There is no silver bullet

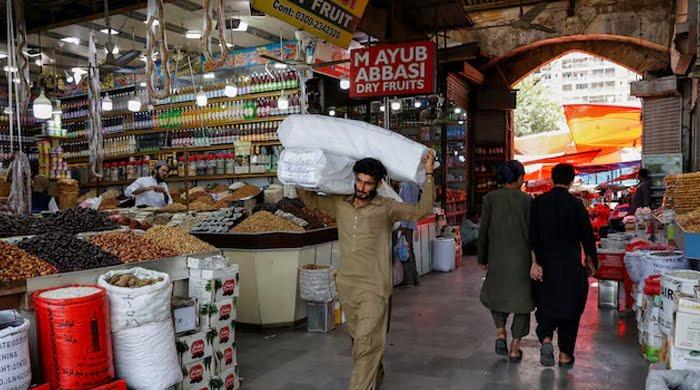

Pakistan trapped in low-value production, import dependence with disconnect between headline indicators and lived experience

December 26, 2025

In the aftermath of the May 2025 armed confrontation with India, Pakistan entered a familiar phase of heightened nationalism and strategic self-assurance.

Official narratives framed the episode as a moment of diplomatic resilience and internal consolidation, highlighting renewed engagement with traditional partners, strong signalling on deterrence and a surge of public confidence.

For many, it reinforced a long-standing belief that centralised authority and decisive leadership are the country's most reliable instruments in moments of crisis. Once again, the strongman archetype — promising order, speed and resolve — appeared vindicated.

Yet beneath this surface confidence lies a harsher reality. Diplomatic optics and security posturing, however valuable in the short term, do not address Pakistan’s chronic economic fragility or its deeply corroded governance structures.

The country's future is not being shaped on battlefields or in ceremonial halls, but in neglected classrooms, mismanaged ministries, uncompetitive factories and institutions hollowed out by decades of rent-seeking — now compounded by the growing extortionary behaviour of state officials. Without confronting these structural failures, the post-conflict momentum risks dissolving into yet another cycle of stagnation and disappointment.

Pakistan's economic record over recent decades reveals an unmistakable pattern. Growth has been episodic and fragile, driven largely by external inflows such as aid, remittances or short-lived consumption booms, only to collapse into balance-of-payments crises.

The trend has been unmistakably down since 2010. The economy has failed to achieve sustained productivity-led expansion and per capita income growth has lagged well behind comparable developing countries in Asia. While Bangladesh and Vietnam steadily climbed global value chains through export-oriented industrialisation, Pakistan remains trapped in low-value production and import dependence.

A stark illustration of this disconnect between headline indicators and lived experience is the trajectory of real wages. While nominal wages have risen, inflation has decisively outpaced these gains. Real wages are now around 13% lower than in FY2020–21 and nearly 19% below their level in 2018–19, effectively wiping out most of the purchasing-power gains of the past decade and pushing real incomes back to where they were before 2015.

For most households, higher pay on paper has translated into less purchasing power in practice, compressing consumption and deepening economic insecurity.

Public debt has simultaneously swollen to dangerous levels, consuming an ever-larger share of government revenues.

Debt servicing now crowds out development spending, leaving little fiscal space for education, health, infrastructure or technological upgrading. Each stabilisation cycle relies on new borrowing to service old obligations, locking the economy into a vicious dependency loop. Foreign exchange reserves, periodically replenished through bilateral deposits or emergency financing, provide only temporary relief and fail to mask the underlying fragility that resurfaces with every external shock.

The external sector tells a similarly troubling story. Whenever growth accelerates, imports surge far faster than exports, reopening current-account gaps and forcing currency devaluations. These devaluations may restore short-term competitiveness, but they also fuel inflation and erode household purchasing power.

Policymakers repeatedly fall prey to the illusion that growth can be import-led without commensurate productivity gains or that exchange-rate stability can be defended indefinitely in a reserve-constrained economy. The outcomes are predictable and costly.

De-industrialisation has quietly but steadily advanced. Manufacturing’s share of GDP has shrunk, while the economy drifts toward low-productivity services and subsistence agriculture. Remittances, now exceeding $30 billion annually, have become a critical lifeline, financing consumption and mitigating external pressures.

