Exchange companies remove dollar cap to dent grey market

ECAP's Zafar Paracha expects dollar to trade at Rs254-257 after cap removal

January 24, 2023

- Exchange companies take major decision.

- Dollar expected to trade between 254-257.

- Decision taken to curb grey market.

KARACHI: In a major decision, the Exchange Companies Association of Pakistan (ECAP) has decided to remove the cap on the US dollar, effective from tomorrow (Wednesday), hoping to end the surging "artificial" demand for the greenback in the market.

The dollar is currently being traded at three different rates — the official rate of the State Bank of Pakistan, the exchange companies' rate, and the rate in the black market.

In a statement on Tuesday, after a meeting of the ECAP members, the association said it was withdrawing the cap on the US dollar as the limit was causing adverse effects.

"There was artificial demand in the market as people would buy the dollar from us and sell it in the grey market," the association's statement mentioned, highlighting the impact of different rates.

As a result of the people opting for this, the business was shifting from official channels to the grey ones, hurting not only the reserves but also dealing losses to the exchange companies.

Explaining the reason behind the removal of the cap, the association said that once the dollar was allowed to trade at the market value, the customers would automatically shift from the grey market to the legitimate channels.

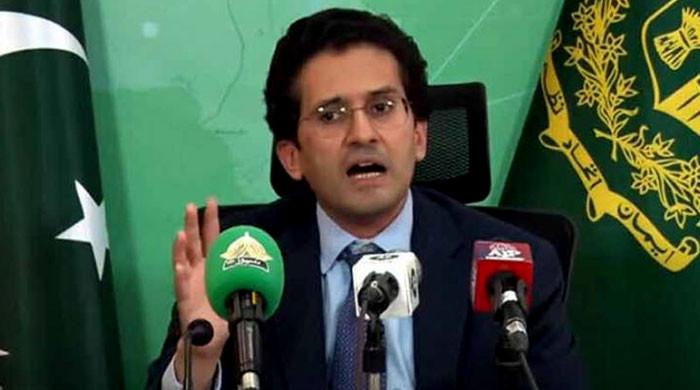

In a conversation with Geo.tv after the meeting, ECAP General Secretary Zafar Paracha said that as much as 90% of the demand was "fictitious" — people would buy dollars from official channels and sell them to illegitimate dealers.

"Through this step, we aim to provide people with the actual value of their money. Supply of the dollar will increase and demand will come down; it will have a positive impact on the market."

Paracha added that although the rates would be determined by market forces, he foresaw the dollar being traded at Rs254-257 — close to the price in the black market.

In response to a question whether he believes Finance Minister Ishaq Dar would remove the cap placed on the dollar, Paracha said: "I am hopeful that things will move in a better direction."

The ECAP general secretary said that in the last 8-10 days, the dollar's value had increased against the rupee — which closed at 230.40 in the interbank market today.

"Things will become better as all the forums, including the International Monetary Fund (IMF), are demanding the removal of the artificial cap," Paracha added.

He added that if this intervention did not work, the association would meet again later this week to discuss the future line of action.

The ECAP secretary general noted that the remittances — which dropped 19% in December to $2 billion from $2.52 billion in the same month of 2021 — would also witness an increase after the cap's removal.