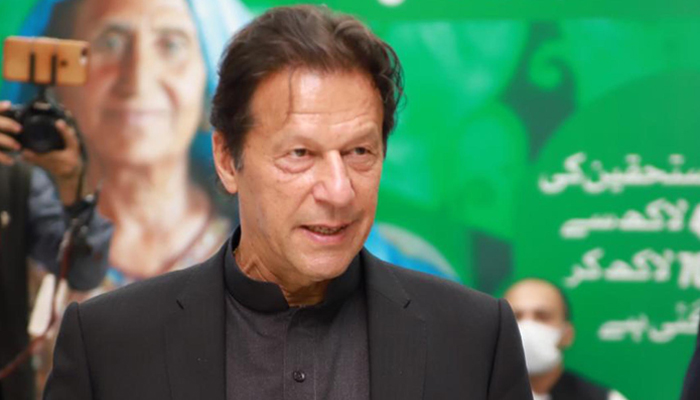

PM Imran Khan kicks off phase I of Ehsaas Kafaalat payments

The programme will benefit 7 million people, while each beneficiary will be paid Rs12,000

November 27, 2020

ISLAMABAD: Prime Minister Imran Khan on Friday kicked off the first phase of the Ehsaas Kafaalat Payment programme that has seven million beneficiaries, according to a statement by the government's press information department (PID).

Prime Minister Imran Khan's special assistant Dr Sania Nishtar, briefing the premier, said that several measures were taken to improve the quality of payments and to ensure protection against cyber-attacks.

Through the scheme, women can access banks and withdraw money from ATMs, the special assistant said.

“The Ehsaas payment system [is] designed to provide maximum options to the beneficiaries, including the first-time introduction of the option to draw money from a biometric ATM," she said.

Explaining the importance of the measure, Dr Nishtar said that vulnerable women would no longer be hostage to "corrupt agents and touts" who tend to deduct money.

The Ehsaas Kafaalat payment will be made in phases. Phase I has commenced today with payments for 4.3 million women beneficiaries.

Each beneficiary will be paid Rs12,000 — covering the period of July 2020 to December 2020.

Payments to additional beneficiaries will be made from December 2020 onwards, and the process would be completed in the current fiscal year.

During his visit to the Ehsaas Kafaalat payment site in Islamabad today, the prime minister was also shown a trial run of the operations of “Ehsaas One Woman One Bank Account".

From next year onwards, Ehsaas Kafaalat beneficiaries will have the option of either drawing their money or saving money into digital wallets.

“We will have to focus on financial literacy to ensure that women draw maximum benefit from this empowering initiative”, Dr Nishtar said.

"By providing individuals with access to secure, useful, and affordable financial products and services like transactions, payments, savings, credit, and insurance, we are giving them the financial security required to escape poverty and create a better life for themselves and their families,” she added.

As part of an efficient digital system for Kafaalat, payments will also be possible at the point of sales at retail points through machines that authenticate biometrically.