Secret documents reveal how offshore company dealt with banks' suspicion

Offshore company Outreach Global is owned by Axact FZ LLC and Shoaib Ahmed Sheikh is its sole owner

October 07, 2021

- Offshore company Outreach Global is owned by Axact FZ LLC and Shoaib Ahmed Sheikh is its sole owner.

- At one point, Outreach Global's service provider refused to represent it further in the British Virgin Islands.

- files reveal the company was facing credibility issues abroad even well before its parent company, Axact, was unmasked by The New York Times in 2015.

ISLAMABAD: Secret documents detailed how an offshore company, behind the operation of issuing fake diplomas, dealt with suspicions raised by banks when it did not share the details of the owners with them.

Registered on February 1, 2010 in the British Virgin Islands, Outreach Global is owned by Axact FZ LLC and Shoaib Ahmed Sheikh is the sole owner of Axact.

At one point, the service provider of Outreach Global refused to represent it any further in the British Virgin Islands.

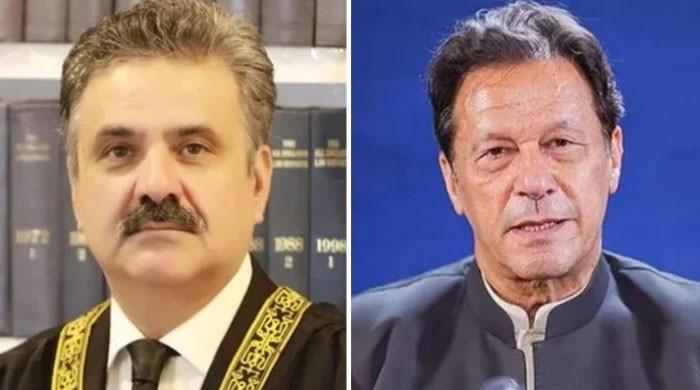

Outreach Global has been uncovered, thanks to Pandora Papers. The International Consortium of Investigative Journalists (ICIJ) collaborated in the investigation. The company had two directors, Viqas Atiq of Axact and Imran Khan of a Dubai-based chartered accountancy firm of Pakistani partners.

The files reveal the company was facing credibility issues abroad even well before its parent company, Axact, was unmasked by The New York Times in 2015. Soon after its incorporation, Outreach Global opened an account with the First Caribbean Bank in BVI and it was terminated in September 2011.

Viqas Atiq pleaded that the bank reconsider its decision. He referred two US-based e-commerce and payment processing companies (2checkout Inc. and Digital River Inc.) as business partners to make a point that Outreach Global receives a majority of payments in the bank account from these two organisations, which enjoy a good reputation.

In one month alone, Viqas mentioned in an email to Caribbean Bank, $615,000 was received in the account through these two e-commerce companies.

“It is not possible for any organisation to work with these companies without having a very high customer satisfaction,” he argued and requested that "at least the bank considers postponing its decision for two months."

The bank, however, conveyed to Trident Trust, the service provider of Outreach Global, that there was no documentation that the client could have provided to maintain the account.

“You should appreciate that our accounts are subject to ongoing monitoring and that the KYC/due diligence of any account relationship is an ongoing process and not restricted to the account opening stage. We are not required to give specific reasons when we are exiting relationships and neither do we re-open accounts that we request the client to close. To this end, there was no documentation that the client could have provided to maintain the account,” replied the bank in an email to the service provider when it pressed on reconsideration of the decision on behalf of Outreach Global.

Outreach Global later tried to open an account with the Liechtenstein-based VP Bank for its "e-commerce operations." Business with sales of $100,000 per month and payment to different vendors were among the details of intended activities mentioned while applying for the account in VP Bank.

"Funds would be received from individual customers who will either be paying through credit card or through wire transfer. The funds would be used for payments to different vendors," it was further explained.

However, the bank, after reviewing the documents and keeping in view the nature of transactions, declined to do so.

"We are not able to assist due to the specific profile of business and expected high frequency of transactions involved. Our banking services are restricted to either BVI holding companies for corporate entities or private investment," the VP Bank said.

Outreach Global later tried to enter into an agreement with the Royal Bank of Scotland but was not successful. Finally, it was able to open an account with the Standard Chartered Bank in Dubai.

Another document has revealed that a review of its transactions raised red flags at the Standard Chartered New York Branch in 2015, which generated a Suspicious Activity Report and recommended further investigation to the Federal Bureau of Investigation, Financial Crime Wing, because negative media was identified relating to Axact, the owner of SCB Dubai customer, Outreach Global.

The document further suggested that Outreach Global’s account has been used as "a vehicle to both remit and receive payments associated with potential unlawful and/or potential fraudulent business activities."

This was the time when the second SAR was issued and the bank’s Dubai branch also terminated Outreach Global’s account.

In the meanwhile, Axact was facing litigation in the United States. Trident Trust wrote to Outreach Global regarding a complaint filed against it in the superior court of Delaware and for New Castle County.

Tullow Inc. and Appostrophic LLC, two other companies linked with Axact, were also made party in the case other than Outreach Global. Hasan Khushaim, a Saudi citizen, was the plaintiff. He wanted to develop mobile applications in Arabic for two card games, Trix and Belote. The former is commonly played in the Middle East and the latter played in France and the Middle East.

He found a website linked with the above-mentioned companies that offered to develop mobile applications and they entered into a project contract.

He made a payment of around $40,000 but never received the final version of the mobile applications. Earlier, they kept promising and later cut off all communications. He ended up even losing his copyright software design. Failing in completion of the development of mobile applications resulted in the loss to Hasan of subscription for these two games, which would have totalled $27,000,000.

While this litigation was in progress, Outreach Global was struck from the register of companies in BVI for non-payment of its 2015 government license fee. In 2017, Viqas deposited the fee and had it renewed in October 2017 and sought Certificate of Incumbency, which Trident delayed until the information about the beneficial owner of the company was shared.

Trident had been asking for this information since 2013 and it was not being provided.

In November 2017, the service provider Trident Trust declined to offer services any further to Outreach Global. No reason was mentioned. “Please see attached our letter of intent approval to resign Registered Agent for the above entity. 90-day notice provided,” its email reads.

As Viqas protested on it, Trident listed the reasons behind its decision to resign.

"We sincerely regret that you are unhappy to provide the requested information prior to your request being processed as well as for the update of our records pursuant to legislative requirements. If the information to identify the beneficial owner of the company is not received, we are mandated to terminate our services as Registered of the company. The same information was requested in May 2013 via our Dubai referral office. We did not receive a response from our client of record,” it wrote to Outreach Global at its email ([email protected]).

The News contacted Shoaib Sheikh before the release of the Pandora Papers in order to ask him for an email address for sending questions. He blocked this correspondent on WhatsApp. Once the papers were released and his name surfaced in connection with the company, he declared the information to be "baseless" and complained that he was not approached for his version.

He was contacted again through a key person of his media operation, Amir Zia, who said there was no point in asking questions after the release of the initial information. He was nevertheless sent questions which received no response other than the allegation that The News has made a concerted effort to damage Shoaib Sheikh's reputation.

Other people close to him said the allegations are a result of a conspiracy by a mix of elements that include Indian forces, international competition and local media competition, who do not want Axact to compete in the local market.

Originally published in The News