharged by the sugar mafia, it resulted in Rs5bn more for sugar mills owners.

Another anomaly discovered by the sugar inquiry commission was that though mill owners are supposed to sell sugar to brokers and receive payment in return, but brokers were not only sold sugar, they were also paid by sugar mill owners.

It is believed that many times, sugar brokers were sugar mills' own frontmen and not regulated individuals who come under the tax net. The commission alleges that in this exchange of money, many illegal activities, such as money laundering, was being facilitated by the sugar brokers.