Pakistan faces severe gas crisis in January as LNG trading companies take a back seat on bidding

SAPM Nadeem Babar says no gas crisis expected, govt has a back up plan that will be shared in a day or two

December 11, 2020

- Major gas crisis expected in Pakistan after no bids were received for the first time from the LNG suppliers for the first half of January

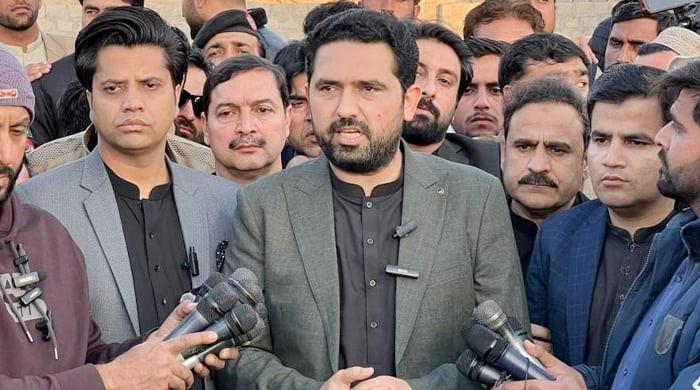

- Special Assistant to Prime Minister on Petroleum Nadeem Babar says all is well and the government has a plan to avoid a gas crisis

- Energas CEO says Pakistan should get help from Qatar Petroleum

ISLAMABAD: Pakistan is likely to face a major gas crisis in January, 2021 as international LNG suppliers did not offer bids for the first half of January and at higher rates for the second when spot cargoes were opened Thursday.

It emerged when bids of spot cargoes were opened for the early part of January 2021 after bids for six LNG cargoes were sought.

According to a The News report, international LNG suppliers didn’t offer bids for the time slots of January 8-11, 2021, January 12-14 and January 14-15.

So how will Pakistan’s government now meet the country’s energy needs?

Regasified liquefied natural gas (RLNG) demands are higher than ever.

Read more: PTI govt hints at raising power, gas tariffs

“The government may have to declare an RLNG emergency under the force majeure clause, enabling it to arrange LNG putting the Public Procurement Regulatory Authority rules aside,” The News quoted a top official as saying.

Govt says it has a back-up plan

Pakistan LNG Limited [PLL] did not get bids, confirmed Special Assistant to Prime Minister on Petroleum Nadeem Babar.

He said it is because of everything that went on for one month and that many bidders have stayed away.

But he says the government has a back-up plan which will be shared in a day or two.

What bids were made for January?

According to the bidding documents, PLL received expensive bids for a price tag of 33.9499% of Brent for three spot cargoes instead of six vessels and that too for the last three time slots of January.

The opening of bids on Thursday for January shocked the authorities as traditional LNG suppliers Gunvor and ENI didn’t participate. But extremely-high bids were received for three LNG cargoes from January 20-21, 2021, January 26-27 and January 29, Feb 1, 2021 by the Pakistan LNG Limited.

Surprisingly, Qatar Petroleum bidded for the first time with the lowest offer of up to over 17% of the Brent, forcing Pakistan to purchase the cargoes at a higher cost.

Read more: Domestic, industrial consumers to get ‘uninterrupted’ gas supply during winters: report

The News report said Qatar Petroleum has offered LNG cargo at 17.3203% of Brent for January 20-21, at 17.3207% of Brent for January 26-27 and at 15.3209% of Brent for January 29-February 1. Qatar Petroleum outpaced LNG trading companies by a big margin.

“Another company SOCAR offered bids at 20.4832% of Brent only for the last time slot of January 29-February 1, 2021, Trafigura offered bids for two slots of January 20-21 at 27.2727% of Brent and for January 29 to February 1 at 33.9499% of Brent. Energy Asia/ENOC gave the bid at 24.8888% of Brent for January 29 to February 1,” the report said.

Vitol bidded for the last time slot at 24.4321 percent of Brent. But BP Singapore’s bid was disqualified for January 29 to February 1, 2021.

What can Pakistan do?

Qatar Petroleum’s inclusion is a good omen, said Energas CEO Anser Khan.

He said Qatar is an LNG producing country. “LNG trading companies always cartelise the prices but the LNG producing country or company can offer lower bids,” he said, warning of a looming LNG crisis from January 1-18.

But he thinks Pakistan can figure the crisis out if it has bilateral talks with Qatar Petroleum.

The media, however, will take on the government as the bilateral arrangement does not require the PPRA rules implementation, he cautioned.

Read more: Omar Ayub says PM Imran Khan keen to resolve gas sector's issues

Khan reasoned that LNG trading companies did not offer bids for January as the Gorgan company of Australia which used to produce LNG from 16.5 million tons to up 18 million tons per year has shut its operations, creating an LNG shortage in the international market.

He said Gunvor and other LNG trading companies first purchase from LNG producing countries or companies and then sell it to buyer countries. But because of a shortage, trading companies can’t bid.