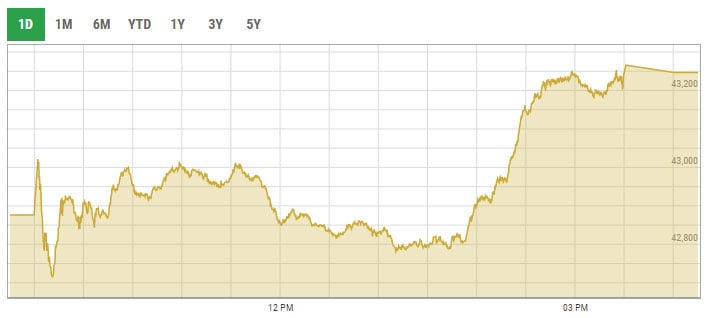

PSX ends pre-monetary policy session with 370-point gain

Concerns over the policy rate announcement later in the day kept market participants on the sidelines in initial trading

December 14, 2021

- Concerns over the policy rate announcement later in the day kept market participants on the sidelines in initial trading.

- At the close, the benchmark KSE-100 index closes with a gain of 0.86%, at 43,246.71 points.

- Shares of 323 companies were traded during the session.

KARACHI: The pre-monetary policy session at the Pakistan Stock Exchange (PSX) on Tuesday ended with a 370-point gain as investors were wary of the policy rate before assessing details of the economic situation.

Concerns over the policy rate announcement later in the day kept market participants on the sidelines in initial trading, however, a rally was witnessed towards the end of the session.

Later, the State Bank of Pakistan (SBP) announced that the benchmark interest rate has been raised by 100 basis points to 9.75%.

Late buying helped the benchmark KSE-100 index surpass the 43,000-point barrier once again.

Dismal remittances data released on Monday which declined by 6.6% to $2.4 billion in November on a month-on-month basis aided support to the early pessimism at the bourse.

Today, the benchmark KSE-100 index recorded an increase of 370.34 points, or 0.86%, to close at 43,246.71 points.

A report from Topline Securities noted that it was a lacklustre day at the PSX where the KSE-100 index initially opened in negative territory and remained sideways most of the day ahead of the monetary policy announcement.

“However, investors opted for value hunting across the board during the last trading hours,” it added.

Shares of 323 companies were traded during the session. At the close of trading, 237 scrips closed in the green, 67 in the red, and 19 remained unchanged.

Overall trading volumes rose to 212.35 million shares compared with Monday’s tally of 150.4 million. The value of shares traded during the day was Rs6.8 billion.

WorldCall Telecom was the volume leader with 21.05 million shares traded, gaining Rs0.10 to close at Rs1.80. It was followed by Byco Petroleum with 16.13 million shares traded, gaining Rs0.34 to close at Rs5.99, and TPL Properties with 12.8 million shares traded, gaining Rs1.26 to close at Rs30.64.