What kind of VC should be hired for Quaid-e-Azam University

Universities are fighting for their survival with the fierce urgency of now

December 07, 2022

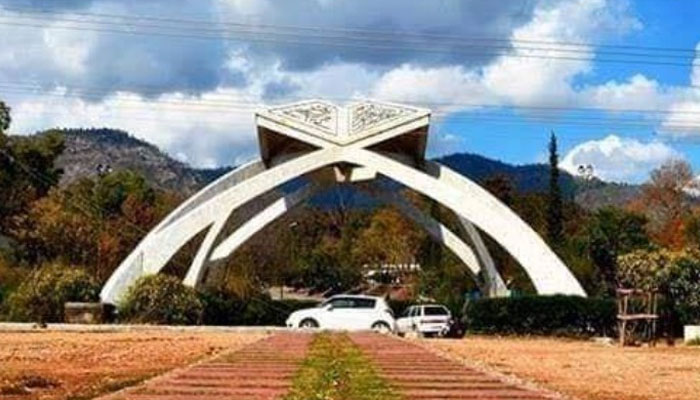

The Ministry of Federal Education and Professional Training (MoFEPT) is preparing to interview applicants for the position of vice-chancellor (VC) for three major public-sector universities in Islamabad – the Quaid-e-Azam University (QAU), Allama Iqbal Open University (AIOU), and the International Islamic University, Islamabad (IIUI). Some may wonder what the ministry has got to do with selection of vice chancellors (but this op-ed is not about that).

More than a hundred applicants have been shortlisted for interviews. The interest by applicants is expected to centre on two universities – QAU and AIOU. What are the relevant issues facing these universities, what should the search committees’ priorities be?

Right off the bat, if there are qualified women among the applicants, their applications should be given special consideration, seeing how none of the leading federal universities have been led by women.

Given that the duration of the tenure of VCs at federal universities is four years, it makes sense to assess applicants in-part on their plans to respond to immediate issues any new VC will be confronted with. Let’s take a look at what some of those issues might be, beginning with QAU.

As anyone who reads the paper and that has even a passing interest in education knows, the QAU community is currently embroiled in a land issue with the Capital Development Authority (CDA). Land encroachment issues are perennial. The university’s 1709 acres of allocated land was not demarcated in CDA maps with 150 acres still awaiting handover. The CDA had also committed to compensate and relocate the more than 400 residents on that land. According to QAU staff, the university paid the CDA for the land once in 1967 and then again in 1990.

While the CDA got paid by the university to acquire land on its behalf, the CDA acquired land but never relocated the original tenants and never handed it over to the university. Decades later, those hamlets continue to grow and, unless the issue is taken up with the CDA, the unrest caused by sporadic conflicts will continue. According to university faculty members, any expansion in university infrastructure is met with resistance from the residents. They also allege that anything that is not locked up is pilfered, contributing to an insecure campus environment. This is a well-known issue. Anyone who wants the job of VC of QAU should be expected to have a plan for resolving it, once and for all.

A second issue QAU is afflicted with (though perhaps less than some other universities) is campus discipline and unrest. Some faculty members feel that “the hostels are no-go areas for the administration.” It is alleged that student accommodation on campus is divvied up by ethnicity. According to university staff, back in the early 2000s, a VC was temporarily able to resolve the issue after a student got shot. Unfortunately, once his tenure ended, subsequent VCs have patronised one council or another.

Drug use on campus is another pressing issue for all universities. I cannot imagine what the situation must be like in hostels that are inaccessible to the administration. How will the new vice chancellor deal with these disciplinary issues?

All public universities, without exception, are bearing the brunt of a major financial crunch. While their allocations of public funds in absolute terms may not have changed for the last few years, in real terms that means inflation has effectively cut them in half. Almost all universities rely on two principal sources of funding: 1) allocations of public funds (by the HEC); and 2) tuition fees collected from students (Rs50,000-Rs200,000 per annum). A business development manager of a UK university who learnt this on a tour of a university in the capital had a jaw-drop moment when he heard how shockingly little the university charged its students in terms of tuition fee.

While I wish that cost should not stand in the way of any young person who wishes to study at a university, that is never going to happen unless universities move towards becoming more self-sustainable (as few already have) by generating other revenue streams from which they can subsidise the cost of their programmes. At the moment, QAU still has no sources of income worth mentioning other than HEC grants (in the range of approximately Rs900 million —Rs1.2 billion) and tuition fees. According to a university staff member’s estimate, in an environment of stagnant public fund contributions, rising costs and inflation, the university will be bankrupt by 2028 if it continues on its present path.

Recently, students had to be asked to bring their own answer sheets for exams because the department could no longer afford them. On another occasion there were no funds to buy phenyl to clean the bathrooms. In the end, faculty pooled contributions to share this expense. How many other departments or organisations of the government must face such indignity on an ongoing basis? If you think the department may be squandering funds elsewhere, know that the same department’s monthly budget is Rs12,000! The same department’s library budget to buy books is Rs85,000 per annum. Payments to publishers have been pending for so long, they have refused to supply books altogether.

All the while, universities’ pension liabilities have been growing. When organisations face budget shortfalls, one of the first things that gets raided is the employee pension fund. As a matter of fact, in a recent document submitted by the CDA to the Islamabad High Court in the case of the bypass passing through QAU, it came to light that one of the goodies it is being promised is “[PKR] 5 billion for the pension/endowment needs of the university,” in return for giving up university land.

Growing pension liabilities is a threat to the financial sustainability of all universities. The University of Peshawar has been in the news for years for this. Yet, employees continue to resist any moves away from the traditional defined-benefit pension of the BPS (in which the risk is borne by the employer) to a defined-contribution pension plan (in which the risk is borne by the employee). More on that perhaps another time. Several universities had to stop offering BPS appointments and defined-contribution pensions for new appointees altogether. One VC, I spoke with, shared that he has been unable to pay his retirees for the last two years. Beyond pensions and salaries, utility bills take another big bite out of university budgets.

At another time, I would have included questions about where candidates for the office of VC stand on issues of raising quality of faculty members and the education they impart, on the relevance of research that is conducted, innovation, and workforce development for an increasingly complex world. However, all of that must take a backseat when some universities are fighting for their survival with the fierce urgency of now.

The common thread that runs through most of these problems is the financial self-sustainability of universities. In 2022, if there are to be interviews of candidates for the position of VC, and there is to be a single question put to them all it should be this: what is your immediate plan for steering the university away from default in the short term and how will you move it towards financial self-sustainability in the medium and long term?

Additionally, in the case of QAU, candidates must present their path forward on the issue of the bypass road which has risen to national prominence. That, not pliancy, is what search committees for these openings must look for today. Seeking anything less than thoughtful and realistic plans to resolve the most pressing problems universities are facing will leave the search process little more than a dog-and-pony show.

The writer (she/her) has a PhD in Education.