Ukraine crisis: ‘Dump-and-run’ at PSX as KSE-100 plunges over 1,300 points

Market talk suggests ongoing Ukraine crisis is prime reason behind investors’ dump-and-run approach at PSX

February 24, 2022

- Market talk suggests ongoing Ukraine crisis is prime reason behind investors’ dump-and-run approach at PSX.

- Analyst says it is important for Pakistan to adopt a balanced approach in Ukraine’s case.

- Index has been under immense pressure since start of this rollover week.

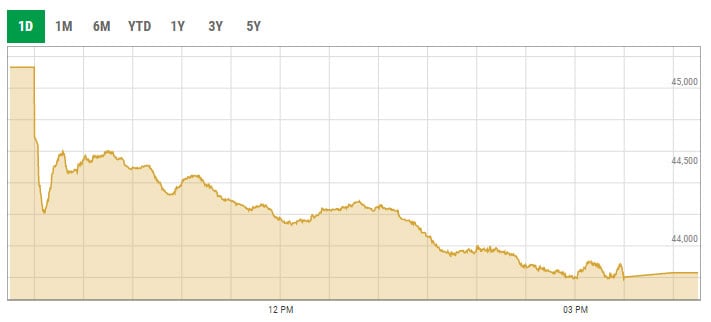

KARACHI: Investors adopted a dump-and-run approach as the KSE-100 index plunged over 1,300 points or 2.89%, falling below the 44,000 level with political uncertainty and the Ukraine crisis doing enough to push stocks deep in the red.

The KSE-100 – a benchmark for market performance – underwent selling pressure from the word go, dipping to a low of 43,802.52 points during intra-day with volumes remaining on the lower side.

Market talk suggested that the ongoing Ukraine crisis is the prime reason behind investors’ dump-and-run approach at the Pakistan Stock Exchange (PSX).

At the close, the benchmark KSE-100 index nosedived 1,302.41 points, or 2.89%, to settle at 43,830.51 points.

Speaking to Geo.tv, Alpha Beta Core CEO Khurram Schehzad said that the international oil prices — that breached $100 a barrel for the first time since 2014 — dented the investors' sentiment.

“Rising international oil prices can negatively affect Pakistan’s inflation, current account deficit and circular debt,” he said, adding that uncertainties mean negative sentiment.

Read more: Oil breaches $100 for first time since 2014 on Ukraine attacks

The analyst said that it is important for Pakistan to adopt a balanced approach in Ukraine’s case as we are already under Financial Action Task Force (FATF) and the International Monetary Fund (IMF).

He said: “Our major part of the trades, especially exports, investment and debt are from and with the US. Hence Pakistan needs to be extra cautious and more balancing at this point.”

The index has been under immense pressure since the start of this rollover week when the Opposition intensified their efforts to bring a no-confidence motion against Prime Minister Imran Khan as it was widely seen as a negative for stock market investors.

Analysts expect that the stock market is likely to remain under pressure unless clarity emerges on the Ukraine front.

Shares of 377 companies were traded during the session. At the close of trading, 36 scrips closed in the green, 317 in the red, and 24 remained unchanged.

Overall trading volumes soared to 350.05 million shares compared with Wednesday’s tally of 186.35 million. The value of shares traded during the day was Rs8.75 billion.

Flying Cement was the volume leader with 38.42 million shares traded, gaining Rs0.36 to close at Rs1.19. It was followed by WorldCall Telecom with 33.13 million shares traded, losing Rs0.14 to close at Rs33.13, and Hum Network Limited with 20.48 million shares traded, losing Rs0.62 to close at Rs6.66.