Yet this dependence is itself an indictment of domestic failure. Millions of Pakistanis are forced to seek livelihoods abroad because the local economy cannot generate enough decent jobs. The accelerating outflow of skilled and semi-skilled workers drains precisely the human capital required for innovation and industrial revival.

Social indicators reinforce the depth of the crisis. Poverty remains widespread, functional illiteracy is alarmingly high, and millions of children remain out of school. The much-touted youth bulge, often described as a demographic dividend, increasingly resembles a demographic risk in an economy unable to absorb new entrants into productive employment.

Official unemployment figures understate the reality of underemployment and informality, while inflation continues to squeeze households struggling with rising food, energy and transport costs. Roughly a quarter of the population lives below the poverty line, with many more hovering just above it.

Agriculture, long neglected by policy and investment, faces mounting stress from climate change, erratic weather patterns and chronic water mismanagement. Declining yields and rural distress threaten food security and deepen regional inequalities. Water scarcity — more than any external adversary — represents an existential challenge, yet public debate remains fixated on grand infrastructure symbolism rather than efficient management, conservation and equitable distribution.

At the core of these economic failures lies a governance system that has decayed over decades. Pakistan inherited a highly centralised, colonial-era administrative structure that privileges control over service delivery.

Over time, this evolved into a hybrid order dominated by military, bureaucratic and judicial elites, with politicians and business groups incorporated to protect shared interests. Power preservation, rather than institutional performance, became the organising principle of the state.

Political competition has largely degenerated into rotations among entrenched elites, often mediated by non-electoral interventions that disrupt democratic continuity without addressing root causes. The post-2025 security environment has further reinforced centralisation, narrowing the space for dissenting expertise and rewarding loyalty over competence.

Budgetary choices reflect these distortions. To satisfy lenders, governments impose regressive consumption taxes while shielding powerful sectors such as traders, real estate and large agriculture. Privileges persist, while social spending remains among the lowest in the developing world.

Education and health, the foundations of long-term growth, continue to receive a fraction of what is required. The result is a deeply unequal society in which opportunity is determined more by birth than by talent. The top income groups capture a disproportionate share of national wealth, while the majority survive in an informal economy with little protection against shocks.

Foreign investment remains scarce, constrained by political uncertainty, regulatory inconsistency and weak rule of law. Beyond these structural flaws lie subtler but equally damaging behavioural failures. Elites remain insulated, ego-driven and increasingly disconnected from global economic realities.

While other countries adapt to digitalisation, artificial intelligence and green transitions, Pakistan's leadership clings to outdated, patronage-based models. A bloated bureaucracy resists reform, public enterprises haemorrhage resources, projects stall for years and policy reversals undermine credibility.

Meritocracy is conspicuously absent. Appointments favour pliability over expertise, breeding mediocrity and intellectual stagnation. Entrepreneurship suffers under excessive red tape, arbitrary taxation and rent-seeking. Unlike dynamic Asian economies that actively nurture startups and export-oriented firms, Pakistan’s policies keep most businesses small, informal and unproductive.

The state’s obsession with superficial indicators compounds the damage. Raising the tax-to-GDP ratio mechanically, without expanding investment and exports, risks choking an already fragile economy. Sustainable growth requires dismantling elite monopolies, boosting investment to meaningful levels and integrating into global markets. Energy reform, water management and investment in education are not optional but existential imperatives.

Underlying all of this is a persistent myth: that salvation lies in a single leader, a decisive moment or a geopolitical triumph. History suggests otherwise. Growth under different regimes has been uneven and often illusory, driven by liquidity rather than reform. Waiting for a messiah has repeatedly enabled authoritarian drift and postponed sustainable progress.

There is no silver bullet for Pakistan's predicament. Diplomatic gestures and strongman governance may offer fleeting reassurance, but they substitute spectacle for substance. Real progress demands humility, competence and systemic renewal: institutions that reward merit, policies grounded in evidence, investment in people and a society oriented toward openness rather than fear.

Without confronting the deep behavioural and structural failures that define the present, the promise of the post-2025 moment will fade, leaving Pakistan once again adrift in a rapidly changing world, its vast potential unrealised.

The writer is former head of Citigroup’s emerging markets investments and author of "The Gathering Storm".

Disclaimer: The viewpoints expressed in this piece are the writer's own and don't necessarily reflect Geo.tv's editorial policy.

Originally published in The News