Sales tax on toll manufacturing will rest with the Centre: NTC

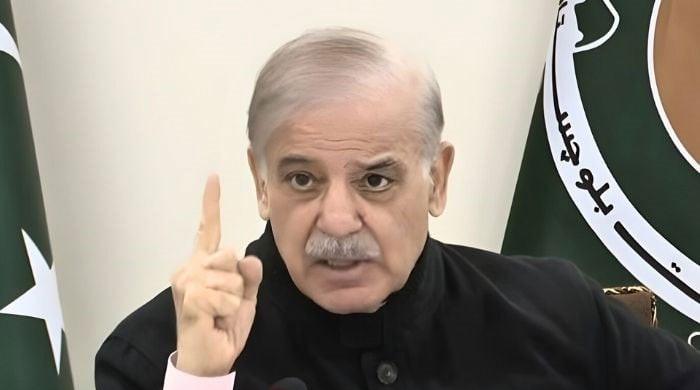

Major decisions made at NTC meeting headed by Minister of Finance Shaukat Tarin at Finance Division

September 16, 2021

- Tarin highlights the need to evolve a consensus between the Centre and provinces regarding the sales tax harmonisation.

- FBR chairman outlines areas to work out an arrangement to harmonise between the Centre and provinces.

- NTC to set up a single portal for filling Sales Tax returns by the first week of October.

The National Tax Council (NTC)Thursday decided after due deliberation with the stakeholders to entrust the responsibility of collection of sales tax on toll manufacturing to the federal government and vest the taxation rights on transportation business in the provinces.

Toll manufacturing is a process in which a company provides raw materials or semi-finished goods to a third-party servicing company.

A statement issued by the NTC said that Federal Minister for Finance and Revenue Shaukat Tarin presided over an NTC meeting at Finance Division.

The meeting was also attended by provincial finance ministers, Finance Division secretary, Federal Board of Revenue chairman, Sindh Revenue Board chairman, and other senior officers.

Tarin welcomed the participants to the meeting and highlighted the need to evolve a consensus between the federal government and provinces in matters relating to sales tax harmonisation.

He stressed the need to resolve tax-related issues in a spirit of cooperation between the federation and the federating units.

During the meeting, the FBR chairman made a detailed presentation and outlined areas for further deliberation to work out an arrangement in a collaborative manner relating to harmonisation of Goods and Service Tax amongst the Centre and provinces.

The FBR and the provincial finance ministers narrated their respective positions on the taxation of transportation, restaurants, toll manufacturing, and construction.

The meeting was informed that the NTC is working to set up a single portal for filling Sales Tax returns, which is likely to be launched by the first week of October.

The statement said that the measure will cut the compliance cost for taxpayers and help increase Pakistan’s rating on Ease-of-Doing Index.

Among other decisions made at the meeting, the one regarding the taxation on construction business was to share the taxation right as per the constitutional arrangements, and a technical committee consisting of all revenue authorities would decide the operational modalities.

The federal minister decided that the provinces will continue to tax restaurants. However, a reference drafted in consultation with provinces will be sent to Law Division for an opinion on the decision.

In addition to this, it was also decided that detailed input will be invited from Provincial Revenue Authorities (PRAs) for the development of a single sales tax portal acceptable to all. Similarly, FBR shall also develop a standardised income tax return format, in consultation with the provincial governments.

All stakeholders agreed to proceed ahead in the spirit of greater national interest and harmony under the umbrella of NTC.