UK budget 2025: Viewer's guide to expected key announcements

Reeves prepares ‘Smorgasbord’ of tax rises in high-stakes budget amid economic downgrade

November 26, 2025

UK Chancellor of the Exchequer, Rachel Reeves, will present a highly significant autumn budget to the Parliament on Wednesday, November 26.

The nation has all eyes on the critical document to assess how an increasingly "unpopular" government will navigate a worsening economic outlook, with a “smorgasboard” of tax increases expected to fill a multibillion-pound hole in the public finances.

Ms. Reeves has asserted a “difficult” set of tax and spending plans, guided by the principles of “fairness and opportunity,” but influenced by a deteriorated global economic environment.

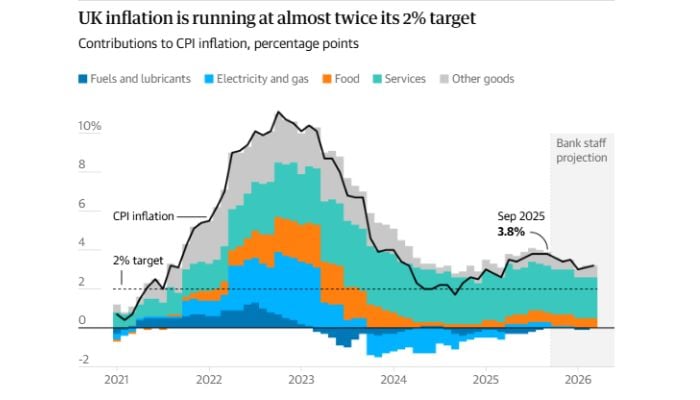

The primary challenge is a major fiscal shortfall, exacerbated by a critical downgrade to the UK’s economic growth forecast from the independent Office for Budget Responsibility (OBR).

The watchdog is anticipating to report that the potential for growth of the UK's economy has been weakened for each of the next five years, largely attributed to the legacy of underinvestment.

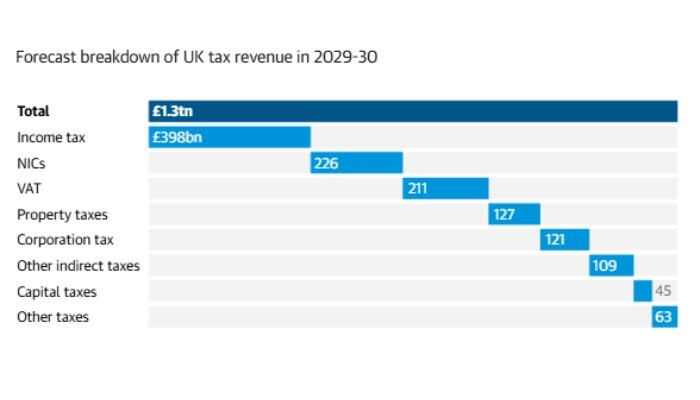

This downgrade indicates the Treasury is projected to receive less tax revenue in the future, forcing Ms. Reeves to find tens of billions of pounds through tax rise and spending cuts to meet her own “ironclad” fiscal rule to have debt falling.

Why is this budget highly significant?

The first budget presented by Ms. Reeves was one of the largest tax-and-spend events in recent history but it left a minimal financial buffer of less than £10 billion.

That cushion has now been erased by higher borrowing costs, more welfare spending, and the estimated OBR growth downgrade.

As per economists estimation, the chancellor needs to find up to £30 billion just to balance the books and rebuild a credible financial buffer.

In case it won’t happen, it could spook bond markets, pushing up the UK’s borrowing costs, already the highest in the G7, and increasing the staggering £100 billion annual bill for debt interest.

Earlier Ms. Reeves also acknowledged this stating, “The economic circumstances have declined, deteriorated, since a year ago.”

Expected tax and policy measures

Having ruled out increases to income tax, national insurance, or VAT rates to avoid a direct breach of Labour’s manifesto, the chancellor is expected to deploy a wide array of smaller, targeted tax changes.

Major announcements that are expected to roll out are:

- Extending the freeze on income tax threshold for a further two years, a “stealth tax” that pulls more people into higher tax brackets as their wages rise. This could raise over £7 billion a year.

- A “mansion tax” targeting high-value homes, likely an annual levy on properties worth over £2 million, will be imposed. Revaluations of the top council tax bands are also expected.

- A cap on tax-free pension contributions through salary sacrifice schemes and a reduction in the annual ISA allowance from £20,000 to £12,000 to encourage stock market investment.

- Shifting green levies from electricity bills to general taxation to cut household costs, while introducing a new "pay per mile" tax for electric vehicles to replace lost fuel duty. A freeze on rail fares and fuel duty is also expected.

- A “milkshake tax” extending the sugary drinks levy, higher taxes on gambling, and reforms to inheritance tax, including a cap on tax-free gifts.

Spending and relief measures

The budget is also expected to announce several measures focusing on easing the cost-of-living and supporting lower-income families.

Most importantly, Ms. Reeves is expected to put an end to the controversial policy that restricts child tax credit and universal credit to the first two children in a household. With this, half a million children can be lifted out of poverty at a cost of around £3.5 billion.

Additionally, a 4.1 % increase to £12.71 per hour for workers over 21, and a larger 8.5% rise for younger workers aged 18-20 will be rolled out to improve the national living wage.

Ms. Reeves is also expected to announce a freeze on the price of prescription in England.