Creative destruction: The missing engine

Escaping IMF trap needs creative destruction, not temporary economic stabilisation

January 06, 2026

In my previous article, 'Escaping the IMF trap' (December 31, 2025), I examined Pakistan's recurring cycle of IMF dependence – where successive programmes provide short-term macroeconomic stability but fail to deliver sustained prosperity because the deep structural drivers of stagnation remain unaddressed.

Today, I turn to another side of that same structural challenge: the missing engine of long-term growth — creative destruction — the process through which innovation, competition, and renewal unleash productivity, creativity, and sustainable economic progress.

The idea is not new. In the mid-20th century, the Austrian economist Joseph Schumpeter described capitalism's defining feature as creative destruction — a continuous process in which old technologies, firms, and business models are destroyed and replaced by new and superior ones. Capitalism, he argued, advances not by perfecting what already exists, but by relentlessly dismantling what has become obsolete.

Schumpeter's insight has since been refined and deepened by modern growth economists. Joel Mokyr, Philippe Aghion, and Peter Howitt showed how creative destruction operates through innovation, competition, and institutional re-engineering driven by technological advancement.

In 2025, all three were awarded the Nobel Prize in Economics for expanding this framework and demonstrating how sustained economic growth depends on allowing new ideas and firms to replace obsolete ones. Their conclusion is simple but uncomfortable: economies that protect the past eventually lose the ability to create the future.

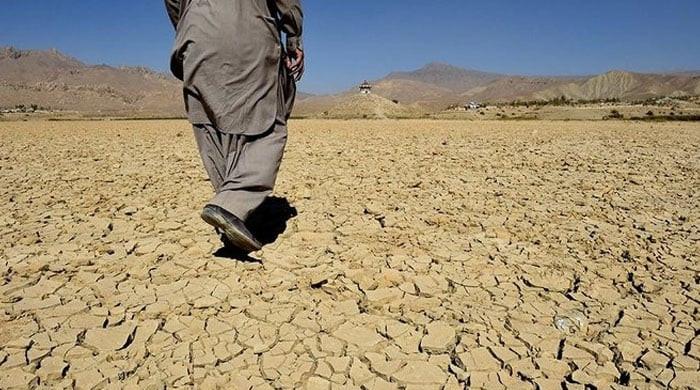

This is not an abstract academic debate. It goes to the heart of why Pakistan struggles to grow despite repeated stabilisation efforts. Without creative destruction, productivity stagnates, exports fail to diversify, and investment remains trapped in low-value activities — making external financing and IMF programmes a recurring necessity rather than a temporary bridge.

Joel Mokyr explains long-term growth as a feedback loop between two types of knowledge. Propositional knowledge is scientific understanding — the 'why.' Prescriptive knowledge is technology and engineering – the 'how.' In healthy economies, science feeds technology, and technology in turn creates new tools for science. This virtuous loop allows societies to climb ever higher levels of productivity.

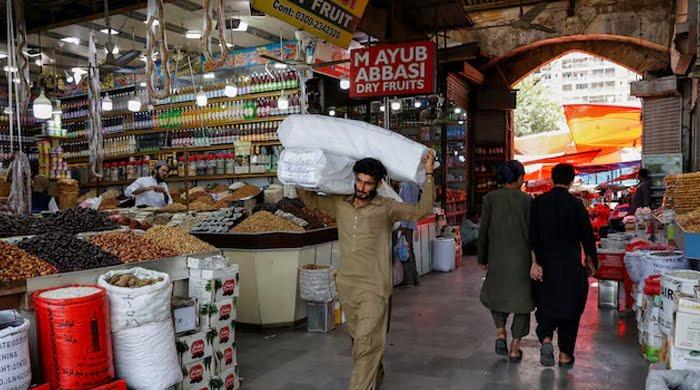

In Pakistan, this loop is weak and fragmented. Universities produce graduates and research papers, but very little of this knowledge reaches and is considered usable by factories, farms, or firms producing goods and services. Industry, meanwhile, demands little from science, relying instead on obsolete practices of the past, imitation, and marginal incremental improvements. As a result, Pakistan's production structure remains stuck in low-value segments of the past.

We export low-value yarn and basic commodities instead of advanced textiles, clinker instead of engineered construction materials, and manufactured goods produced using decades-old techniques. Without new scientific and technological ladders, firms remain stuck on the same rung — and so does the economy.

