Geneva pledges and Pakistan's economic challenges

News from Geneva conference will remain meaningless unless followed by vigorous and long-overdue economic reforms

January 11, 2023

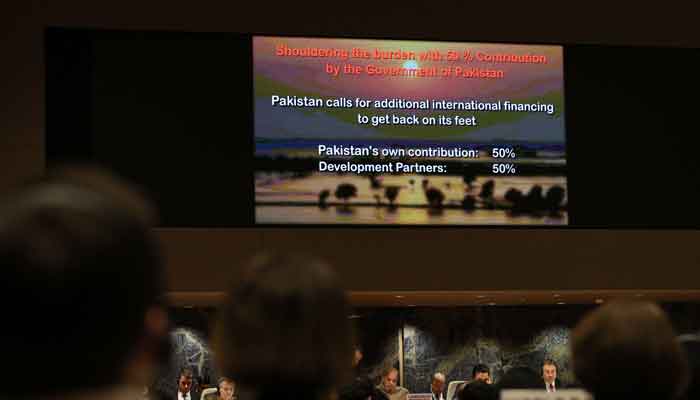

Monday’s conference of prospective international donors in Geneva for Pakistan’s flood-stricken regions concluded with a predictable outcome – billions of dollars in pledges of more than $9 billion.

The outcome, though celebrated by members of Pakistan’s ruling structure, tragically carries little consequence for tackling Pakistan’s immediate economic challenges.

The pledges on paper may flow across to Pakistan over a period of time. But judging by prior experience of Pakistan and other recipient countries, it is hard to imagine Monday’s promises coming in full.

As Pakistan’s official foreign currency reserves continue to plummet and are now roughly equivalent to the cost of about three weeks of imports, key decision-makers notably Finance Minister Ishaq Dar continue to live in fantasy land. Notwithstanding Dar’s mantra of Pakistan set to avoid a default on its foreign payments, the reality is starkly different.

From large stakeholders in the industry to mainstream businesses, there is no shortage of enterprises suffering from painful delays in making foreign currency payments. And individual depositors in onshore foreign currency accounts have found little joy in visiting their banks recently. A shortage of US dollars has made it increasingly tough for foreign currency depositors to freely withdraw their funds.

Signs of financial stress, notably surrounding foreign payments, have tragically coincided with Dar’s apparently poor choice of words in his utterances related to the International Monetary Fund (IMF). Monday’s conference in Geneva saw IMF officials meet with Dar on the sidelines to discuss ways of unblocking IMF funds for Pakistan.

The choices ahead are politically unpalatable but economically vital. One sign of the coming trends is set to come on January 23 when the State Bank of Pakistan is due to meet for a review of its monetary policy. With inflation galloping ahead relentlessly, the state bank will be under pressure to raise interest rates beyond the 16% mark. Though a further rise in interest rates will not be wise notably in an election year, an increase may well indicate that the Pakistani authorities are succumbing to the IMF’s pressure.

Other bitter pills including a sizable increase in utility rates may well follow soon under a ‘mini-budget aimed at unlocking the next IMF tranche of just over $1 billion. That is fundamentally essential to unlock the billions of dollars that Pakistan needs to fill its dangerously large current account gap.

But the scramble to keep Pakistan afloat provides no assurance of an enduring solution to the country’s vast and chronic economic challenges. Instead, they are embedded in the powerful reality of a country which has long lived beyond its means. Even the displacement of tens of millions of Pakistanis from last year’s floods seemingly failed to move the likes of the finance minister to embrace tough steps to speed up relief and rehabilitation work.

In brief, members of Pakistan’s well-protected ruling class for long have been protected under successive regimes without fail.

Going forward, Pakistan must move rapidly to change its economic direction and alter course irrespective of the cost for one lobby or another. Towards this end, Pakistan must embark on a two-pronged long overdue journey of change.

On the one hand, it is essential for Pakistan to move ahead rapidly for enforcing a much wider tax regime irrespective of the prospective taxpayers’ clout. This requires a comprehensive departure from decades gone by where repeated eras of no more than lip service to tighten the tax regime have been fiercely resisted by powerful lobbies of the rich and mighty.

Meanwhile, Pakistan’s foreign exchange security has been badly compromised as consumption patterns of the rich and mighty along with growing reliance on imports furled recurringly high current account deficits. A meaningful change must be built upon brutally targeting consumption patterns across the country, to enforce a steep decline in luxury imports till Pakistan can comprehensively raise its exports.

On the other hand, Pakistan needs to brutally cut its expenditure across the board to significantly narrow its recurring fiscal deficit. For years, the country’s repeatedly stubborn fiscal deficit has caused more harm to its interests than any other trend. Living beyond means has become Pakistan’s way of life irrespective of the consequences. Across the board today, barring a few exceptions, it's hard to find a public-sector company which is also profitable. Besides, periodic bailouts of entities like Pakistan International Airlines (PIA) have only proven that Pakistan’s national airline can not continue to operate without repeated financial support, all at the expense of Pakistan’s relatively few taxpayers.

Monday’s news from the Geneva conference will remain largely meaningless unless followed by vigorous and long-overdue economic reforms across Pakistan. With their eye on the next elections, can the likes of Dar take on the proverbial bull by the horn and make a difference? For now, the answer to that riddle remains in the non-affirmative.

The writer is an Islamabad-based journalist who writes on political and economic affairs. He can be reached at: [email protected]