Winter is coming: Pakistan, brace yourself for an early gas crisis this year

Two companies back out of agreement to provide LNG cargoes in November 2021; energy ministry calls meeting to strategise way forward

November 01, 2021

- Gas crisis in Pakistan around the corner as LNG trading companies willfully default on agreement for November.

- Under term agreement with Pakistan LNG Limited, Italy-based ENI was to deliver an LNG cargo on November 26-27 and Singapore-based GUNVOR on November 19-20.

- High-level meeting being held today (Monday) with officials from energy, petroleum and powers divisions to strategise way forward.

ISLAMABAD: In a major setback for the country, two LNG trading companies have backed out of an agreement made with Pakistan LNG Limited (PLL) to provide the country two LNG cargoes for this month (November) for mammoth monetary gains of up to 200% profit in the international spot market.

The two LNG trading companies had made an agreement with PLL, with Italy-based ENI promising to deliver the LNG cargo on November 26-27 and Singapore-based GUNVOR promising delivery on November 19-20, The News reported.

The move by these LNG trading companies has left top authorities in the energy ministry in the lurch, with some saying that the situation may expose the PTI government to a severe political backlash from the masses in November.

What exactly is the agreement?

ENI is in a 15-year term agreement with PLL under which it is bound to provide an LNG cargo every month at 11.95% of the Brent and GUNVOR is also in a five-year term agreement and bound to provide a cargo at 11.6247% of the Brent.

Under the contract, in case of default, PLL can impose a penalty of 30% of the contractual price of one cargo to each LNG company and both companies are ready to pay the penalty as profit in the spot market is huge, prompting them to sell Pakistan’s term cargo to the international market.

PLL has inked the term agreements with both companies to avoid purchase of LNG cargoes at higher prices, but both companies have backed out and defaulted on the agreements at a time when the spot LNG prices are hovering at $30-35 per MMBTU, the publication reported.

What happens now?

A high-level meeting is to be held today (Monday) in the petroleum division to look into the new situation, top sources in both the gas distribution companies were cited as saying by the publication.

The meeting may decide to contact the Italian government on a war footing, asking to influence the ENI to show respect to the 15-year term agreement inked with PLL, it was reported.

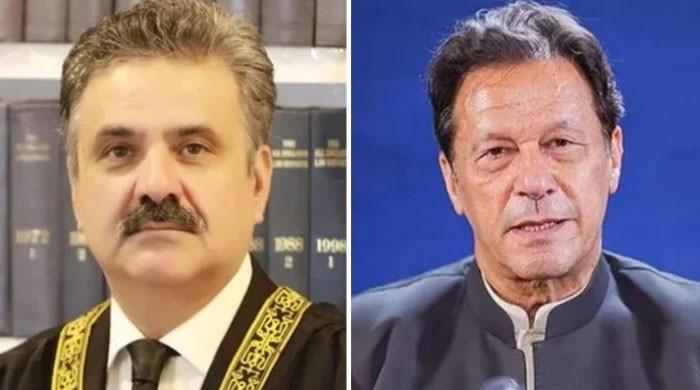

Petroleum Secretary Dr Arshad Mehmood confirmed the development, saying that the energy minister will be chairing a meeting today (Monday) morning to gauge the situation and strategise a way forward in consultation with the petroleum and power division officials.

PLL's managing director could not be contacted for confirmation of the default by two LNG trading companies.

A gas crisis was expected to haunt Pakistanis from December to February, but sources are now insisting that it will start earlier (in November) because of the default by the two LNG trading companies.

Why did the LNG trading companies back out and has it happened before?

ENI informed PLL on October 30 that it won't deliver the term cargo on November 26-27. Interestingly, ENI has committed default three times, including the latest one.

It first defaulted in January 2021 by providing half of the term cargo and then it did not provide a full term cargo in August and now it has backed out of its term cargo due in November.

The LNG trading company has reportedly told PLL that its supplier has cancelled the cargo in the wake of commercial considerations and logistic issues, so it is not possible for it to deliver the term cargo in November.

ENI has become a "habitual defaulter for monetary gains" by repeatedly selling the term cargoes of Pakistan in the spot market wherein LNG prices have jacked up to 200%, sources said.

GUNVOR, meanwhile, defaulted for the first time. It said that there was a system breakdown at the loading port, which is why it may not deliver the term LNG cargo on November 19-20.

PLL has already received no bids for eight spot cargoes, four each for December and January because of the highest-ever LNG prices. The absence of eight spot cargoes in December and January will increase the gas deficit up to 600mmcfd, triggering massive gas loadshedding in the country.