Philippe Aghion highlights a paradox of capitalism: yesterday's innovators often become today's incumbents – and then use their power to block tomorrow's innovators. This is clearly visible in Pakistan's corporate landscape.

The Pakistan Stock Exchange (PSX) is dominated by banks, fertiliser companies, cement producers, and energy firms that have held leading positions for decades. There is nothing inherently wrong with these sectors except the missing piece of 'innovation' through new ideas and experimentation.

Out of more than 500 listed companies, there is no large-scale data or platform company, no globally or even regionally competitive technology firm, and no digital enterprise reshaping markets. Pakistan's stock market increasingly resembles a museum of 20th-century industry.

In dynamic economies, firms rise and fall constantly. In Pakistan, firms rarely die, but they also rarely transform. Sheltered by tariffs, subsidies, preferential taxation, regulatory barriers, and high entry costs for new competitors, many incumbents thrive without innovating. This is not stability; it is subsidised stagnation.

The contrast with the US S&P 500 is instructive. In the 1960s, a company stayed in the index for more than 30 years on average. Today, the average tenure has fallen to around 15 years. This churn reflects creative destruction in action.

Over time, industrial giants such as General Electric, Exxon Mobil, and General Motors have been replaced by firms like NVIDIA, Apple, Microsoft, Alphabet (Google), Amazon, and Tesla — companies that barely existed a generation ago.

Pakistan's market shows the opposite pattern. The same names dominate year after year. When inefficient firms are protected from exit, there is no room for new entrants to scale. A 'Google of Pakistan' cannot emerge in an ecosystem that does not allow outdated models to disappear.

Aghion's concept of 'Lost Einsteins' highlights another cost of stalled creative destruction. Innovation depends disproportionately on a small upper tail of talent. When gifted individuals lack access to quality education, mentors, capital, or entrepreneurial ecosystems, their potential is permanently lost.

Pakistan loses these Einsteins in two ways. First, many are never discovered due to weak public education and limited exposure to science and technology. Second, those who are discovered often leave. India's startup ecosystem, with more than 100 unicorns and billions of dollars in venture capital, has created a functioning market for innovation – including credible exit options. Pakistan, by contrast, remains stuck in repeated funding droughts.

The problem is not talent; it is the severe shortage of risk capital and a banking system that overwhelmingly lends to the government and large corporations. Wealth flows disproportionately into government securities, protected oligopolies, cartels, and established business groups – not into high-risk, high-reward innovation. In such an environment, ambitious entrepreneurs naturally look abroad.

Joel Mokyr warns that technology is easy; institutions are hard. Pakistan's institutional framework has historically been built for control rather than experimentation. Business failure carries stigma. Bankruptcy laws punish rather than rehabilitate. Industrial policy remains focused on import substitution and protection. Excessive, unpredictable taxation deters new investment.

When firms do not fear displacement, they do not innovate. Peter Howitt describes growth as a process of 'escape competition' — a force largely absent in Pakistan. This helps explain why IMF-led stabilisation repeatedly fails to translate into lasting growth. Stabilisation without creative destruction merely preserves an inefficient economic structure — guaranteeing that the next crisis will arrive.

This is not a new diagnosis. In 2021, I wrote a series of four articles on creative destruction, warning that Pakistan's business-as-usual approach — excessive government and regulation, 20th-century thinking, protection of large incumbents, suppression of competition, and discouragement of risk-taking — would inevitably lead to stagnation and repeated balance-of-payments crises. Four years later, the symptoms are more visible and the costs far higher.

Creative destruction is not about destruction for its own sake. It is the mechanism through which economies renew themselves, generate new ideas, raise productivity, and create new opportunities. Pakistan's path forward requires difficult choices: allowing inefficient firms to fail, dismantling protectionist barriers, reforming insolvency laws, improving and linking universities with industry, and redirecting capital away from bureaucracy and the public sector toward private-sector innovation.

Escaping the IMF trap requires more than temporary stabilisation. It requires restarting the missing engine of destruction. Countries that refuse to destroy the old eventually lose the capacity to create the new. Pakistan can still choose otherwise – but the window is narrowing.

The writer is a former managing partner of a leading professional services firm and has done extensive work on governance in the public and private sectors. He can be reached at: X/Twitter: @Asad_Ashah

Disclaimer: The viewpoints expressed in this piece are the writer's own and don't necessarily reflect Geo.tv's editorial policy.

Originally published in The News