UK inflation falls for first time since March, easing to 3.6%

UK inflation falls for first time in seven months

November 19, 2025

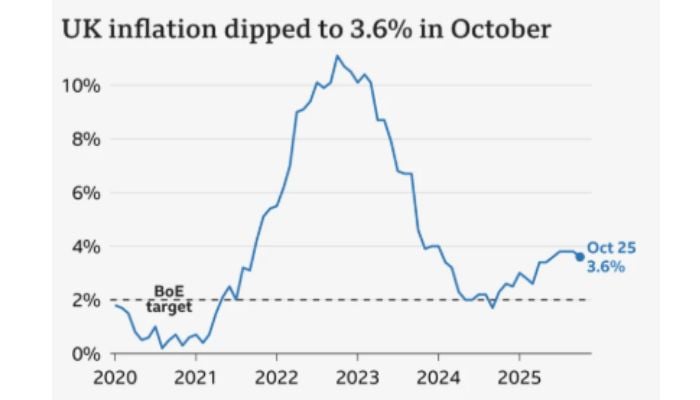

The UK’s inflation rate has fallen for the first time in seven months, providing a modicum of relief to households amid the ongoing cost-of-living crisis.

The Office for National Statistics (ONS) revealed official figures stating that the consumer price index (CPI) fell to 3.6% in the year to October, down from 3.8% in September.

This figure signifies the lowest level since June, though the rate remains well above the Bank of England’s 2% target.

The decline is mainly due to energy prices rising at a slower annual pace than in previous months.

But, the drop was slightly less than economists had predicted, with food prices continuing to exert upward pressure.

A year ago, the prices of food and beverages were about 4.9% higher than today.

The fall was also acknowledged by the Chancellor Rachel Reeves who undermines the continued strain on family budgets.

She stated, “I know the cost of living is still a big burden,” promising further action in the upcoming budget to bring prices down.

Although the decrease in inflation is highly appreciated, some opposition conservatives criticised the government’s fiscal decisions of the past for “stoking” inflation.

While the deceleration in price growth may increase the likelihood of an interest rate cut from the Bank of England in coming months, economists warn that persistent underlying price pressures and a fragile economic backdrop remain significant concerns.

As of now, prices are still rising across the economy but at a relatively more gradual pace.