A cautiously optimistic budget

Consequently, overtaxed segments will continue to bear the burden of a narrow tax base, struggling to stay within the system

June 13, 2024

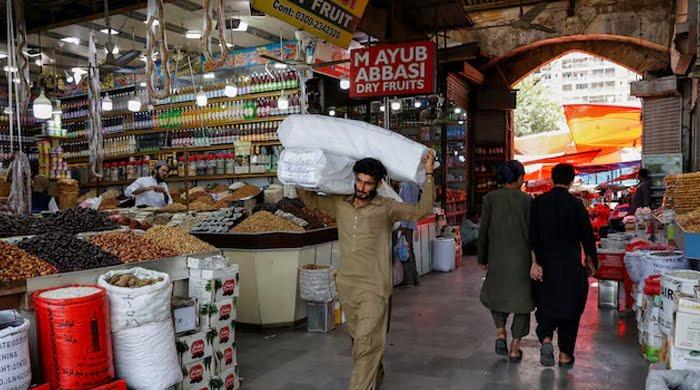

The federal budget for the upcoming fiscal year can be described as cautiously optimistic. It’s neither bold nor innovative. The budget maintains its focus on deepening the existing taxpayer base, with minimal effort to expand the tax net to include new entities and individuals.

Despite clear statements in the budget speech about transitioning from a consumption-oriented to an investment-oriented economy, the specifics of this transition remain vague.

The federal budget aims for a 37.8% increase in tax revenue, seeking to raise the tax-to-GDP ratio to 10.4% —a challenging goal, as such growth in tax revenue is rare.

With expected inflation of around 15% next fiscal year, the budget suggests a real (inflation-adjusted) tax revenue growth of about 22%. Achieving this significant growth by simply deepening the existing tax base is a tough challenge.

Income taxes are projected to rise by about 48%—another ambitious target. Although the tax rate for the salaried class remains unchanged, changes in tax slabs have increased their tax burden.

Over the past five years, real incomes have dropped by more than 30%, and higher taxes will further reduce post-tax income, exacerbating financial strain on salaried individuals. In some tax slabs, the increase is as high as 40%, targeting the salaried class because they are less vocal compared to other interest groups.

The budget continues to focus on existing taxpayers, while the untaxed segment remains largely unaffected. A significant change is the revised taxation regime for export-oriented industries, which will raise corporate taxes and reduce reinvestment incentives. Most of the increase in direct taxes comes from existing taxpayers, indicating a deepening rather than an expansion of the tax base.

Indirect taxes are set to rise, with sales tax expected to increase by 36% and the Petroleum Development Levy by 33 %. These taxes are inherently inflationary, increasing the overall cost base. The increase in withholding taxes from 1% to 2.5% on the manufacturer-distributor-retailer value chain is unlikely to convert non-filers to filers.

Instead, manufacturers will likely pass the cost to consumers, further raising costs and contributing to inflation. This situation encourages the informal cash market to thrive, as there are more incentives to avoid the formal system.

It's unclear whether increasing withholding taxes for non-filers has led to more individuals filing taxes. Additionally, whether those who become filers do so fairly is questionable. Withholding taxes have been around for a long time without significantly increasing the conversion of non-filers to filers.

Draconian measures like blocking mobile phone SIMs of individuals who fail to file taxes have further discouraged compliance. The tax policy design is flawed, as evident in the budget. The withholding taxes for non-filers increase the cost of doing business without significantly improving compliance or tax collections.

The bulk of taxes continues to be paid by the usual suspects: corporations in the formal system, salaried individuals, and indirect taxes like the Petroleum Development Levy. These consumption-based taxes disproportionately affect vulnerable households compared to affluent ones.

The budget offers some hope for macroeconomic stability, targeting a real growth rate of 3.6 % with minimal reliance on external funding to cover deficits. This suggests growth will be largely domestic rather than import-driven.

Another positive aspect is the plan to privatise loss-making state-owned entities, particularly electricity distribution companies and the national airline. Privatisation could reduce recurring losses and subsidies in the power sector. However, achieving this requires extensive structural reforms, which the government has shown some commitment to.

On the revenue side, the budget failed to broaden the tax base, further burdening salaried and formal segments of society. Higher withholding taxes will likely speed up the shift from the formal to the informal economy. An expansion in the cash economy is also likely, as little has been done to discourage it.

The budget is cautiously optimistic but inherently inflationary. It continues to penalise existing taxpayers and does little to shrink the informal economy. While it aims to encourage investments, it does not implement any policies to achieve this.

Capital outside the system may continue to circulate in cash, leaving the formal economy starved of resources. Consequently, overtaxed segments will continue to bear the burden of a narrow tax base, struggling to stay within the system.

The writer is an independent macroeconomist. He posts on X @rogueonomist

Disclaimer: The viewpoints expressed in this piece are the writer's own and don't necessarily reflect Geo.tv's editorial policy.