Shining gold, nervous economy

Over recent months, gold prices in Pakistan have crossed unprecedented thresholds

February 12, 2026

The remarkable surge in gold prices over the past two years is no longer just a financial headline; it has become a powerful indicator of how deeply uncertainty has penetrated the global and domestic economic situation.

Across international trading floors and local bazaars in Pakistan, gold has once again reclaimed its historic role as the ultimate safe-haven asset. In early 2026, international bullion prices crossed the symbolic threshold of $5,000 per ounce, compared to nearly $2,300 in 2023, reflecting an increase of more than 120% in less than three years.

In 2025 alone, gold recorded an extraordinary gain of around 64%, the strongest annual rise since the late 1970s. This rally has continued into 2026 as investors, central banks and households alike retreat from risky assets and search for protection against geopolitical turmoil, monetary uncertainty and economic fragility.

What makes this episode particularly significant is that the rise in gold is not driven by a single crisis, but by a convergence of global disruptions that have altered investor psychology. Wars and geopolitical tensions remain central. The prolonged Russia-Ukraine conflict continues to disrupt energy markets and global supply chains, while instability in the Middle East has revived concerns over oil routes, regional security and broader escalation risks.

Strategic rivalry among major powers has intensified, weakening diplomatic cooperation and increasing military expenditures worldwide. Each of these developments injects uncertainty into markets. Historically, when geopolitical risks increase, capital shifts away from equities and currencies toward assets that preserve purchasing power, and gold becomes the primary beneficiary of that shift.

At the same time, the global economy is experiencing a period of structural stress. Growth in advanced economies has slowed, debt levels have risen, and financial systems remain sensitive to shocks. Although inflation has moderated in some regions, it remains stubborn due to fragmented supply chains, climate-related disruptions to food and energy production and the economic costs of geopolitical realignments.

Central banks therefore face a complex policy dilemma: tightening too much risks recession, while easing too quickly may revive inflation. Markets increasingly expect interest-rate cuts in the US and Europe, and when interest rates fall, the opportunity cost of holding non-yielding assets like gold declines. As bond yields weaken and currencies fluctuate, gold becomes relatively more attractive, reinforcing demand from institutional and retail investors.

Another powerful factor behind gold’s ascent is the changing behaviour of central banks themselves. Over the past three years, central banks have emerged as some of the largest buyers of gold in the world. Global central-bank purchases have exceeded 1,000 tons annually, marking the highest accumulation in decades.

This shift reflects deeper strategic concerns about over-reliance on the US dollar, exposure to sanctions, and geopolitical fragmentation of the international financial system. Emerging economies in particular are diversifying reserves to reduce vulnerability to external shocks. As official demand rises alongside private investment through gold-backed exchange-traded funds, the global supply-demand balance tightens, exerting sustained upward pressure on prices.

Trade disruptions and economic nationalism have also reshaped investor expectations. The world trading system is no longer governed purely by efficiency and openness. Tariff disputes, industrial policy interventions, strategic decoupling and reshoring initiatives are redefining how countries interact economically. These shifts weaken confidence in long-term global growth. Investors now perceive uncertainty as structural rather than temporary.

In such an environment, gold becomes more than a crisis hedge; it becomes insurance against systemic instability. The metal’s rally therefore reflects not optimism, but caution about the durability of the existing global economic order.

