Shares rally, oil slumps as Iran-Israel ceasefire goes into effect

Risk assets rallied, with S&P 500 futures up 1% and Nasdaq futures 1.3% higher

June 24, 2025

- Brent crude futures down over 10% in two days.

- European, Asian shares and Wall St futures rise.

- Dollar extends pullback, Treasury yields steady.

Oil tumbled 4%, global shares surged and the dollar dropped on Tuesday as US President Donald Trump said a ceasefire between Israel and Iran was in place, a dramatic turnaround after the US bombed Iran's nuclear sites over the weekend.

Brent futures had already slid 7% on Monday and US shares jumped after Iran made a token retaliation against a US base and signalled it was done for now.

With the immediate threat to the vital Strait of Hormuz shipping lane seemingly over, the global benchmark was last at $67.68 a barrel, its lowest since June 11. US crude futures dropped 3.6% to $66.02 a barrel.

"With markets now viewing the escalation risk as over, market attention is likely to shift towards the looming tariff deadline in two weeks' time," said Prashant Newnaha, senior Asia-Pacific rates strategist at TD Securities.

"Our sense is that the quicker than expected resolution to the Middle East conflict leads to expectations for a swifter resolution on tariffs and trade deals."

But for now, equity markets were basking in the eased geopolitical tensions.

Risk assets rallied, with S&P 500 futures up 1% and Nasdaq futures 1.3% higher. Europe's Stoxx 600 gained 1.3% in early trade, with travel stocks, such as airlines surging 4%, opens new tab while oil and gas names shed 3%.

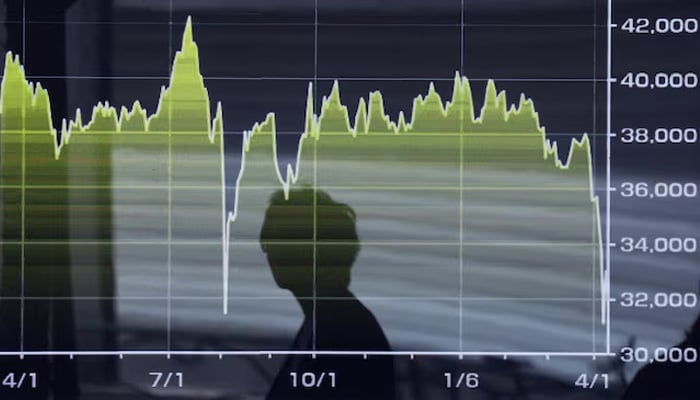

Earlier in the day MSCI's broadest index of Asia-Pacific shares outside Japan, opens new tab jumped 2.2% while Japan's Nikkei, opens new tab rallied 1.1%.

On trade, two sources told Reuters that Japan's tariff negotiator Ryosei Akazawa was arranging his seventh visit to the United States for as early as June 26, aiming to end tariffs that are hurting Japan's economy.

Government bonds largely looked through the news. The war has been a challenge for bond traders to process as they have had to weigh safe haven flows against the effect of higher oil prices on inflation.

Rate cuts approaching?

Federal Reserve Vice Chair for Supervision Michelle Bowman said the time to cut interest rates was getting nearer as risks to the job market may be on the rise.

That followed Fed Governor Christopher Waller saying on Friday he would consider a rate cut at the July 29-30 meeting.

Fed Chair Jerome Powell will have his own chance to comment when appearing before Congress later on Tuesday and, so far, has been more cautious about a near-term easing.

Markets still only imply around a 22% chance the Fed will cut at its next meeting on July 30, but a September cut is near to fully priced.

Ten-year Treasury yields were mostly steady at 4.33%, having declined 5 bps overnight. Germany's 10-year yield was flat at 3.52%

News of the ceasefire saw the dollar extend an overnight retreat and slip 0.7% to 145.43 yen , having come off a six-week high of 148 yen overnight.

The euro rose 0.2% to $1.1602 on Tuesday, having gained 0.5% overnight.

The yen and euro benefited from the slide in oil prices as both the EU and Japan rely heavily on imports of oil and liquefied natural gas, while the United States is a net exporter.

The risk-on mood saw gold prices ease 1% to $3,333 an ounce .