Tareen in full control of £7m house: experts

Three leading professionals gave their opinions on the ‘Trust Deed’ of the PTI leader

November 14, 2017

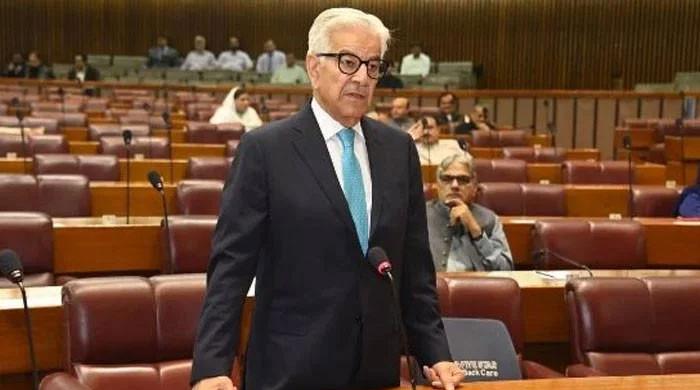

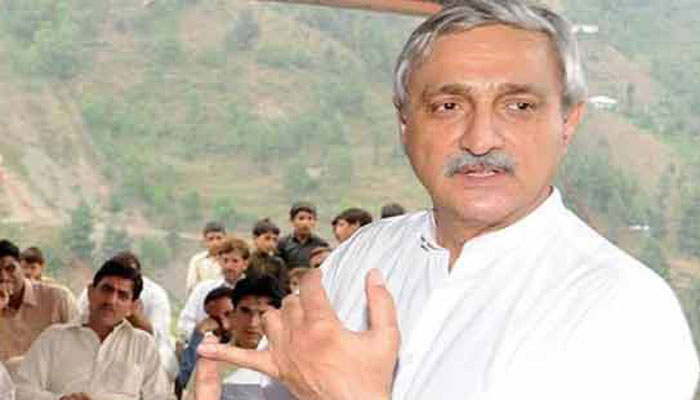

ISLAMABAD: Jahangir Khan Tareen retains beneficial interest and has control of the Trust that owns £7 million Hyde House, an examination of the ‘Trust Deed’ shows that he has submitted before the Supreme Court in his disqualification case.

The ‘Trust Deed’ establishes that not only the Pakistan Tehreek-e-Insaf (PTI) leader Jahangir Khan Tareen and his wife Amina Tareen are “Discretionary Lifetime Beneficiaries” of the palatial 12-acre property in Newbury, Hampshire, but they also retain full control over the trust and its assets – therefore making Tareen and wife owner of the asset.

At least three leading professionals -- with expertise in property, tax and Trust laws in England & Wales -- gave their opinions on the ‘Trust Deed’ of Tareen and all of them agreed that it is Jahangir Tareen who is not only the settlor but the actual controller and owner of the Trust that was created by Jahangir Khan Tareen’s Shiny View Limited offshore company to buy the property. Tareen has said in the court that the Hyde House belongs to his children and that he didn’t declare it before the Election Commission of Pakistan because it was not his asset.

Howard Young, a tax law expert who advises offshore companies and trusts, said that “there is absolutely no doubt that Jahangir Tareen is involved with this Trust for the reasons that the document is a formal Deed of Trust and he is the settlor; the front sheet clearly displays his name; the Deed is validly executed and there are no defects; it is said to be Deed, executed as such by both parties and witnessed (page 38) and is then formally sealed”.

He said that the witnesses are clearly identified and could be traced and asked to confirm that they witnessed it. “That’s an incontrovertible proof that Tareen is a party. Page 34 confirms his wife’s date of birth and page 33 contains his date of birth. On the face of the document, any court would declare it to be valid and between the parties identified. In my experience Random Trusts such as this are used by very wealthy individuals and contain significant funds; that is the whole point of them and why they are drafted and executed with the precision you see here.”

He said that any court in the UK would consider him a beneficial owner and controller of the Trust and therefore being in possession of the Hyde House – his asset. He said that anyone who says that he has no beneficial interests in this property is lying.

Jawad Hassan Raza, a chartered accountant based in Oxford, said that this Trust has a defined life of 150 years and does not extends to perpetuity. “All major decisions still lie with the settlor, namely Mr. Jahangir Khan Tareen, hence the control there in.”

He added: “At points 6 and 6.1b & 6.2 of page 7 & 8 respectively, it’s clearly identified that control during the lifetime of settlor lies with the settlor (J K Tareen). Clause 7 in page 9 identifies that powers held by the settlers in 6 does not apply only after life time of the settlor, JK Tareen.”

He said, “In the attached schedule I (directed investment provision), point 2 & 5 clearly identifies the core business of the trust and states control rests with the settlor. Both points cover the governing document at the start of investment and towards the end of period as defined within the trust or earlier if so wished by the settlor.”

He compared Jahangir Tareen’s case with the disqualification case of former Prime Minister Nawaz Sharif who was disqualified for not declaring a salary that he never received from his son from the Dubai company.

Raza added: “The Supreme Court of Pakistan stated in the case of former Prime Minister Nawaz Sharif that you may not have withdrawn benefit but you had the power to control or had power to exercise right of withdrawal as accrued. If same principle applies in the case of Jahangir Tareen, he will be disqualified too because he has not declared his asset which is estimated at around £7 million.”

Barrister Rashad Aslam said that having reviewed the trust deed, it is possible for the Settlor (Jehangir Khan Tareen) to transfer and add any other property and shares to the trust fund.

“In particular clause 6.2 indicates that settler can direct the trustee to pay income from the trust fund to the Lifetime Beneficiaries. It is evident form the Schedule 3 of the trust deed that Jehangir Khan Tareen and his wife were the Lifetime Beneficiaries.”

Originally published in The News