Where does the govt expect to find the money to spend on its new budget?

Govt may have touted the budget as offering ‘major relief’ to the people, but the document is hiding some possibly unpleasant surprises

June 11, 2021

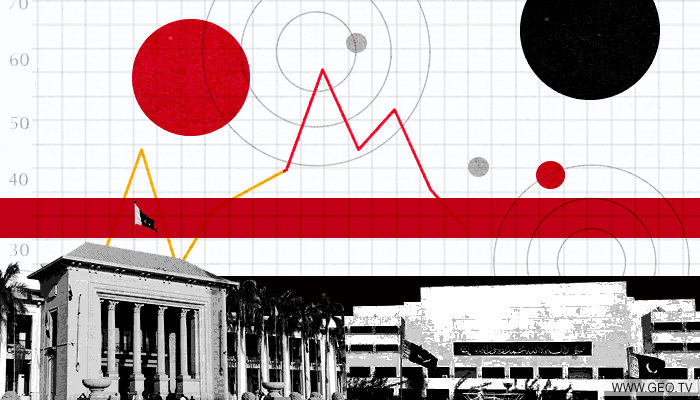

The federal budget for fiscal 2021-22 has been announced today, and we are waiting for analysts, businesspersons and pundits to wrap their heads around the document and analyse what financial wizardry (and acrobatics) the government has applied to tell its economic turnaround story.

From an early look at the numbers shared by the government, it is clear that the government’s managers are changing gear from economic stabilization to boosting growth. Development programmes have been ramped up significantly and relief has been granted in various areas to stimulate the economy.

However, while the government has talked a lot about refusing to burden the masses with additional taxes, it’s clear that the extra money it intends to spend is to come from somewhere.

The budget document holds some important clues about to how the government plans to raise that money.

The tax revenues head in the budget – specifically the indirect taxes head – is of particular interest in this regard. It shows that the government expects to raise around 30.5% more through sales taxes than the budgeted amount this year. This is not an insignificant number – it translates to an additional burden of Rs587 billion. It’s not immediately clear whether the government expects to record this significant increase in sales tax revenue through compliance with the tax code alone – and this may spell trouble for the average Pakistani, as the money may come out of their pockets eventually.

Likewise, the customs duty target has also been hiked up by 22.6% (an additional burden of Rs145bn), and it’s unclear how this significant bump is to be achieved. Will imported goods generally become more expensive, or is the government targeting only specific, non-essential items to ramp up revenues? A detailed analysis of the budget will tell.

The government’s budgeting for non-tax revenues also tells some interesting stories. The most significant bumps in revenue targets concern the energy sector.

For example, the government wants to generate 36% more under the petroleum levy, which means additional taxes of Rs160 billion. This will come out of ordinary citizens’ pockets. Separately, it has jacked up expected receipts under the Gas Development Surcharge (paid by gas companies to the government) by 260% for next year, for additional revenue of Rs26bn.

Meanwhile, the target for the Gas Infrastructure Development Cess, which targets industries, has been jacked up by an eyewatering 767% to generate nearly Rs115bn more than the outgoing year. Together, the government expects to raise nearly Rs400bn extra through these measures alone.