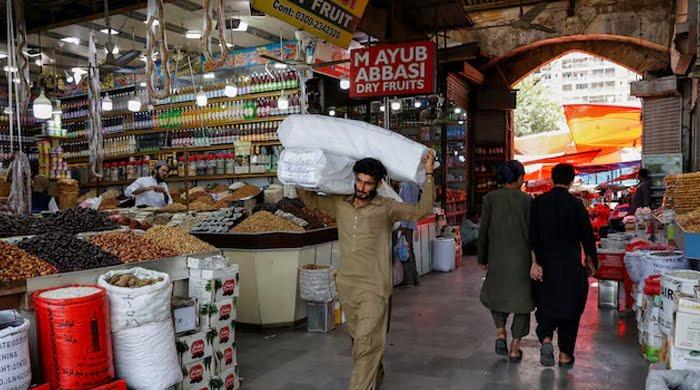

These global forces transmit directly into Pakistan’s gold market, often with magnified intensity. Pakistan is largely a price taker in bullion, importing global price movements into its domestic economy. When international gold prices rise, local rates adjust almost instantly. However, Pakistan’s own macroeconomic vulnerabilities amplify the impact. Over recent months, gold prices in Pakistan have crossed unprecedented thresholds. One tola of 24-karat gold has climbed beyond Rs500,000, compared with around Rs180,000 in 2022 and roughly Rs300,000 in early 2024. In simple terms, gold prices have almost tripled within three years, transforming what was once a common household asset into an increasingly expensive investment.

Currency depreciation also plays a crucial role in this transmission mechanism. Since gold is priced globally in US dollars, any weakening of the Pakistani rupee immediately raises its local cost. Pakistan’s rupee has remained under pressure due to external debt servicing, trade deficits, limited foreign-exchange reserves and reliance on external financing. Even when global gold prices pause temporarily, rupee volatility ensures that domestic prices continue to rise. Pakistani consumers therefore experience a double shock: global price hikes combined with a fragile local currency.

The implications extend beyond the bullion market itself. Rising gold prices influence savings behaviour, portfolio allocation and even inflation expectations. If households increasingly park wealth in gold rather than in productive sectors such as business investment, manufacturing or capital markets, long-term growth may weaken.

Capital that could finance innovation and employment becomes locked in idle assets. At the same time, higher gold prices may encourage speculative trading, informal hoarding and distortions in household financial planning. Policymakers therefore face the challenge of restoring confidence in financial stability so that gold demand reflects choice rather than fear.

There are also implications for Pakistan’s external sector. Higher gold prices increase the value of imports, potentially widening the trade deficit if demand remains strong. At a time when Pakistan is already managing external financing constraints, any additional pressure on the balance of payments becomes costly. Moreover, volatility in gold prices can transmit into expectations about currency stability, influencing broader perceptions of economic health.

Looking ahead, gold’s trajectory will depend on both global and domestic developments. Internationally, if geopolitical tensions persist, trade fragmentation deepens and monetary policy remains uncertain, gold is likely to remain elevated. Some global forecasts already suggest prices could test $6,000 per ounce if conflicts widen or financial conditions deteriorate further. Domestically, any additional rupee depreciation, resurgence of inflation, or weakening of growth prospects would translate these global pressures into even higher local prices in Pakistan.

Yet gold’s rise should also be interpreted as a warning signal. It reflects a world where investors prioritise safety over productivity, protection over expansion. For Pakistan, the glitter of rising gold prices masks deeper structural challenges related to currency stability, inflation management, export competitiveness and investor confidence. Gold may shine brightly in markets, but its glow reflects caution rather than comfort.

Ultimately, the surge in gold prices tells a larger story about the global economy and Pakistan’s place within it. It is a story shaped by geopolitical friction, fragile growth, nervous investors and households seeking stability in uncertain times.

In Pakistan, gold’s increasing value symbolises both protection and pressure, protection for savers, pressure for consumers and policymakers alike. Until global tensions ease and domestic fundamentals strengthen, gold will remain not merely a commodity, but a mirror of the risks shaping international finance and Pakistan’s economic future.

The writer is affiliated with the Sustainable Development Policy Institute (SDPI), Islamabad and holds a PhD in Applied Economics. He can be reached at: [email protected]. The views expressed are solely his own and do not necessarily reflect the position of the institute.

Disclaimer: The viewpoints expressed in this piece are the writer's own and don't necessarily reflect Geo.tv's editorial policy.

Originally published in The News