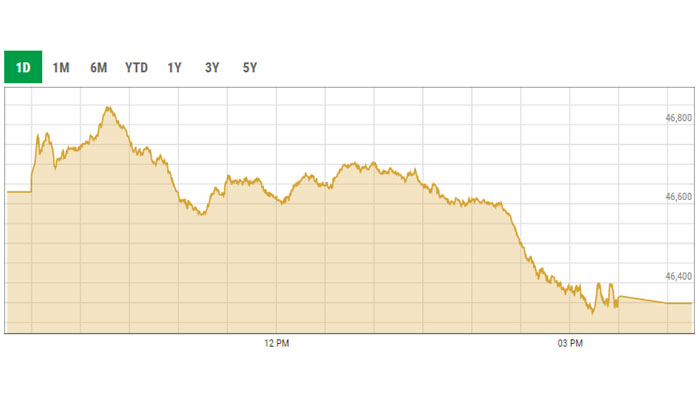

KSE-100 retreats, succumbs to selling pressure

Benchmark KSE-100 index falls over 280 points to settle at 46,348.18 points

November 11, 2021

- Benchmark KSE-100 index falls over 280 points to settle at 46,348.18 points.

- Investors turn wary due to a delay in the $6 billion IMF programme which was expected to resume last week.

- Sectors contributing to the performance included commercial banks, exploration and production, technology, cement and engineering.

After a day’s respite, the market once again succumbed to selling pressure due to concerns regarding soaring inflation and expected policy rate hikes.

Investors turned wary due to a delay in the $6 billion International Monetary Fund (IMF) programme which was expected to resume last week.

Furthermore, the market participants also kept their eyes on the rupee-dollar parity and soaring inflation which will justify the central bank’s stance if it increases the policy rate in its next meeting scheduled to be held on November 26.

At close, the benchmark KSE-100 index fell 281.70 points, or 0.60%, to settle at 46,348.18 points.

A report from Arif Habib Limited (AHL) noted that the market opened on a positive note but remained dull in the first half session of the market.

“Concerns regarding inflation and weakening of Pakistani rupee against the US dollar created uncertainty for investors to take fresh positions, which eventually resulted in profit-booking scenario of last day positions in the second half session,” it said.

The report added that accumulation was witnessed in the banking sector as market participants are eyeing the rate hike in the upcoming monetary policy.

“Activity continued to remain side-ways as the market witnessed hefty volumes in the third tier stocks,” the brokerage house said, adding that on the flip-side, institutional activity remained lacklustre.

Sectors contributing to the performance included commercial banks (-60 points), exploration and production (-55 points), technology (-40 points), cement (-37 points) and engineering (-19 points).

During the session, shares of 352 listed companies were traded. At the end of the session, 95 stocks closed in the green, 232 in the red, and 25 remained unchanged.

Overall trading volumes dropped to 269.5 million shares compared with Wednesday’s tally of 320.3 million. The value of shares traded during the day was Rs9.5 billion.

Ghani Global Holdings was the volume leader with 30.2 million shares, losing Rs1.05 to close at Rs32.19. It was followed by Service Fabrics with 20.5 million shares, gaining Rs0.65 to close at Rs12.09, and Telecard Limited with 14.3 million shares, losing Rs0.34 to close at Rs18.97.